3 New Features in tastytrade Backtest

3 New Features in tastytrade Backtest

It now calculates premium, underlying price offset and percentage out-of-the-money

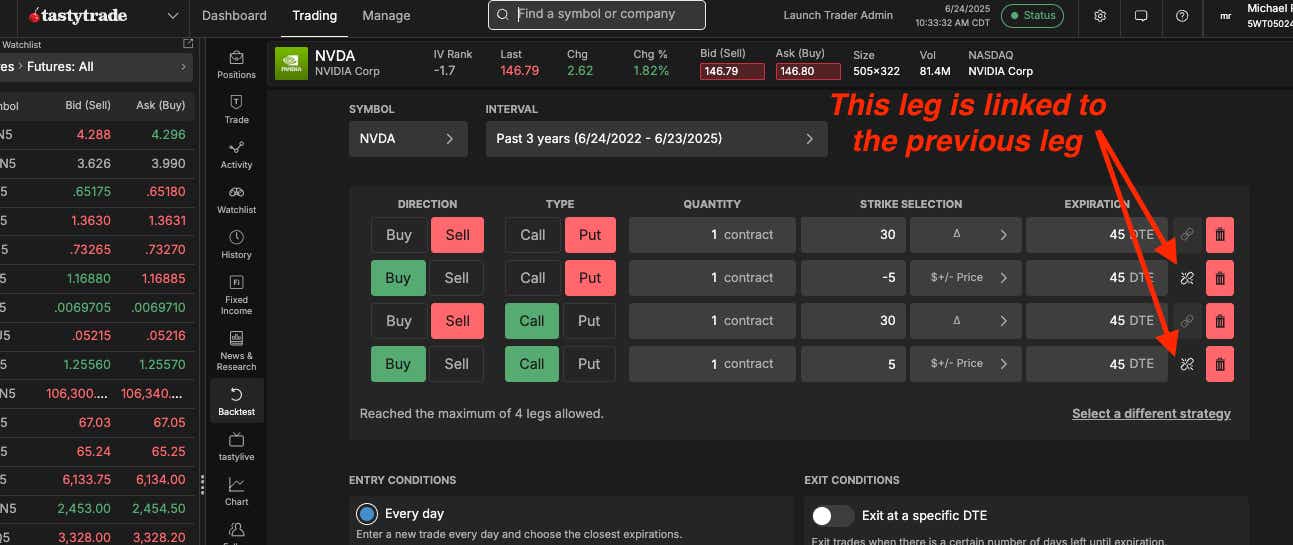

Some serious improvements have been made to tastytrade's backtesting. We now have the ability to test, not just delta, but also:

- Percentage out-of-the-money

- Underlying Price Offset

- Premium

So, for example, say you want to trade an iron condor with wings that five points wide and where the short strikes are based on 30 deltas ... you can now do that! Or say you want to test the results of buying $1.00 calls in market downturns — you can do that as well.

What has call skew Right Now?

Tom Preston discussed call skew in Tesla (TSLA) stock in today's Cherry Bomb newsletter. We looked into this a bit further and found the average call in the stock is trading 15% over the equidistant put.

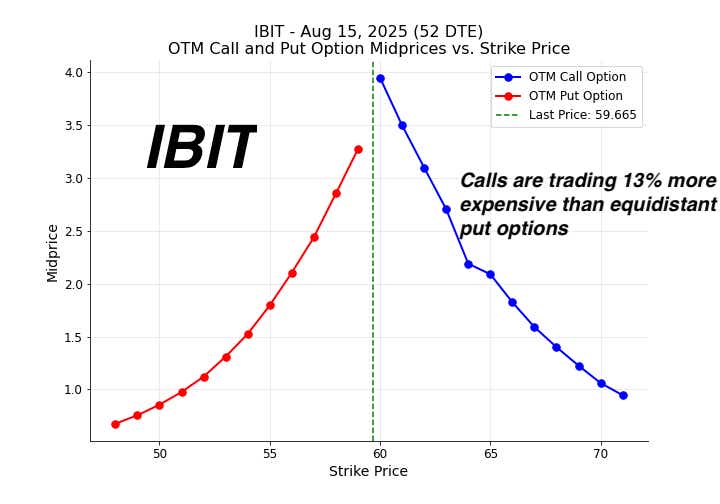

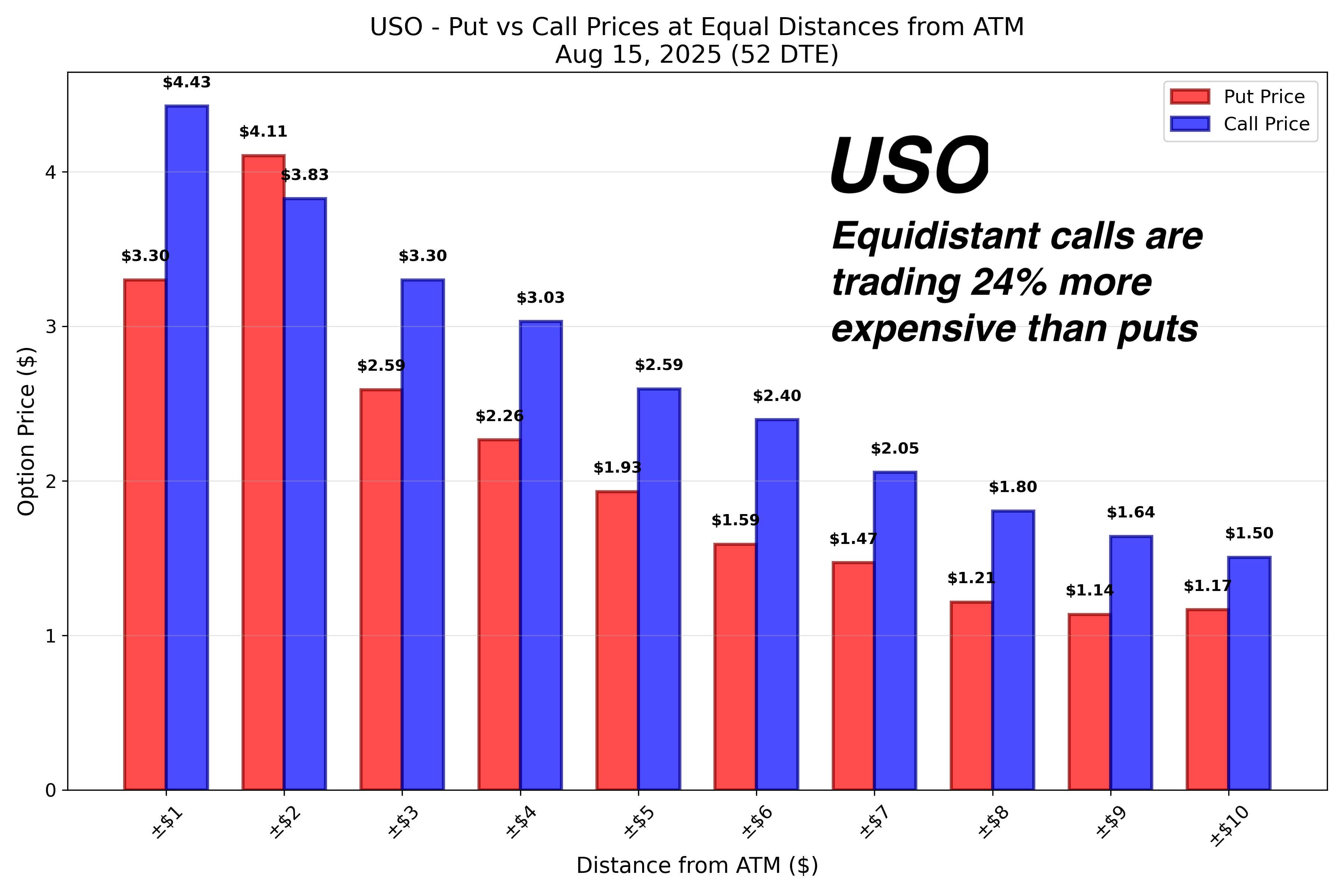

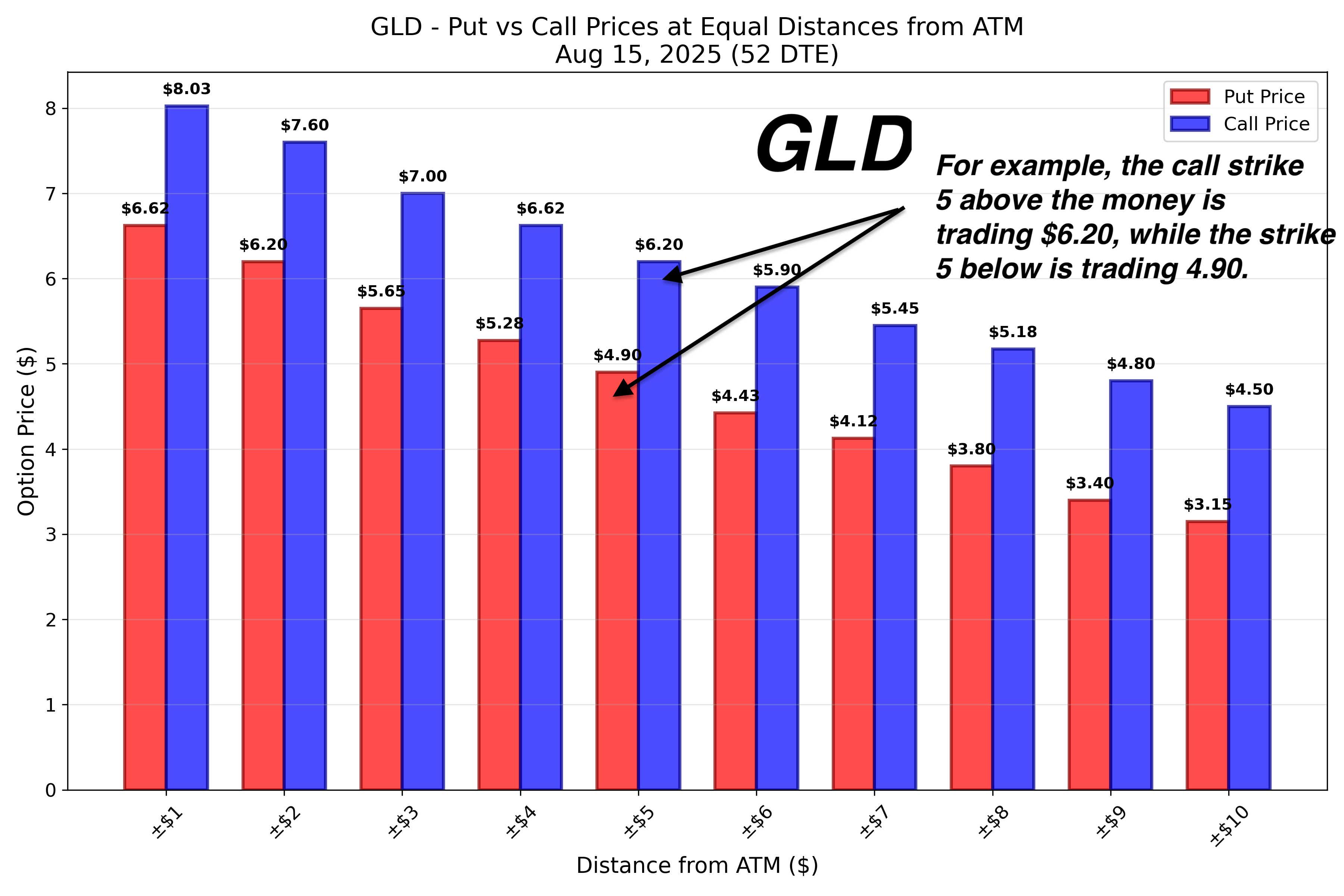

We decided to explore what else is trading with call skew in the month of August.

TSLA calls are trading 18% more expensive than puts.

IBIT (bitcoin) calls are trading 13% more expensive than puts.

USO (Crude) calls are trading 24% more expensive than puts.

Gold (GLD) calls are trading 23% more expensive than puts.

Aptos Crypto (APT/USD) volatility = opportunity?

Aptos Crypto (APT/USD) — With 20+ new tokens now tradable on the tastytrade platform, Aptos is grabbing attention. Born from Meta's abandoned Diem project with daily price swings of ±4.57%, spiking up to 13.5% and crashing 16% (nearly 2x bitcoin's volatility). Currently trading at $4.34 (up 9% today), APT/USD ranks No. 33 by market cap with $169 million in daily volume. The network hit 22 million active wallets in December. Aptos offers the kind of price action that makes traders excited. Whether you're bullish on the tech or just chasing volatility, APT/USD swings provide plenty of price opportunities.

Sign up here.

Foreign Exchange Trade Idea

Because tastytrade now has foreign exchange, we have a trade idea for you in FX.

The Swiss franc has strengthened recently, benefiting from the belief that it is a "defensive" currency amid elevated risks and a weaker US dollar. As a result, USD/CHF has returned to levels not seen in 10 years, trading below 0.8100, which is a threshold that it has closed under only three times in the past 10 years.

For traders expecting an easing of tensions and a rebound in the US dollar, going long USD/CHF offers an unusually low entry point, along with the advantage of positive carry. On the other hand, if you anticipate continued dollar weakness and a sharp move lower in US interest rates, a short position in USD/CHF could capitalize on a potential break below the 0.8000 mark.

Two Trades

NIKE ($60.71) short put (AUG) $1.44 credit

Nike (NKE) has been one of the stocks hit hardest hit since President Donald Trump began instituting tariffs. It’s down almost 40% from the 52-week highs and currently just 10% from lows. If you think the worst is over, selling the 55 put in August nets around $1.44 on only $600 in buying power with a breakeven near lows.

Micron ($126.08) cal CRAB trade (JUL/JUN27) $1.37 debit

Micron (MU) has completely "V" bottomed from the tariff lows, which is almost a double from the lows in April. Earnings will be released after market close on tomorrow, and if you think the upside is capped here, a CRAB trade plays into the inside/up move. Buying the July 130 call and selling 2x the 135 for a small debit of $1.37 has minimal risk to the downside — with a kicker if the stock opens inside/up the expected move.

Our newsletter even counts as "research" when your boss walks by. Forward this email to your friends so they can subscribe to our newsletters, too! Get weekly data-driven trade ideas with Cherry Picks and daily pre-market insights and trade ideas with Cherry Bomb.

Michael Rechenthin, Ph.D., (aka “Dr. Data”), managing director of research and development, has 25 years of trading and markets experience. He’s known best for his weekly Cherry Picks newsletter. On Thursdays, he appears on Trades from the Research Team LIVE.

Nick Battista, tastylive director of market intelligence, has a decade of trading experience. He appears Monday-Friday on Options Trading Concepts Live. On Wednesdays, he co-hosts Johnny Trades. @tradernickybat

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex and macro.

Trade with a better broker. Open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices