3 Small-Cap Stocks Driving Big Gains in 2025

3 Small-Cap Stocks Driving Big Gains in 2025

From turnarounds to moonshots, these small-cap standouts are rewriting their own playbooks in 2025

CommScope (COMM), Opendoor (OPEN), and Viasat (VSAT) have each delivered breakout performances in 2025, carving out big gains despite operating in very different corners of the market.

Opendoor and Viasat represent higher-risk plays—Opendoor as a speculative pivot story with meme-driven surges, and Viasat as a discounted satellite/defense name that’s still reliant on heavy capex.

In contrast, CommScope offers the turnaround angle, offering a cleaner balance sheet, stronger margins, and a renewed focus on shareholder returns.

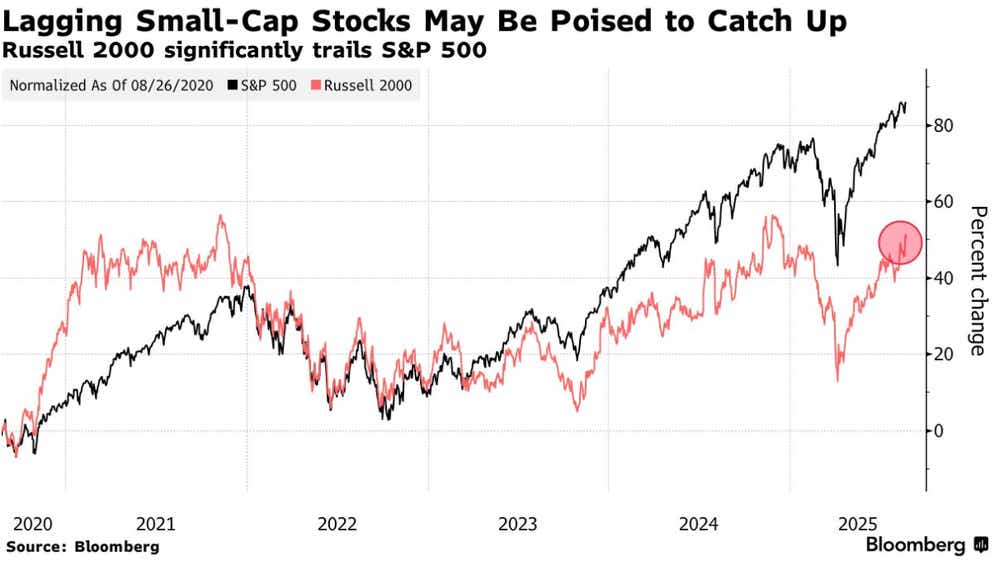

Small-cap stocks often serve as the proving ground for companies that grow into larger, more established players. In 2025, a handful of names have broken out from the pack, delivering eye-catching gains and building momentum with investors. Whether driven by turnarounds, speculative interest, or execution on growth plans, these companies are starting to punch above their weight.

Three of the most notable include CommScope (COMM), Opendoor (OPEN), and Viasat (VSAT)—each surging by more than 200% year-to-date. Today, we break down what’s fueling their momentum, and what investors should be watching next.

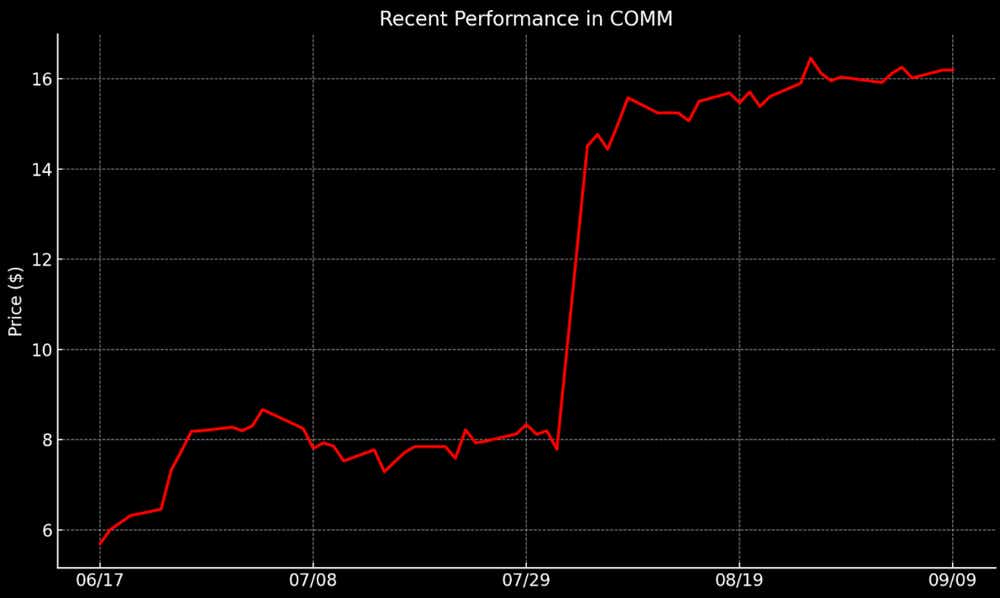

CommScope: Leaner and More Focused in 2025

CommScope Holding Company (COMM) has long been a critical supplier in the global connectivity ecosystem, providing both wired and wireless networking solutions to telecom operators, cable companies, and enterprises worldwide. With the rise of 5G, cloud computing, and AI-driven workloads, demand for robust connectivity is only accelerating—and CommScope is reshaping itself to capture that opportunity.

In 2025, the company is in the midst of a dramatic transition, divesting its Connectivity and Cable Solutions (CCS) unit to Amphenol for $10.5 billion—a deal expected to close in the first half of 2026. That transaction is expected to reduce debt, return capital to shareholders, and leave behind a more streamlined business built around its Access Network Solutions (ANS) and RUCKUS segments.

The turnaround is showing up in the financials. Last quarter, CommScope delivered net sales of $1.39 billion—up nearly 32% year over year. Adjusted EBITDA climbed 79% to $338 million, lifting margins to 24.3% from 17.9% a year ago. Growth was broad-based, with both ANS and RUCKUS posting sharp revenue gains thanks to healthier channel inventory and rising demand for access technologies. Free cash flow also swung positive at $64.5 million, a clear sign that fundamentals are strengthening as management sharpens its operational focus.

Balance sheet strength is another key theme—and the shift underway is hard to ignore. CommScope ended Q2 with $571 million in cash and nearly $1 billion in liquidity, providing a much stronger financial cushion. Management has pledged to use proceeds from the CCS sale to retire outstanding debt and preferred equity, a transformative move for a company long weighed down by leverage. Just as notably, executives have indicated they intend to return excess capital to shareholders via a dividend after the transaction, creating a potential near-term catalyst for investors seeking both growth and income.

From a valuation perspective, COMM trades at about 38x trailing GAAP earnings, above the sector median of 29x. However, its price-to-sales ratio of 0.7 is discounted relative to the sector median of 3.4, reflecting both its leaner footprint and ongoing execution risks. Analyst sentiment leans positive—four of five covering firms rate the stock a “buy” or “overweight”—with an average price target of $17/share, slightly above current levels near $16.

Bottom line: CommScope is emerging from years of debt pressure and operational sprawl with a leaner, more profitable core. The stock’s 200%-plus rally in 2025 underscores how far the turnaround has already come, yet the story still feels unfinished. If management follows through on expanding margins, eliminating debt, and returning capital to shareholders, COMM could continue closing the valuation gap with sector peers. For investors willing to embrace the risks inherent in small-cap stocks, it remains a compelling narrative.

Opendoor: Strategic Pivot Meets Challenging Housing Market

Opendoor Technologies (OPEN) is best known for pioneering “iBuying”—instant cash offers that let homeowners sell their properties quickly and with less hassle. After two tough years, the company is reworking its model to be more flexible and less risky. Instead of relying mainly on buying homes itself, Opendoor is now opening its platform to partner agents through a program called Key Connections and introducing Cash Plus, a service that gives sellers fast offers while keeping the listing active. Both moves are designed to generate lighter, fee-based revenue while reducing the need to hold large amounts of housing inventory on its balance sheet.

Opendoor’s Q2 results showed progress even as the housing market remained under pressure. Revenue came in at $1.6 billion, up 4% year over year and 36% from the prior quarter, on 4,299 homes sold. Gross profit climbed to $128 million, an 8.2% margin, and adjusted EBITDA turned positive at $23 million—Opendoor’s first quarter of profitability on this metric since 2022. The net loss also narrowed to $29 million. Inventory declined to $1.5 billion (4,538 homes) as the company slowed purchases by 63% from last year—a risk reduction tactic.

Strategically, Opendoor is aiming for a healthier business mix: taking on less risk from home inventory, capturing more seller leads through agent partnerships, and laying the groundwork to add services like mortgages, insurance, warranties, and moving. In the near term, however, the company is deliberately slowing home purchases to protect profitability—an approach that creates pressure on both volumes and margins. The stock has been highly volatile, fueled by renewed retail trading interest and elevated short interest, which can magnify swings in either direction.

Valuation and sentiment highlight the divided view on Opendoor. With losses ongoing, P/E isn’t meaningful. On a trailing basis, the stock trades at 0.6 times sales—well below the sector median of 4.5—but at 5.2 times book value, far richer than the median of 1.5. That premium reflects thin equity and hopes for stronger returns ahead.

Analyst coverage remains cautious: among nine analysts, just one has a “buy” rating while four rate it “sell” or “underweight.” The average price target is $1, well below the current $5 share price. For Opendoor to earn higher multiples, it must prove sustained EBITDA profitability, demonstrate that agent-led products can scale, and deliver stronger unit economics in a weak housing market. Those are not easy hurdles.

Bottom line: Opendoor Technologies is a high-beta turnaround tied to housing liquidity and the success of its shift from first-party (buying homes directly) to third-party (partner-driven, fee-based) transactions. The bull case is converting today’s volatility into durable, fee-heavy revenue and consistent profitability. The bear case is that weak housing conditions and inventory dynamics derail recent progress. Speculative investors may see upside in the new model, but fundamentals-focused investors may be more skeptical.

Viasat: Defense Business is Growing, But Risks Remain

Viasat (VSAT) is a global satellite communications provider with customers ranging from airlines and shipping fleets to governments and defense agencies. Its 2022 acquisition of Inmarsat broadened its mobility footprint, while the ViaSat-3 program aims to add significant capacity and expand coverage worldwide. Unlike many peers, Viasat builds and operates both its satellites and ground systems, a model that offers greater control but comes with heavy capital demands.

Recent results showed a mix of progress and lingering challenges. Last quarter, revenue grew 4% year over year to $1.17 billion, while adjusted EBITDA held steady at roughly $400 million. Free cash flow did turn positive at $60 million, but the company still posted a net loss of $56 million. Growth was strongest in defense and advanced technology (up 15%) and aviation services (up 14%), offset by weakness in fixed broadband and maritime.

Viasat’s balance sheet is manageable, but stretched. Net leverage stands at 3.6 times EBITDA, while annual capital spending remains heavy at roughly $1.2 billion as satellite investments continue. To ease that burden, management is leaning on shared infrastructure models and directing growth toward higher-margin aviation and defense services, including advanced cyber and encryption solutions.

Valuation paints a mixed picture. Viasat trades at just 0.9 times sales and book value—well below sector medians of 3–4 times—signaling investor doubts about execution and high spending needs. Analysts are divided, with most rating the stock a “hold” and an average price target of $26/share, under the current $31 level. To win higher multiples, Viasat will have to prove it can generate consistent free cash flow, reduce debt, and successfully deliver on the ViaSat-3 rollout.

Bottom line: Viasat sits at the crossroads of long-term opportunity and near-term risk. The company’s satellites underpin growth in aviation, defense, and secure communications, but execution on cash flow and the ViaSat-3 rollout will determine whether investors are rewarded. For those willing to bet on management’s delivery, today’s discounted multiples could prove attractive; for others, patience may be prudent.

Small Cap Stocks Takeaways

Small-cap stocks often move in sharp bursts, and 2025 has been no exception. CommScope, Opendoor, and Viasat have all staged strong runs this year, each with its own mix of catalysts, risks, and valuation quirks.

CommScope is a turnaround story, reshaping itself through asset sales, debt reduction, and a sharper focus on core connectivity businesses. Strong Q2 results and plans to return cash to shareholders highlight its transition into a leaner, more profitable company. With sales multiples well below peers, COMM may appeal to investors looking for a cleaner near-term catalyst.

Opendoor is a more speculative play. The pivot from pure iBuying to a hybrid agent-led platform has early momentum, and Q2 delivered its first EBITDA-positive quarter since 2022. But with management guiding for losses, and the housing market still weak, the setup leans more on momentum/hope than fundamentals. The stock may reward risk-seekers, but it remains a speculative proposition.

Viasat occupies a middle ground. Aviation and defense are delivering growth, free cash flow has turned positive, and the stock looks cheap on sales and book value. But heavy capex spending and a leveraged balance sheet make ongoing results highly sensitive to execution. For the stock to re-rate higher, Viasat will probably need to demonstrate strengthening free cash flow and meaningful progress on debt reduction.

In sum, COMM is demonstrating what a disciplined turnaround looks like, OPEN is betting big on a reinvention, and VSAT is grinding through the realities of scaling up. All three have rewarded investors this year, but the real test is whether those storylines can mature into durable value—rather than just flashes of momentum.

Andrew Prochnow has traded the global financial markets for more than 15 years, including 10 years as a professional options trader.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices