A Technician's Contrarian Take on the Markets in 2024

A Technician's Contrarian Take on the Markets in 2024

By:Tim Knight

Euphoric investors anticipate repeated rate cuts and higher stock prices, but the technical charts don’t agree

- Market sentiment is euphoric.

- But 2024 could be nothing like people anticipate.

- Here’s what the technicals are saying.

As we approach the end of 2023, I sense that it's the upside-down version of the end of 2022. A year ago, it was universally agreed there would be a recession and equities were a disaster. These days, folks looking at 2024 agree it's going to be all about rate cuts and daily lifetime highs in equities. Sentiment is absolutely euphoric, and looking at these major index charts (which are either at lifetime highs or poised to achieve them), I wonder if they're right.

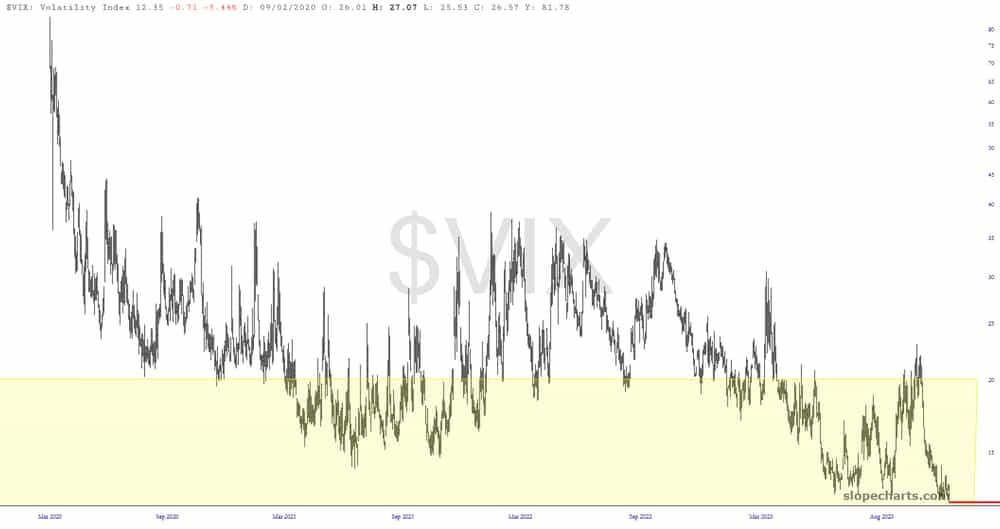

Yet the market delights in proving as many people wrong as possible. Given that the Chicago Board Options Exchange's Volatility Index (VIX) has almost been suffocated and we could easily see an 11-handle on this poor beast in a matter of days, something tells me 2024 is going to be absolutely nothing like people are more assuredly anticipating.

Finally, I would note that when viewed through the lens of valuation measured by gold or the money supply, the long-term picture of the stock market is really pretty awful, in spite of superficial perceptions.

Dow Composite divided by gold

Dow Composite divided by M2 money supply

Tim Knight, a charting analyst with 35 years of trading experience, hosts Trading Charts, a tastylive segment airing Monday-Friday. He founded slopeofhope.com in 2005 and uses it as the basis of his technical charting and analysis. Knight authors The Technician column for Luckbox magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.