Natural Gas Rally Fades Ahead of New Year—Bearish Outlook to Kick Off 2024

Natural Gas Rally Fades Ahead of New Year—Bearish Outlook to Kick Off 2024

Prices are on track to close about 8% lower for December, following November’s massive loss of nearly 30%

- Natural gas prices pulled back today, trimming weekly gains.

- Inventory will remain elevated as warm weather continues.

- The technical outlook is tilted to the bearish side despite the recent rally.

Natural gas price forecast remains bearish into 2024

Natural gas prices (/NGG4) moved about 0.5% lower through mid-day trading today, reducing the commodity’s weekly gain to about 2%. Despite being at three-week highs, prices are on track to close about 8% lower for December. That would follow November’s massive loss of nearly 30%.

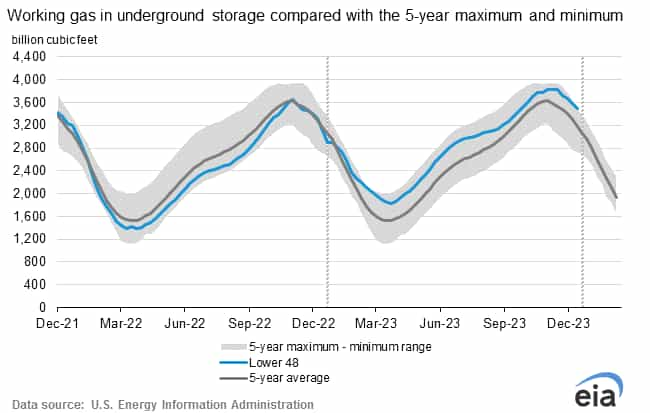

An unusually warm start to winter, when stockpiles typically decline steadily, has kept inventory at unusually high levels in both the United States and Europe. Earlier this week, the U.S. Energy Information Administration (EIA) reported an 87 billion cubic feet (Bcf) decrease in underground gas storage.

That was a rather modest decrease compared to seasonal norms and put total inventory at 3,490 bcf, which is 348 bcf higher than at the same time a year ago and 316 bcf higher than the 3,174 bcf five-year average, according to the EIA. The chart below from the EIA illustrates the elevated inventory levels.

Where does that leave price direction for natural gas prices in January? That largely depends on the weather. The United States is looking at near-normal to slightly above-normal temperatures for the next two weeks across much of the Midwest and East Coast, where a significant amount of demand comes from.

Europe is also looking at mild temperature forecasts over the next week as well, which should keep export demand for U.S. products subdued. European inventory levels are also at record highs for this time of year. And with the recent bounce in prices, it may look like a good time to get short or remove long exposure.

Natural gas technical forecast

Prices remain below key moving averages, including the 50-day simple moving average (SMA) and the 26-day exponential moving average (EMA). The rebound from lows around the 2.2 level looks exhausted at the 23.6% Fibonacci retracement from the November high to the December low move.

That said, prices may retrace lower before bulls try for another push higher, but the technical posture remains bearish, so traders may want to sell into any strength and wait for a larger pullback before going long.

Check out my 2024 Oil Market Forecast.

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.