S&P 500, Russell 2000 Bounce After CPI-Induced Sell-Off

S&P 500, Russell 2000 Bounce After CPI-Induced Sell-Off

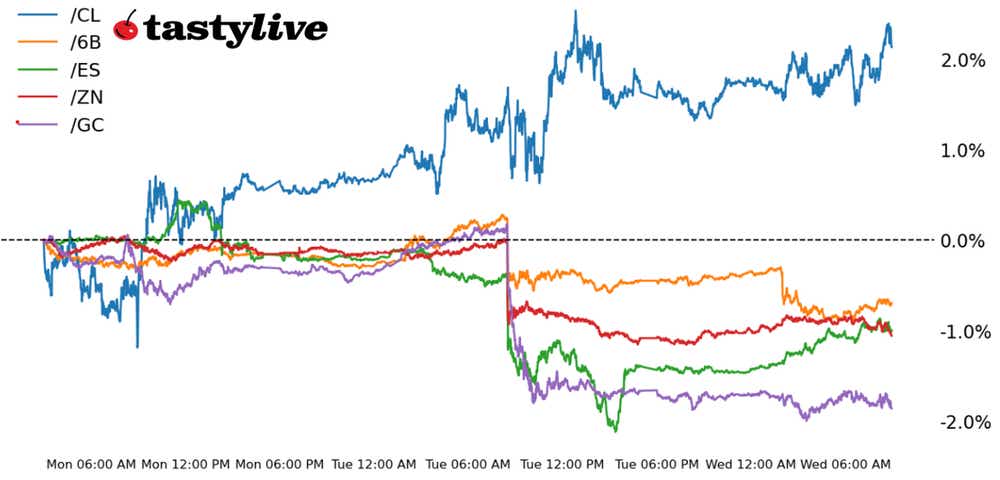

Also, 10-year T-note gold, crude oil, and British pound futures

- S&P 500 e-mini futures (/ES): +0.43%

- 10-year T-note futures (/ZN): +0.06%

- Gold futures (/GC): -0.20%

- Crude oil futures (/CL): +0.49%

- British pound futures (/6B): -0.19%

After a deleterious trading session on Tuesday, asset classes are reversing meaningfully at the start of trading on Wednesday.

Quirks in the January U.S. inflation report may have led to an overreaction by traders, who with the benefit of hindsight, are reassessing their positioning amid a sharp decline in Fed rate cut odds (the first cut is now priced in for June). The S&P 500 (/ESH4) is attempting to retake the psychologically significant 5000 level, while the Russell 2000 (/RTYH4) is leading the rebound, up over +1%.

Symbol: Equities | Daily Change |

/ESH4 | +0.43% |

/NQH4 | +0.53% |

/RTYH4 | +1.26% |

/YMH4 | +0.25% |

Stock futures move up

Equity futures bounced back Wednesday morning as traders wrote off yesterday’s inflation report that sent stocks sharply lower.

Despite rate traders trimming bets for a Fed cut in March, analysts expect the central bank to loosen policy later this year and that is enough for equity traders. Lyft Inc. (LYFT) Rose sharply this morning despite a typo in its earnings report that launched the stock nearly 70% higher.

Strategy: (43DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 4900 p Short 4950 p Short 5150 c Long 5200 c | 35% | +1212.50 | -1287.50 |

Short Strangle | Short 4950 p Short 5150 c | 51% | +4312.50 | x |

Short Put Vertical | Long 4900 p Short 4950 p | 70% | +512.50 | -1987.50 |

Symbol: Bonds | Daily Change |

/ZTH4 | +0.05% |

/ZFH4 | +0.07% |

/ZNH4 | +0.06% |

/ZBH4 | 0.00% |

/UBH4 | -0.20% |

Bond futures inch higher

In the bond market, 10-year T-note futures (/ZNH4) inched higher ahead of the opening bell but prices remain well below where they were before yesterday’s CPI print.

Yields remain near their highest levels since December along the middle of the curve. Friday’s producer price index is set to drop on Friday, which may help to put a bid on Treasuries if the data comes in on the light side. Tomorrow’s U.S. retail sales report also has some potential to influence rate cut bets and yields for that matter.

Strategy (37DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 107 p Short 107.5 p Short 112.5 c Long 113 c | 64% | +125 | -375 |

Short Strangle | Short 107.5 p Short 112.5 c | 70% | +484.38 | x |

Short Put Vertical | Long 107 p Short 107.5 p | 89% | +62.50 | -437.50 |

Symbol: Metals | Daily Change |

/GCJ4 | -0.20% |

/SIH4 | +0.09% |

/HGH4 | +0.03% |

Gold drops

Gold prices (/GCJ4) are down again and the metal is approaching the critical 2,000 level, which hasn’t been touched since November.

A close below that mark could induce another round of weakness. Meanwhile, traders continue to put their cash into equities with the prospect of rate cuts later this year, and despite geopolitical tensions in the Middle East, gold hasn’t seen much benefit. We do have some Federal Reserve speakers due today, which could change things for gold, but probably not.

Strategy (47DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1980 p Short 1990 p Short 2060 p Long 2070 c | 43% | +560 | -440 |

Short Strangle | Short 1990 p Short 2060 p | 39% | +3140 | x |

Short Put Vertical | Long 1980 p Short 1990 p | 59% | +300 | -700 |

Symbol: Energy | Daily Change |

/CLH4 | +0.49% |

/HOH4 | -0.37% |

/NGH4 | -3.08% |

/RBH4 | -0.44% |

Crude oil goes higher

Crude oil prices (/CLH4) rose after OPEC left its forecast for demand unchanged for 2024 and 2025. Meanwhile, Kazakhstan—an OPEC member--stated that it would trim its production over the next few months to make up for overproducing in January.

Today will see a U.S. inventory report from the Energy Information Administration (EIA) and tomorrow will bring the International Energy Agency’s monthly oil report.

Strategy (38DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 72 p Short 73 p Short 82 c Long 83 c | 50% | +420 | -580 |

Short Strangle | Short 73 p Short 82 c | 63% | +2020 | x |

Short Put Vertical | Long 72 p Short 73 p | 77% | +180 | -820 |

Symbol: FX | Daily Change |

/6AH4 | +0.51% |

/6BH4 | -0.19% |

/6CH4 | +0.22% |

/6EH4 | +0.07% |

/6JH4 | +0.13% |

The dollar weakens

The U.S. dollar is mostly weaker across the board on Wednesday as traders rethink their reaction to the U.S. inflation report yesterday.

The one currency failing to rebound is the British pound (/6BH4), which saw its own January U.K. inflation report today come in slightly weaker than expected. The Bank of England rate cut odds jumped in the wake of the report, with markets pricing the probability of a 25-basis-point rate cut in June rising from 41% to 69%.

Strategy (51DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1.23 p Short 1.24 p Short 1.27 c Long 1.28 c | 45% | +318.75 | -306.25 |

Short Strangle | Short 1.24 p Short 1.27 c | 58% | +781.25 | x |

Short Put Vertical | Long 1.23 p Short 1.24 p | 81% | +143.75 | -481.25 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices