S&P 500 Is Losing Gains and Yields Are Falling After Powell’s Jackson Hole Speech

S&P 500 Is Losing Gains and Yields Are Falling After Powell’s Jackson Hole Speech

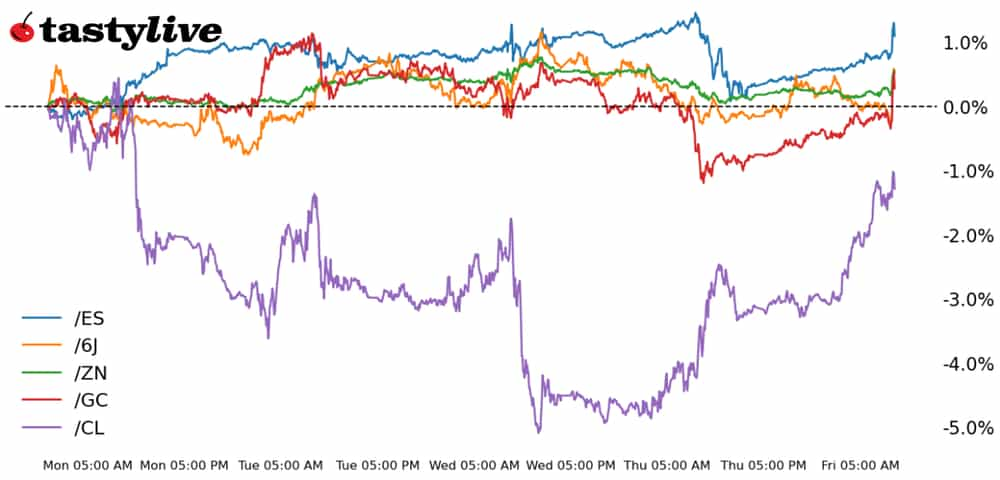

Also, 10-year T-note, gold, crude oil and Japanese yen futures

S&P 500 E-mini futures (/ES): +0.03%

10-year T-note futures (/ZN): -0.38%

Gold futures (/GC): +0.40%

Crude oil futures (/CL): +0.28%

Japanese yen futures (/6J): -0.99%

Federal Reserve Chair Jerome Powell’s speech in Jackson Hole, Wyoming, was as close to a declaration of victory over inflation as anything said or done since the start of the rate hike cycle. He bluntly declared that “the upside risks to inflation have diminished. And the downside risks to employment have increased … the time has come for policy to adjust.” Bonds may be liking the acknowledgement that the cut cycle is nigh, but stocks are feeling hot under the collar: After being up by nearly 1.5%, the S&P 500 (/ESU4) has seen its gains evaporate while this report was being written.

Symbol: Equities | Daily Change |

/ESU4 | +1.18% |

/NQU4 | +1.62% |

/RTYU4 | +2.65% |

/YMU4 | +1.01% |

S&P 500 contracts (/ESU4) gained this morning after the conclusion of Powell’s comments, rising above 1% on the day as traders look to close out a second weekly gain for the index. This week’s move takes us just below the July all-time high of 5,721.25, which will be the target for bulls next week. Monday will start the week with durable goods orders for July and then consumer confidence data on Tuesday. However, stocks were dropping rapidly over the course of the morning, quickly falling back from session highs.

Strategy: (45DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 5325 p Short 5350 p Short 5925 c Long 5950 c | 64% | +282.50 | -967.50 |

Short Strangle | Short 5350 p Short 5925 c | 70% | +2262.50 | x |

Short Put Vertical | Long 5325 p Short 5350 p | 86% | +100 | -1150 |

Symbol: Bonds | Daily Change |

/ZTU4 | +0.11% |

/ZFU4 | +0.23% |

/ZNU4 | +0.33% |

/ZBU4 | +0.55% |

/UBU4 | +0.73% |

Bonds moved a bit higher during this morning’s remarks from Powell, with markets anticipating a nearly 100% chance of a rate cut at the September meeting. The 10-year yield remains below 4% as the yield tracks toward a second weekly drop. The question for bond markets will quickly shift from what rates are expected to do this year toward the path for next year.

Strategy (63DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 110 p Short 110.5 p Short 116.5 c Long 117 c | 57% | +140.63 | -359.38 |

Short Strangle | Short 110.5 p Short 116.5 c | 64% | +640.63 | x |

Short Put Vertical | Long 110 p Short 110.5 p | 92% | +46.88 | -453.13 |

Symbol: Metals | Daily Change |

/GCZ4 | +0.81% |

/SIU4 | +2.4% |

/HGU4 | -0.97% |

Gold bulls took advantage of the drop in the dollar and yields resulting from Powell’s comments. The metal is trading into fresh all-time highs as traders look to lock in a fourth weekly gain. Still, with the risk-on mood, capital flowing into equities might take away some of gold’s appeal, which could set prices into a range trade as profit taking occurs.

Strategy (33DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2400 p Short 2420 p Short 2660 c Long 2680 c | 65% | +550 | -1450 |

Short Strangle | Short 2420 p Short 2660 c | 72% | +2380 | x |

Short Put Vertical | Long 2400 p Short 2420 p | 85% | +350 | -1650 |

Symbol: Energy | Daily Change |

/CLV4 | -0.44% |

/HOU4 | +1.29% |

/NGU4 | -0.68% |

/RBU4 | +0.88% |

Crude oil futures (/CLV4) rose over 2% this morning but that wasn’t enough to put the commodity into positive territory for the week. Traders defended the $72 a barrel level earlier this week despite growing concerns about global demand, especially from China. This week’s inventory numbers from the Energy Information Administration put a floor on bearish speculation, and now the focus shifts to OPEC as the cartel approaches planned production increases that are all but certain for now.

Strategy (55DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 65 p Short 66 p Short 82 c Long 83 c | 62% | +230 | -770 |

Short Strangle | Short 66 p Short 82 c | 69% | +1530 | x |

Short Put Vertical | Long 65 p Short 66 p | 83% | +140 | -860 |

Symbol: FX | Daily Change |

/6AU4 | +1.07% |

/6BU4 | +0.78% |

/6CU4 | +0.62% |

/6EU4 | +0.51% |

/6JU4 | +0.51% |

Japanese yen futures (/6JU4) got a boost this morning from the U.S. dollar’s weakness after Powell underscored the very high chance for a rate cut in September. Bank of Japan Governor Kazuo Ueda, overnight, said that the bank is positioned to make additional rate hikes if the data supports them. That said, a rate hike is likely to be communicated with intention ahead of a potential move, given the recent blowback policymakers received following the last rate adjustment.

Strategy (42DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.0065 p Short 0.0066 p Short 0.0072 c Long 0.0073 c | 65% | +250 | -1000 |

Short Strangle | Short 0.0066 p Short 0.0072 c | 71% | +712.50 | x |

Short Put Vertical | Long 0.0065 p Short 0.0066 p | 93% | +37.50 | -1212.50 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.