Boost Your Success by Trading Frequently

Boost Your Success by Trading Frequently

By:Kai Zeng

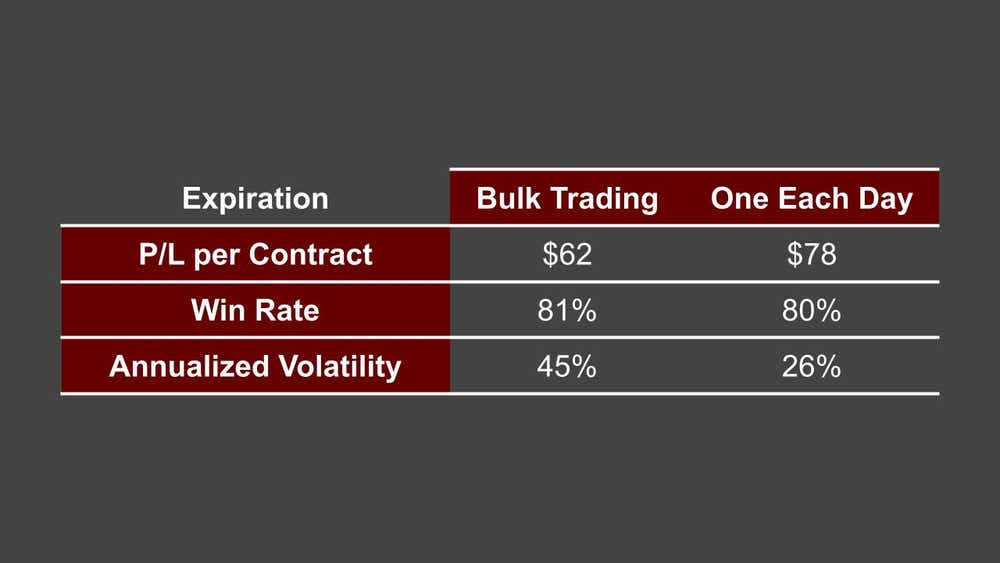

Selling one contract a day instead of in bulk raises profits and reduces volatility

- Small-scale trading aligns with the law of large numbers.

- Selling one contract a day instead of in bulk produces a better average profit/loss ratio and decreases portfolio volatility.

- Spreading out trades captures small profits that add up over time and potentially outweigh the gains from fewer, larger trades.

Traders often grapple with the question of whether to engage in bulk trading or to adopt a small-scale approach with multiple entries and exits. The answer to this question lies in the understanding of statistical outcomes and risk management.

Bulk trading, where traders enter and exit positions with multiple contracts at once, may seem appealing because of its simplicity. However, its counterpart, small-scale trading, where the same total number of contracts is traded consecutively one by one, offers a different set of advantages. The latter aligns more closely with the law of large numbers, which suggests that increasing the number of occurrences in trading can lead to results that are more predictable and in line with statistical expectations.

Consider the analysis of the SPDR S&P 500 ETF Trust (SPY) 45 day-to-expiration (DTE) 16-delta strangles over the past 15 years. In this study, two methodologies were compared: selling one contract every day throughout the 45-day cycle vs. selling an equivalent number of contracts once at the expiration cycle.

The results were telling; small-scale trading not only produced a better average profit/loss ratio but also exhibited a significant decrease in portfolio volatility.

Moreover, when strategies were tweaked to manage trades at 21 DTE—thereby halving the trading duration—the average number of contracts per 45-day cycle dropped to 23. This early management concept further reduced risk and diversified trading cycles, leading to an enhanced performance across the board.

.jpg?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

For example, a trader engaging in small-scale trading with the likes of Apple (AAPL) or Microsoft (MSFT) could benefit from the frequent adjustments and reduced exposure to sudden market moves. By spreading out their trades, they can capture small profits more regularly, which can add up over time and potentially outweigh the gains from fewer, larger trades.

The key takeaway for traders is the importance of diversifying trading volume and maximizing the frequency of occurrences. By doing so, one can effectively decrease the volatility of their portfolio. Additionally, managing trades earlier, at 21 DTE, can serve as a risk mitigation tool, diversifying trading cycles and leading to improved overall performance.

Kai Zeng, director of the research team and head of Chinese content at tastylive, has 20 years of experience in markets and derivatives trading. He cohosts several live shows, including From Theory to Practice and Building Blocks. @kai_zeng1

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices