Stock Markets Sink as Traders Sour on the Federal Reserve

Stock Markets Sink as Traders Sour on the Federal Reserve

By:Ilya Spivak

Stock markets have decided that they are unhappy with the Federal Reserve

- Markets struggled at first with what to make of the Fed monetary policy update

- Traders weighed underwhelming 2026 rate cut bets against new asset purchases

- Stocks seesawed amid uncertainty, then finally plunged to end the trading week

The markets seemed wholly focused on the outcome of the year’s last monetary policy update from the Federal Reserve at the start of the trading week. As the dust began to settle after Wednesday’s announcement, traders appeared to be struggling with what to make of the outcome.

The bellwether S&P 500 stock index finished the day cautiously higher after Fed Chair Jerome Powell walked off the podium at the obligatory press conference following the conclave of the Federal Open Market Committee (FOMC). However, prices pointedly fell short of a move beyond the bounds of their narrow weekly range.

Officials voted for a 25-basis-point (bps) rate cut, as widely expected. The perennially dovish Stephen Miran dissented in favor of a 50bps reduction. Chicago and Kansas City Fed presidents Austan Goolsbee and Jeffrey Schmid also broke ranks with the majority, voting against cutting rates altogether.

Markets to Fed officials: make this make sense

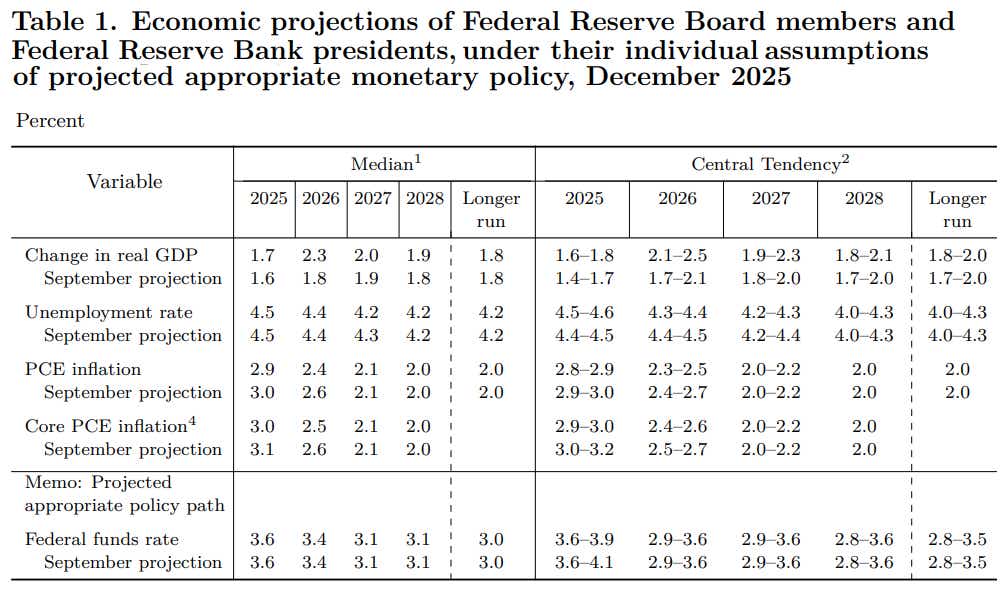

That much seemed easy enough to digest. Conflicting cues coming alongside the rate cut were harder to reconcile. On one hand, a new Summary of Economic Projections (SEP) continued to show just one 25bps rate cut in 2026, clashing with the markets’ call for at least 50bps. This disparity has long bothered traders, and it was left glaringly unresolved.

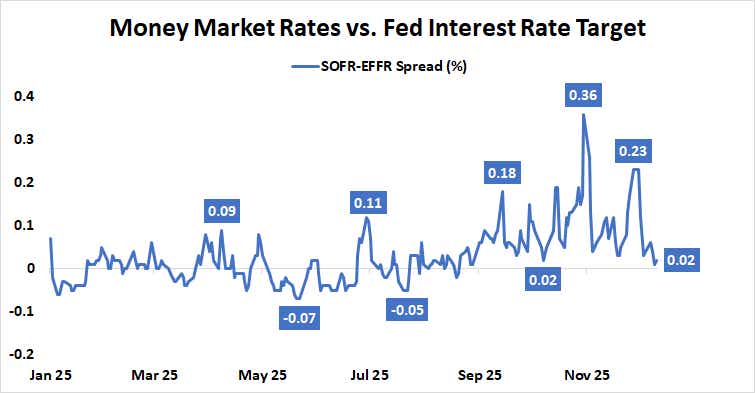

On the other hand, the Federal Open Market Committee (FOMC) resolved to “initiate purchases of short-term Treasury securities” in a bid to bring money market lending rates back in line with the Fed’s target. Powell explained that this would entail buying $40 billion of Treasury bills per month, starting this week.

The gap between the Secured Overnight Financing Rate (SOFR), the broadest measure of the cost of overnight funding secured by Treasuries, and that of the effective Fed Funds rate, the Fed’s policy goal, has been widening since mid-year. It spiked to a worrying six-year high of 36bps in October.

Traders decide the FOMC missed the mark after all

Powell went to great lengths to explain that these purchases were not intended as stimulus and aimed only to ensure smooth market function from the year-end liquidity drain to the busy refinancing period heading into April’s tax reporting season. Nevertheless, traders picked up a whiff of quantitative easing (QE). The US dollar conspicuously fell.

Traders spent the better part of 48 hours swinging prices back and forth in head-spinning ranges as they tried to decide what all of this will mean for the market mood. The results were finally in by Friday as the S&P 500 and the tech-tilted Nasdaq 100 suffered their biggest one-day losses in three weeks, dropping 1.11% and 1.94% respectively.

Sellers were supposedly set off by earnings reports from Oracle Corp (ORCL) and Broadcom Inc (AVGO), which seemed to hint at cooling momentum in the buildout of artificial intelligence (AI). Such nuance might have been painlessly ignored amid feverish AI optimism mere months ago. Not so, it seems, if Fed easing feels inadequate.

Ilya Spivak, tastylive head of global macro, has over 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive.com or @tastyliveshow on YouTube

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices