Russell 2000 Rally Continues as Yields Pull Back

Russell 2000 Rally Continues as Yields Pull Back

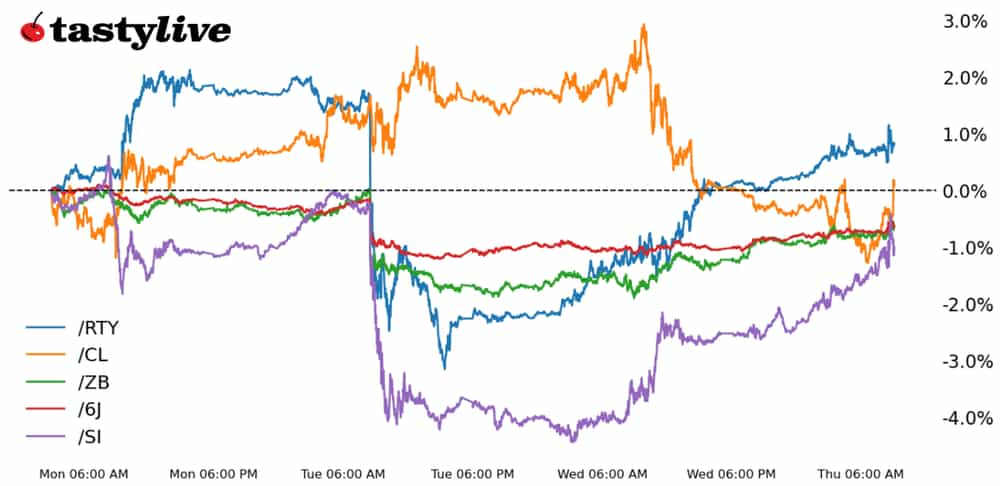

Also, 30-year T-bond, silver, crude oil and Japanese yen futures

- Russell 2000 e-mini futures (/RTY): +0.81%

- 30-year T-bond futures (/ZB): +0.63%

- Silver futures (/SI): +1.71%

- Crude oil futures (/CL): +0.45%

- Japanese yen futures (/6J): +0.39%

Less than two days after the January U.S. inflation report shook weak hands out of stocks, U.S. equity indices are once again in spitting distance of all-time highs.

Led higher by the Russell 2000 (/RTYH4), stocks have almost erased all the losses from Tuesday. Bonds are bouncing back as well, lifted by economic data this morning that showed a slowing pace of consumption, and a labor market remains stable. The pull-back in yields is spilling over to other asset classes, where precious metals are trading higher amid a softer U.S. dollar.

Symbol: Equities | Daily Change |

/ESH4 | +0.10% |

/NQH4 | +0.07% |

/RTYH4 | +0.81% |

/YMH4 | +0.15% |

Stocks move up

All four U.S. equity indexes are pointing higher on Thursday morning, once again led by the Russell (/RTYH4), which led lower on Tuesday and has led the rebound over the past two sessions.

The contribution of Super Micro Computer (SMCI), the largest component of the Russell 2000, can’t be dismissed either. Both the S&P 500 (/ESH4) and Nasdaq 100 (/NQH4) are more than +1.5% above their weekly lows.

Strategy: (42DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1950 p Short 1975 p Short 2150 c Long 2175 c | 42% | +595 | -655 |

Short Strangle | Short 1975 p Short 2150 c | 58% | +2810 | x |

Short Put Vertical | Long 1950 p Short 1975 p | 66% | +300 | -950 |

Symbol: Bonds | Daily Change |

/ZTH4 | +0.09% |

/ZFH4 | +0.23% |

/ZNH4 | +0.34% |

/ZBH4 | +0.63% |

/UBH4 | +0.88% |

First rate cut could come in June

The flush on Tuesday may have been the final capitulation for bonds. Fed rate cut odds have been decimated, with markets expecting the first rate cut to come in June.

Given the correlations between the three-month SOFR futures (/SR3H4) and the various bond products–the 21-day correlation between /SR3H4 and 2s (/ZTH4) is +0.94, while it is +0.77 for /SR3H4 and 30s (/ZBH4)–effectively suggests that any further weakness in bonds at these levels must be a result of traders deciding that they don’t think the Federal Reserve will cut rates in the first half of 2024.

Strategy (36DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 115 p Short 116 p Short 124 c Long 125 c | 59% | +296.99 | -703.13 |

Short Strangle | Short 116 p Short 124 c | 66% | +984.38 | x |

Short Put Vertical | Long 115 p Short 116 p | 78% | +203.13 | -796.88 |

Symbol: Metals | Daily Change |

/GCJ4 | +0.50% |

/SIH4 | +1.71% |

/HGH4 | +1.07% |

Precious metals move up

The drop in U.S. yields and the weaker greenback are help gild the path higher for precious metals. Silver prices (/SIH4) are leading the way higher, carving out what may be a bullish falling wedge since October. Momentum is starting to improve, setting the stage for a potential bullish breakout in the coming sessions.

Strategy (39DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 22 p Short 22.25 p Short 23.5 c Long 23.75 c | 34% | +760 | -490 |

Short Strangle | Short 22.25 p Short 23.5 c | 58% | +3985 | x |

Short Put Vertical | Long 22 p Short 22.25 p | 66% | +370 | -880 |

Symbol: Energy | Daily Change |

/CLJ4 | +0.45% |

/HOH4 | -0.35% |

/NGH4 | +3.29% |

/RBH4 | -0.09% |

Natural gas rises

The world may be awash in energy supply, but traders are looking around the corner and offering natural gas prices (/NGH4) some help.

Net-short /NG positions in the futures market are at their highest level since mid-December, which is when short covering ahead of the holidays helped spark a move to the upside.

Elsewhere, crude oil prices (/CLJ4) are shaking off a nasty reversal candle on Wednesday that coincided with an area that has been holding up as resistance since early-November. Much like at the start of 2023, the first few weeks of 2024 have produced a viable range trading environment for /CLJ4.

Strategy (29DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 72 p Short 73 p Short 80 c Short 81 c | 42% | +520 | -480 |

Short Strangle | Short 73 p Short 80 c | 59% | +2430 | x |

Short Put Vertical | Long 72 p Short 73 p | 70% | +240 | -760 |

Symbol: FX | Daily Change |

/6AH4 | +0.37% |

/6BH4 | +0.05% |

/6CH4 | +0.17% |

/6EH4 | +0.33% |

/6JH4 | +0.39% |

Japan officially entered a recession at the end of 2023, and receding price pressures may put the kibosh on hopes that the Bank of Japan will begin to normalize its monetary policy this year.

Even so, the cross-asset flows of lower U.S. Treasury yields are giving traders reason to jettison the dollar, boosting the Japanese yen (/6JH4) to the point where it may climb through the 2023 low, suggesting a veritable bottom has formed.

Strategy (50DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.0065 p Short 0.00655 p Short 0.007 c Long 0.00705 c | 69% | +150 | -475 |

Short Strangle | Short 0.00655 p Short 0.007 c | 74% | +500 | x |

Short Put Vertical | Long 0.0065 p Short 0.00655 p | 81% | +62.50 | -562.50 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.