Russell 2000 Leads Rebound After Worst Rout in Months

Russell 2000 Leads Rebound After Worst Rout in Months

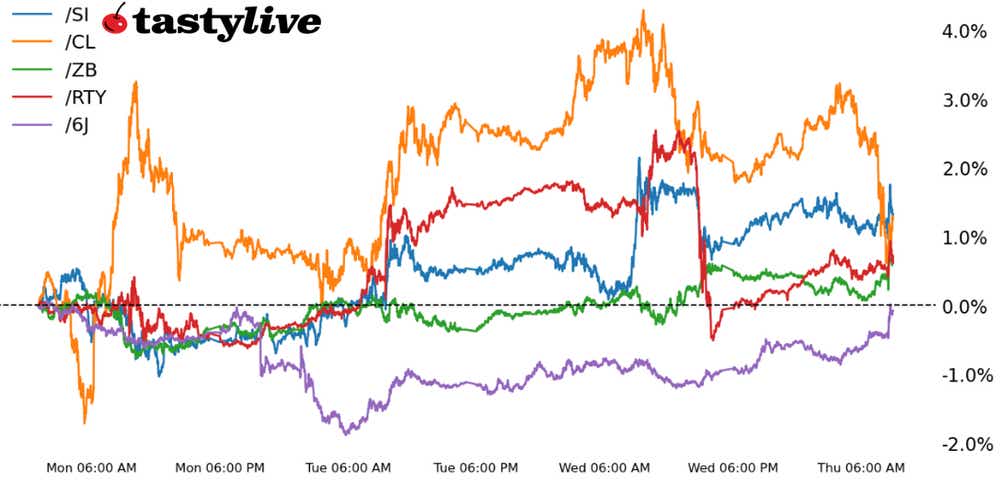

Also, 30-year T-bond, silver, crude oil and Japanese yen futures

- Russell 2000 e-mini futures (/RTY): +1.16%

- 30-year T-bond futures (/ZB): +0.33%

- Silver futures (/SI): +0.14%

- Crude oil futures (/CL): -1.35%

- Japanese yen futures (/6J): +1.08%

Investors are brushing off the worst U.S. equities sell-off in months—since Sept. 26 for the S&P 500 (/ESH4), since Oct. 26 for the Nasdaq 100 (/NQH4), and since Oct.18 for the Russell 2000 (/RTYH4)—on Thursday.

Bonds continue to edge higher, undercutting the U.S. dollar, paving the way for modest strength in precious metals. A gross domestic product (GDP) revision and strength in weekly U.S. jobless claims have investors re-embracing the soft-landing narrative once more.

Symbol: Equities | Daily Change |

/ESH4 | +0.76% |

/NQH4 | +1.03% |

/RTYH4 | +1.16% |

/YMH4 | +0.60% |

Dovish rate-cut bets stay put

A lackluster GDP print out of the United States kept dovish rate cut bets in place, sparking speculative buying across equity indexes.

E-mini-Russell 2000 futures (/RTYH4) is leading the pack, up over 1%. The small-cap index has benefited from falling yields, which has supported financial securities represented heavily in the index is heavy.

Smaller and mid-size banks benefit from falling rates that help support consumer lending, something those institutions heavily rely on for their bottom line.

The outlook on rate cuts will continue to dictate market sentiment, which leaves tomorrow’s personal consumption expenditures (PCE) report in focus for the next cue on where the Federal Reserve will go.

Strategy: (41DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1900 p Short 1925 p Short 2125 c Long 2150 c | 50% | +475 | -775 |

Long Strangle | Long 1900 p Long 2150 c | 33% | x | -1625 |

Short Put Vertical | Long 1900 p Short 1925 p | 76% | +222.50 | -1027.50 |

Symbol: Bonds | Daily Change |

/ZTH4 | +0.10% |

/ZFH4 | +0.19% |

/ZNH4 | +0.24% |

/ZBH4 | +0.33% |

/UBH4 | +0.40% |

30-year yield below 4%

30-year T-note futures (/ZBH4) moved higher Thursday by about 0.43%, which pushed the 30-year note’s yield below 4% and to the lowest level since July.

The final third-quarter U.S. GDP print came in at 4.9% from a quarter ago, which was below the 5.2% consensus estimate. That helped to maintain dovish rate cut bets and put a bid on Treasuries. Today we will see a five-year TIPS auction and tomorrow will serve up the November PCE data print.

Strategy (36DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 121 p Short 122 p Short 128 c Long 129 c | 47% | +468.75 | -531.25 |

Long Strangle | Long 121 p Long 129 c | 33% | x | -1406.25 |

Short Put Vertical | Long 121 p Short 122 p | 74% | +250 | -750 |

Symbol: Metals | Daily Change |

/GCG4 | +0.33% |

/SIH4 | +0.14% |

/HGH4 | +0.44% |

Bad news ahead for precious metals?

Silver futures (/SIH4) fell Thursday before the opening bell, dropping by about 0.64% after U.S. labor data showed fewer initial applications for unemployment benefits than expected.

If the U.S. can avoid a recession as the Fed looks to cut rates, it would bode poorly for precious metals and leave traders more focused on equities and other assets. Tomorrow’s PCE inflation data should influence the market’s narrative around where rates and the economy are headed.

Strategy (35DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 23.95 p Short 24 p Short 25.1 c Long 25.15 c | 23% | +190 | -60 |

Long Strangle | Long 23.95 p Long 25.15 c | 44% | x | -4900 |

Short Put Vertical | Long 23.95 p Short 24 p | 62% | +110 | -140 |

Symbol: Energy | Daily Change |

/CLF4 | -1.35% |

/HOH4 | -1.22% |

/NGF4 | +2.43% |

/RBH4 | -2.29% |

Crude oil drops

Crude oil (/CLG4) is reversing gains from the prior two sessions as an inventory build and rising U.S. production figures bolster bearish sentiment for the commodity despite ongoing hostilities in the Red Sea.

Markets seem confident that a U.S.-led maritime force will be able to suppress Houthi activity in the vital shipping lane. Meanwhile, OPEC suffered a hit after Angola, a 16-year member, announced that it would leave the cartel.

Strategy (27DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 70.5 p Short 71 p Short 75 c Long 75.5 c | 73% | +360 | -140 |

Long Strangle | Long 70.5 p Long 75.5 c | 1% | x | -3020 |

Short Put Vertical | Long 70.5 p Short 71 p | 88% | +170 | -330 |

Symbol: FX | Daily Change |

/6AH4 | +0.45% |

/6BH4 | +0.31% |

/6CH4 | +0.10% |

/6EH4 | +0.36% |

/6JH4 | +1.08% |

Eyes on the Japanese yen

The Japanese yen will be in focus later today, with Japan’s November inflation data due to cross the wires.

Analysts expect the core measure—which excludes volatile food and energy prices—to come in at 2.5% from a year ago. That would be above the Bank of Japan’s target, although a lighter than expected print could sap some bullish optimism that the bank will exit from its current ultra-loose monetary policy stance early next year.

That said, if inflation beats to the upside, it may boost yen prices (/6JH4).

Strategy (50DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.00695 p Short 0.007 p Short 0.0073 c Long 0.00735 c | 45% | +325 | -300 |

Long Strangle | Long 0.00695 p Long 0.00735 c | 34% | x | -1000 |

Short Put Vertical | Long 0.00695 p Short 0.007 p | 74% | +187.50 | -437.50 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices