XLU: Reflecting on 15 Utility Stocks

XLU: Reflecting on 15 Utility Stocks

By:Tim Knight

How to trade the Dow 15 Utilities (XLU) on the heels of extraordinary price action over just the past twenty days

What has taken place with the Dow 15 Utilities (and its trade-able counterpart, the fund XLU) over just the past twenty days has been nothing short of extraordinary. Let's examine this instrument and what appears to be forthcoming.

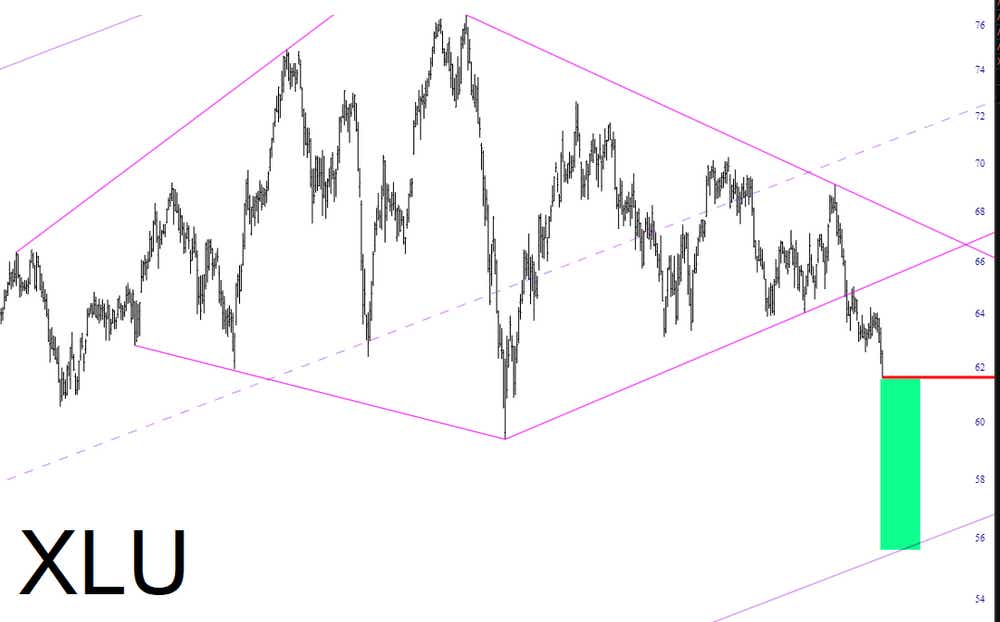

Just to jump to the end of this film, here is the present Dow Utilities. The red arrow marks the point where I established my bearish position, and the green arrow marks where I established my bullish position. As some folks know (because I never stop talking about it), the bearish position created a profit of over 300% in just two weeks. I got out at the +140% mark and haven't stopped kicking myself.

I didn't anticipate going long XLU until the start of October because the absolutely explosive increase in volume, coupled with the remarkable strength of the support zones, convinced me it was worth the risk to take an utterly opposite trade to the one I assembled on the Sept. 15.

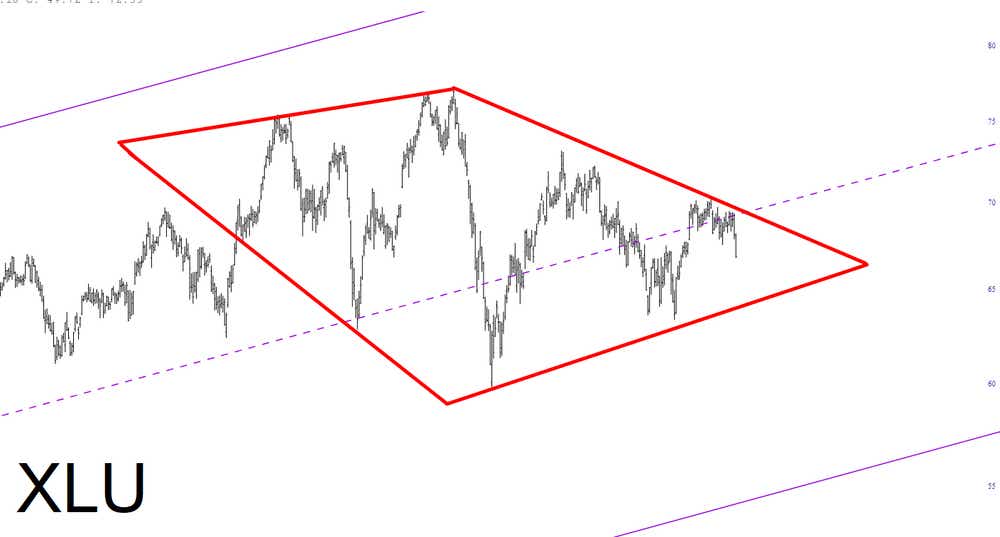

Looking back through my archives, I "discovered" the diamond pattern on the XLU a full five months ago, in May. It was a remarkably well-formed pattern, and although it would have plenty of ups and downs, it never beat the most recent high it had already established.

As the pattern continued to develop, the clarity of the diamond became even more clear, and I used this oval tool to envelop what I perceived as the price pattern. It was astonishingly clean.

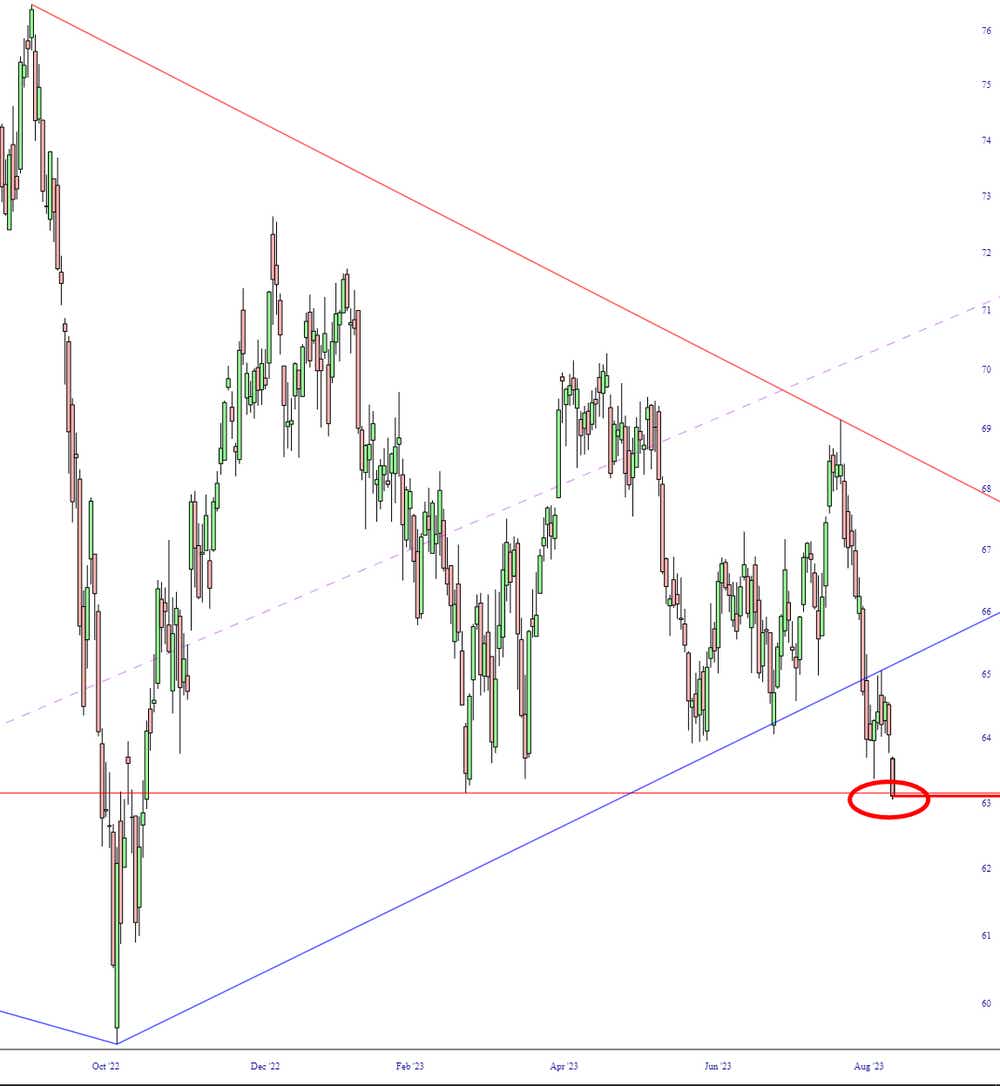

A core break took place early in August.

As the stock began a series of lower lows and lower highs, I had refined the parameters of the pattern as illustrated here. At the time, I went out on a limb and tinted in green the most extreme hope for how far XLU might fall. Incredibly, this almost perfectly nailed the drop that was going to ensue. (It actually went a little lower than this zone suggested).

Because of XLU's volatility, I had plenty of false starts and ham-handed screw-ups along the way. Finally, on Sept. 15, the setup became absolutely irresistible. I piled into puts with the biggest position I had ever had.

Even though I shared the particulars of my trade idea behind a pay wall, I was so excited about the trade that I did this post on my X.com account. In retrospect, it turned out to be just about the perfect opportunity to buy puts, almost to the millisecond.

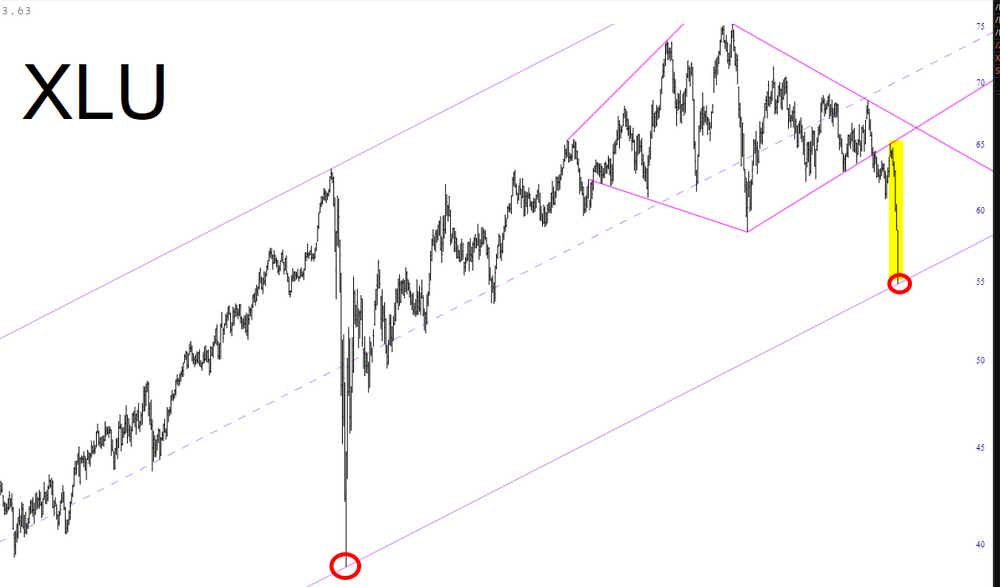

After that point, it fell virtually every day, and with increasing speed. As of this writing, it seems to have bottomed out on tremendous volume, nailing for only the second time in history a trendline that goes back almost a quarter of a century!

The bottom line is that stocks (and exchange-traded funds) have personalities, just like people, and it's valuable to get along with the right financial instruments. My friendship with XLU the past few months has been going splendidly. If it bounces, as I am anticipating, this will definitely be a beautiful friendship.

Tim Knight, a charting analyst with 35 years of trading experience, hosts Trading Charts, a tastylive segment airing Monday-Friday. He founded slopeofhope.com in 2005 and uses it as the basis of his technical charting and analysis. Knight authors The Technician column for Luckbox magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices