A Data-Driven Approach to Trading Crude Oil

A Data-Driven Approach to Trading Crude Oil

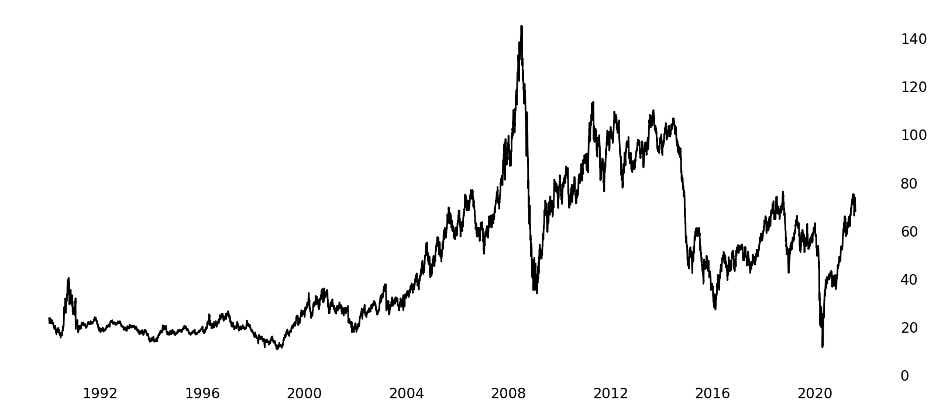

Crude oil can be viewed as one of the few markets that trades in a range; that is, the price of a barrel of crude has been as high as $145 and as low as $10 while always existing somewhere in between.*

Crude Oil Price History

Source: US Energy Information Administration (eia.gov)

In the same time that the range for stocks like AMZN can shift higher by $100s or even $1,000s every few months, crude oil has rallied to but not topped $75 on multiple occasions.† Commodities are often popular day trades for their range-bounded and mean-reverting attributes, but traders can be reluctant to jump on the action when crude starts moving multiple dollars per day as it did last week.

Decrease Memory, Increase Data

Those who sold $100 crude as it blew up to $140 in 2008, or bought $30 oil before its brief collapse below $0 in 2020, know that mean reversion works until it doesn’t. Outliers can cause hesitation for even the most mechanical people, but some of the best day traders live in the moment with no fear of the past. How do they do it?

SMO \ A Day in the Life

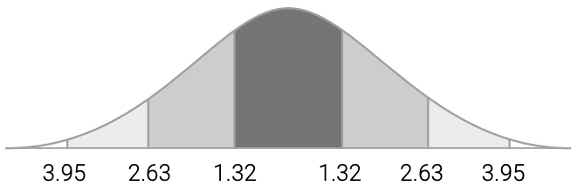

Source: dxFeed Index Services 5/1/21 to 8/4/21 (https://indexit.dxfeed.com)

Data can reduce emotion and other irrational influences to help create memoryless strategies that only act on statistical edges in the market. The standard deviation on SMO, for example, shows a 68% chance of Small Crude Oil futures closing in its range. Data-driven traders can buy or sell outside of that range on a net change basis with their 68% edge while giving no thought to yesterday.

68% of the Time, It Works Every Time

But, of course, data does not hold 100% of the time. The standard deviation is in fact designed to be wrong 32% of the time, since, if it were correct 100% of the time, the market would never reach those bounds. The idea is to reduce losses to the same amount as gains on those 32% days by defining risk in futures and taking losses at predetermined levels.

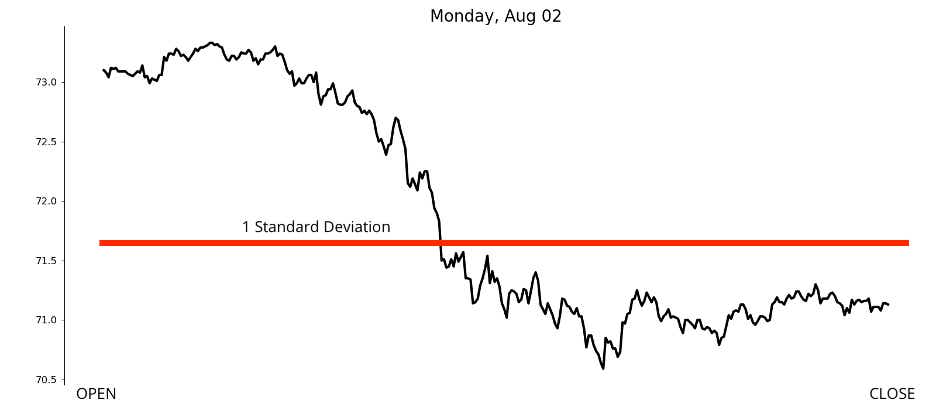

SMO \ Last Monday in the Life

Source: dxFeed Index Services (https://indexit.dxfeed.com)

For example, if you bought SMO around its 1 standard deviation on Monday, August 2nd, and took a $50 loss, you could have bought SMO around the same net change level on the following Tuesday and Wednesday and taken $50 profits from both.

The fear of what could happen will always be there, but data can help traders forget their memory and take advantage of the opportunity at hand.

Follow us on Twitter: https://twitter.com/small_exchange

Subscribe to our YouTube Channel: https://www.youtube.com/channel/UC5pAsul3H_7FYuPmZscClrA

Save Every Time You Trade The Smalls

The Small Exchange has also created a limited number of memberships for a one-time payment of $100 that give traders a lifetime of reduced exchange and market data fees when trading the Smalls.

For more information on the Small Exchange’s products and memberships, visit smallexchange.com. And be sure to check out my new show on tastylive, Small Stakes, where Pete Mulmat and I will show viewers how to navigate Small Exchange products every Monday-Friday and always on demand.

If you’d like to find out where to trade the Smalls products check out the list of brokers that offer their products, or tastylive’s preferred broker tastytrade.

*Spot crude oil prices from 1/1/90 to 8/4/21 from eia.gov

†AMZN and spot crude oil prices from 1/1/18 to 8/4/21 from finance.yahoo.com and eia.gov, respectively

© 2021 Small Exchange, Inc. All rights reserved. Small Exchange, Inc. is a Designated Contract Market registered with the U.S. Commodity Futures Trading Commission. The information in this advertisement is current as of the date noted, is for informational purposes only, and does not contend to address the financial objectives, situation, or specific needs of any individual investor. Trading futures involves the risk of loss, including the possibility of loss greater than your initial investment.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2024 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.