Adobe (ADBE) Earnings Preview: Q3 Looms Large After 40% Pullback

Adobe (ADBE) Earnings Preview: Q3 Looms Large After 40% Pullback

Adobe Earnings Preview

Adobe (ADBE) will report Q3 earnings results after the close on Wednesday, September 11.

Financial momentum remains intact: the company posted 11% revenue growth last quarter, alongside record operating cash flow, and solid double-digit gains in Digital Media ARR.

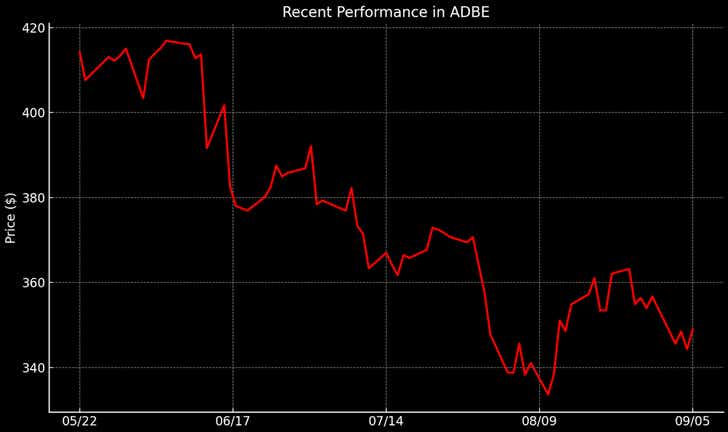

Yet the stock tells a different story—down nearly 40% over the past year—making this report a crucial test of whether Adobe’s new AI initiatives can restore investor confidence.

Adobe (ADBE) enters Q3 earnings with more questions than answers. Long seen as the undisputed leader in creative software, the company has stumbled in 2025—its stock is down roughly 20% year-to-date and nearly 40% over the past twelve months. Management is making a bold bet on agentic AI, a new class of autonomous digital agents built to streamline workflows, accelerate content creation, and personalize user experiences. The open question is whether these tools can evolve into a genuine growth engine—or prove to be overhyped add-ons.

For decades, Adobe built its reputation on staples like Photoshop, Illustrator, and Acrobat—applications that transformed digital creativity and content sharing. The company’s pivot to the subscription-based Creative Cloud became a template for the entire SaaS industry, while Document Cloud and Experience Cloud cemented its reach in enterprise productivity and marketing. Today, Adobe is doubling down on AI-native innovations such as Firefly, which integrates generative design directly into creative workflows, and Acrobat AI Assistant, which turns static PDFs into interactive documents. Together, these initiatives highlight Adobe’s effort to prove it can stay essential in a future where AI, not just software, drives how content is created, managed, and consumed.

Adobe is slated to release its fiscal Q3 earnings results after the close on Wednesday, September 11. Management has guided revenue to $5.875–$5.925 billion, with adjusted earnings of $5.15–$5.20 per share. That lines up closely with Wall Street’s consensus of $5.91 billion in revenue and $5.18 in EPS, reflecting healthy year-over-year growth of about 9% on the top line and 11% on the bottom line. But it’s not just about the numbers—it’s about whether Adobe’s AI strategy is beginning to reshape its long-term growth story.

All Eyes on Adobe’s AI Potential

Adobe’s core franchises—Photoshop, Illustrator, and Acrobat—remain global standards, and in Q2 revenue climbed 11% to $5.87 billion while earnings rose 13%. Yet competition is intensifying on every front. Canva continues to lure entry-level creators with cheaper, user-friendly tools, while Microsoft and Google are embedding generative AI into productivity suites used by hundreds of millions. Even within Adobe’s loyal professional base, growth has begun to slow as market saturation sets in and pricing power comes under pressure.

That is why Firefly and Acrobat AI Assistant are central to growth in 2025 and beyond. Firefly’s generative tools, now embedded across Creative Cloud, helped drive a 30% increase in new subscribers last quarter. Acrobat AI Assistant is turning PDFs into searchable, interactive documents—features that management says are already running ahead of the company’s $250 million AI-ARR target for fiscal 2025. These initiatives reflect a clear strategy: defend the high end with AI-driven enhancements and expand the audience with streamlined, consumer-friendly tools.

The obstacle, however, is scale. Adobe’s AI tools are drawing attention, but they remain only a sliver of the company’s $23.5 billion revenue base. The risk is that faster-moving or lower-cost rivals gain ground before Adobe’s agentic AI reaches meaningful adoption. Demonstrating real momentum in Q3 could help solidify the case for an AI-driven growth story. Without it, skepticism will likely intensify—and the stock’s underperformance could drag on.

Tagged as a Leader, Trading Like a Question Mark

For investors, Adobe poses a valuation paradox—cheaper than peers on earnings, yet richer on other measures. On a trailing GAAP basis, the stock trades at just 22x earnings, below the software sector median of roughly 29. That’s a relatively modest multiple for a company with durable margins, sticky subscription revenue, and a market-leading position.

By other measures, though, Adobe looks pricey. Its price-to-sales ratio stands at 6.7—almost twice the sector median of 3.4—while its 12.8 price-to-book multiple is more than three times the peer average of 3.6. The split underscores a company that screens cheap on earnings yet costly on assets and revenue, a reflection of how investors weigh Adobe’s high-margin model and entrenched ecosystem against slowing top-line growth.

Wall Street remains cautiously optimistic. Of the 42 analysts covering Adobe, 28 rate the stock a “buy” or “overweight,” while 13 recommend holding. The average price target of roughly $475 per share implies nearly 35% upside from current levels near $360. That optimism rests on confidence in Adobe’s ability to monetize AI across its vast user base, reinforced by the stickiness of Creative Cloud. Still, the hold ratings highlight lingering concerns: growth has slowed from 20%-plus in earlier years to closer to 10%–12% today, while competition from AI-native rivals like Canva and Figma continues to build.

All told, bullish investors are wagering that initiatives like Firefly and Acrobat AI Assistant can generate enough incremental revenue to justify Adobe’s premiums and narrow the gap to analyst targets. In the bullish case—where AI adoption materially lifts bookings and monetization—the stock could use its current setup as a launchpad for upside. But if progress disappoints, Adobe risks staying trapped in a valuation paradox: cheap on earnings, expensive on sales, and weighed down by continuing skepticism.

Adobe Earnings Preview Takeaways

Adobe’s September 11 earnings call is more than a quarterly update—it’s a credibility test. The company still delivers double-digit growth, record cash flow, and a loyal subscription base, but those strengths no longer move the stock. What investors want now is proof that its AI gamble is paying off. Firefly and Acrobat AI Assistant aren’t being judged as features—they’re being judged as evidence of a new growth engine that can define Adobe’s next era.

That’s why expectations heading into earnings are divided. Bulls argue that Adobe’s entrenched moat—its deep integration across the creative industry—positions AI as a natural extension of its dominance. Bears counter that Adobe looks more like a slowing incumbent, vulnerable to faster and cheaper AI-native challengers such as Canva and Figma.

What comes next could move the stock decisively. A convincing beat, coupled with evidence that AI adoption is taking hold, could flip sentiment and spark a rebound. But a miss—or even results that feel too familiar—may deepen the slump or, at best, leave shares stuck in neutral.To learn more about trading strategies tailored for earnings season, readers can follow this link.

Andrew Prochnow has traded the global financial markets for more than 15 years, including 10 years as a professional options trader.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices