Astera Labs: The Hidden Backbone of AI Infrastructure

Astera Labs: The Hidden Backbone of AI Infrastructure

A New AI Star - The Breakout of Astera Labs

Astera Labs’ connectivity chips and software have become the backbone of modern AI racks, allowing clusters of accelerators to function as a single system.

The company’s most recent earnings report showed record revenue growth, healthy margins, and strong cash flow, with guidance pointing to continued momentum.

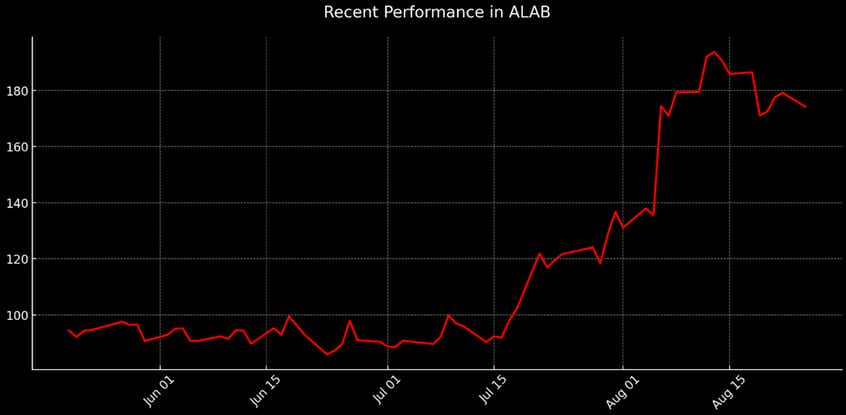

Shares have climbed more than 50% in the past month, but valuation multiples now sit well above sector averages—leaving little room for error if growth falters.

Astera Labs (ALAB) isn’t designing the GPUs that power AI—it’s building the links that let them act as one. The company’s chips and software form the connective tissue inside data-center racks, turning clusters of accelerators into unified engines. As AI models swell and data traffic accelerates, that role has moved from background support to mission-critical—placing Astera at the heart of the AI infrastructure boom.

Investors have rushed in. The stock has jumped more than 50% in the past month to roughly $190/share, lifting Astera’s market value past $30 billion. Once viewed as a niche chip startup, it’s now being cast as a platform player at the center of hyperscale computing. The question is whether that premium price tag reflects lasting leadership—or a rally that’s gotten ahead of fundamentals.

The Backbone of AI Infrastructure

Astera Labs has emerged as a critical enabler of the AI revolution—not by building GPUs or training models, but by creating the high-speed connections that determine how effectively those chips can work together. The company designs PCIe retimers, CXL memory controllers, and high-speed optical interconnects that act as the “nervous system” of an AI server rack, ensuring data moves seamlessly and reliably between CPUs, GPUs, and memory at blistering speeds. Without Astera’s technology, the multimillion-dollar clusters powering today’s generative models would struggle to function as unified systems.

For years, Astera was seen as a niche chipmaker, supplying signal-conditioning parts to a handful of hyperscale clients. That view changed in 2025. As AI racks balloon in size and complexity, Astera’s broader platform—retimers, switches, cables, and software working in concert—has become essential. Beyond performance, it gives hyperscalers something just as valuable: an open, vendor-agnostic alternative to proprietary interconnects.

Astera’s most recent earnings report in early August underscored that shift. The company posted Q2 revenue of $192 million—up 150% from a year ago—driven in part by its new Scorpio PCIe 6 switches, which already make up more than 10% of sales in their first full quarter. At the same time, Astera deepened its Nvidia partnership through NVLink Fusion, expanded into merchant GPU racks with its Aries retimers, and stepped forward as lead sponsor of UALink—the only open memory-semantic scale-up fabric. Together, these milestones highlight Astera’s growing weight in both scale-up and scale-out AI architectures.

The market has noticed. ALAB has jumped more than 50% in the past month to about $190 a share, pushing its value past $30 billion. Investors are no longer treating Astera as a component supplier, but as a platform company at the foundation of AI infrastructure.

Moreover, Astera’s reach extends beyond AI, with its connectivity solutions finding use in high-performance computing, cloud, and advanced networking. But right now, hyperscaler demand is the driving force. As AI models grow more compute-intensive and memory-heavy, Astera’s role as the rack’s connective tissue is elevating it from niche supplier to essential infrastructure provider.

Financials for Astera Labs Strengthen Across the Board in Q2

Astera Labs’ second quarter results, reported on August 5, highlighted both the scale of its hypergrowth and the discipline behind it. Revenue surged to $192 million, up 20% sequentially and 150% year-over-year, fueled by volume production of its Scorpio PCIe 6 switches and strong adoption of Aries retimers and Taurus optical cables. That momentum underscores Astera’s expanding role as the connective platform inside next-generation AI racks.

Margins remain exceptional by semiconductor standards. Non-GAAP gross margin came in at 76%, a 110 basis point improvement from Q1, while operating margin rose sharply to 39.2%. These metrics place Astera in rare territory, with profitability levels closer to software economics than traditional chipmakers. The company generated non-GAAP operating income of $75 million, translating to diluted EPS of $0.44—well ahead of expectations.

Cash flow strength further validates the model. Operating activities produced $135 million in cash during the quarter, pushing Astera’s total cash and equivalents over $1 billion. With no long-term debt and current liabilities of just $106 million, the balance sheet offers flexibility to fund aggressive R&D, support new product ramps, and pursue strategic partnerships without leaning on outside financing.

Looking ahead, management guided Q3 revenue to $203–$210 million, implying 6%–9% sequential growth, with non-GAAP gross margins around 75%. Earnings are projected at $0.38–$0.39 per share, reflecting steady expansion even as product mix shifts toward hardware modules that carry slightly lower margins. Importantly, Astera reiterated its long-term gross margin target of 70%, noting that higher-volume module sales may dilute near-term percentages but drive deeper integration and higher dollar content per rack over time.

One area to watch is taxation. A midyear law change lifted Astera’s non-GAAP tax rate to 20% for Q3, up from the low-teens range in prior quarters. Management expects normalization back toward 13% over the longer term, but near-term profitability optics could appear uneven. Still, with design wins expanding across hyperscalers and collaborations with Nvidia, AMD, and Alchip reinforcing its ecosystem presence, Astera enters the second half of 2025 with both operational momentum and financial resilience.

A Rich ALAB Valuation—Backed up by Unique Market Positioning

After climbing 50%+ in the past month to trade around $190/share, Astera Labs now carries a valuation that places it in a league of its own. On a GAAP trailing basis, the stock fetches a P/E ratio near 300—more than ten times the semiconductor sector median of ~28. Its price-to-sales multiple of 38 and price-to-book ratio of 26 also dwarf industry averages of roughly 3 and 4, respectively. By conventional measures, ALAB looks pricey.

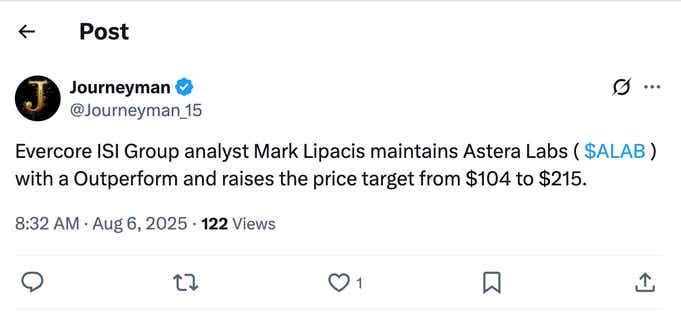

Wall Street is largely constructive on the stock, but not without reservations. Of the 17 analysts covering ALAB, 14 rate it a “buy” or “overweight,” while three rate it “hold.” The average price target of $170/share actually trails the current price, suggesting that much of the near-term optimism has already been priced in.

Going forward, the bull case appears to rest on Astera’s unique position in the AI supply chain. Its PCIe and CXL connectivity products aren’t just components; they are the connective tissue that allows racks of accelerators to function as a coherent system. That scarcity value, combined with elite margins—76% gross last quarter—and consistent cash generation, gives Astera a profile few peers can match. Partnerships with Nvidia, AMD, and Alchip only deepen its role as a linchpin of the AI ecosystem, which helps explain why investors are paying a premium for the shares.

The longer-term question is whether the company can grow into its valuation. Revenue is projected to top $1 billion by 2026, which would ease pressure on multiples, and the upcoming Scorpio X-Series could further lift dollar content per rack. But any wobble in hyperscaler spending, margin compression from a heavier hardware mix, or delays in new product ramps could make today’s premium harder to justify.

For those bullish on the narrative, Astera offers exposure to a company at the heart of the AI buildout with financials that already look more like a software platform than a chipmaker. But for bears, the flip side is clear: with expectations this high, even a small misstep could spark a sharp pullback in the stock.

Astera Labs (ALAB) Investment Takeaways

Astera Labs has quickly become one of the market’s purest plays on the AI buildout. Triple-digit revenue growth, margins north of 70%, and a balance sheet flush with cash set it apart from most chipmakers. With design wins piling up and its technology embedded in hyperscale systems, Astera is increasingly viewed as an indispensable part of AI infrastructure rather than a niche supplier.

The challenge is valuation. At roughly $190 a share, ALAB trades at multiples far above sector norms—pricing in near-flawless execution. That leaves little margin for error if hyperscaler demand cools, hardware margins tighten, or growth stumbles. The stock’s path forward hinges on whether Astera can broaden its platform role quickly enough to support such a premium.

For those convinced AI demand has staying power, Astera offers direct exposure to the connective fabric of next-generation computing. But it’s also a classic high-growth setup with little room for error—where real upside comes with the risk of a sharp pullback if execution falters, particularly with the major market indices trading near all-time highs.

Andrew Prochnow has traded the global financial markets for more than 15 years, including 10 years as a professional options trader.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices