Baidu (BIDU) Earnings Preview: Assessing the Pivot to AI and Robotaxis

Baidu (BIDU) Earnings Preview: Assessing the Pivot to AI and Robotaxis

Baidu (BIDU) Earnings Preview

Baidu (BIDU) will report Q2 2025 results before the U.S. market opens on Wednesday, August 20, with management hosting a call at 8:00 AM ET.

The company enters the quarter with strong momentum in AI Cloud, which grew 42% year-over-year in Q1, and Apollo Go, its robotaxi network, where ride volumes surged 75%.

With a trailing P/E ratio of 9 and a net cash position of roughly $27.5 billion, BIDU trades at a steep discount to global AI peers—but investor optimism may hinge on the potential for a rebound in the Chinese economy.

Baidu (BIDU) isn’t just China’s leading search engine—it has grown into one of the most ambitious global players in artificial intelligence and autonomous driving. Once defined by its dominance in digital advertising, Baidu has spent recent years building new growth engines in AI Cloud and Apollo Go, its fully driverless robotaxi network. Those investments are starting to pay off: AI Cloud revenue surged 42% year-over-year in the first quarter, while Apollo Go has expanded to more than 1,000 vehicles across 15 cities, completing over 11 million rides to date.

At the heart of Baidu’s push is serious technology depth. The company has built homegrown large language models, advanced mapping and navigation systems, and the RT6—a purpose-built, mass-produced Level 4 autonomous vehicle that costs under $30,000 to manufacture. This mix of innovation and cost efficiency is fueling Baidu’s reach beyond its home market. In recent months, it has struck high-profile partnerships with Uber in Asia and the Middle East, and most recently with Lyft to launch Apollo Go robotaxis in Germany and the UK. That move marks not only Baidu’s first step into Europe, but also a test case in one of the world’s most tightly regulated mobility markets.

Baidu reports second-quarter 2025 results before U.S. markets open on Wednesday, August 20, with management hosting a call at 8:00 AM Eastern Time (8:00 PM Beijing). The stakes are high. Last quarter, the company returned to positive top-line growth, powered by AI Cloud momentum and a sharp pickup in Apollo Go ride volumes. This quarter, investors will be watching to see if those gains can offset ongoing weakness in the digital advertising business—and whether Baidu can keep proving it’s more than just a search giant in a rapidly shifting tech landscape

Q2 results will test Baidu's progress toward new growth initiatives

Baidu is often described as “China’s Google,” but the company’s growth story now hinges on two newer pillars: artificial intelligence cloud services and autonomous ride-hailing. Both delivered standout momentum last quarter.

In Q1, Baidu Core revenue climbed 7% year-over-year to $3.54 billion, powered by a 42% surge in AI Cloud sales to roughly $930 million. The unit now contributes more than a quarter of Baidu Core’s revenue and is anchored by ERNIE—Baidu’s family of large language models (LLMs), its answer to OpenAI’s GPT. The latest iterations, ERNIE 4.5 and ERNIE X1, were priced competitively and are being open-sourced to encourage broader adoption across industries from finance to manufacturing.

Apollo Go, Baidu’s driverless ride-hailing service, also continued to scale rapidly. The network now fields over 1,000 vehicles across 15 Chinese cities, with cumulative rides surpassing 11 million and Q1 volumes up 75% year-over-year. At the core is the RT6, a purpose-built Level 4 autonomous vehicle that can be produced for under $4,200 per unit—an edge in a market that could eventually be worth trillions. Recent tie-ups with Uber in Asia and the Middle East, and with Lyft in Europe, underscore Baidu’s ambitions to take this platform global.

This quarter will reveal whether Baidu’s new growth engines can counter ongoing softness in its core advertising business, which slipped 6% in Q1 to $2.22 billion as search transitions toward AI-driven results. The company’s $28 billion net cash position provides ample firepower to keep investing, even against the headwinds of U.S. export restrictions on AI chips and a slowing Chinese economy. A strong beat and upbeat guidance could strengthen the case for Baidu as a rising global leader in AI and mobility, while a miss would renew doubts about how quickly that transformation can deliver tangible returns.

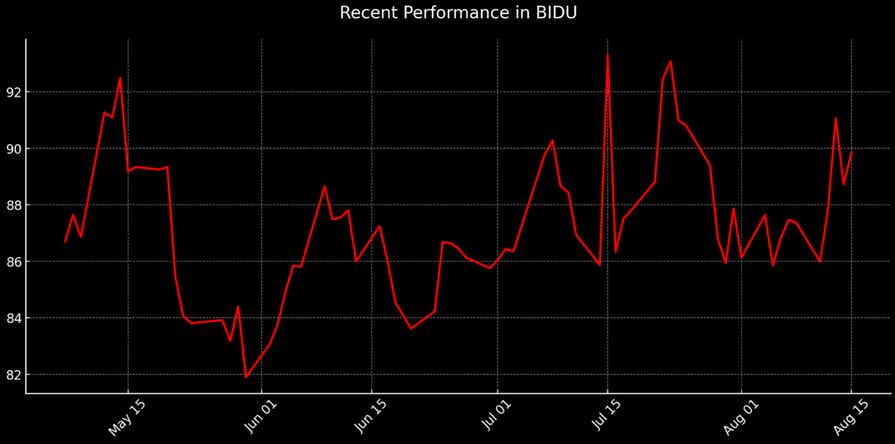

Discounted valuation, but macro overhang remains

Despite its expansion into AI and autonomous mobility, Baidu continues to trade at valuations that look deeply discounted relative to global tech peers. The stock sits near $90—about 10% below the average analyst target of $100—with a trailing P/E ratio of just 9, less than half the sector median of closer to 21. On a price-to-book basis, BIDU also lags the sector at 0.8 versus 2.0, while its price-to-sales ratio of 1.7 is only modestly above the median of 1.3. For a company holding roughly $28 billion in net cash and commanding leadership positions in both AI cloud and autonomous driving, those multiples suggest investors are still applying a steep China discount.

Baidu’s discounted valuation stems in part from China’s softer macro backdrop, where sluggish economic growth continues to drag on corporate ad spending and consumer sentiment. While AI Cloud and Apollo Go are expanding rapidly, the core advertising business remains under pressure, and investors are wary of how quickly AI-driven search can be monetized. Layer on geopolitical risks—most notably U.S. export curbs on advanced AI chips—and it’s clear why the market has been reluctant to grant Baidu the premium multiples commanded by U.S.-based AI leaders.

Even so, Baidu’s balance sheet strength, technology depth, and ability to scale in high-growth markets leave room for a potential re-rating if execution remains solid. Analyst sentiment is broadly constructive—28 of 43 rate the stock a “buy” or “overweight”—with consensus pointing to near-term upside toward the $100 target. A strong Q2 beat paired with confident guidance could help close that gap, while a miss or cautious outlook may keep the valuation capped for now—creating a potential entry point for long-term investors who see Baidu’s current multiple as undervaluing its longer-term prospects.

Investment takeaways

Baidu heads into its August 20 earnings report with strong momentum in AI Cloud and Apollo Go—two businesses that could reshape its future—even as weakness in advertising and China’s slowing economy weigh on the near-term outlook. Investors won’t just be watching the numbers; they’ll be weighing whether Baidu can prove it’s more than a search giant, with AI monetization and global robotaxi expansion as the true litmus tests.

At current levels, the stock looks like a paradox: trading near $90 with a P/E of just 9, less than half the sector median, despite holding $28 billion in net cash and leading positions in two of the world’s fastest-growing markets. For cautious investors, the 52-week low around $75 underscores the risks tied to China exposure. For the bullish, it signals a rare chance to own a cash-rich AI leader at one of the steepest discounts in global tech.

The bigger picture is straightforward: this earnings call could prove a turning point. A beat and confident guidance might begin closing Baidu’s valuation gap with U.S. peers, while a stumble could hand patient investors the pullback they’ve been waiting for—an opportunity to buy into a technology-driven platform at a compelling discount.

Andrew Prochnow has traded the global financial markets for more than 15 years, including 10 years as a professional options trader.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices