Banking Crisis May Strike Commercial Real Estate After Tech, SVB

Banking Crisis May Strike Commercial Real Estate After Tech, SVB

By:Ilya Spivak

The banking crisis is not going away. It may hit commercial real estate next after tearing through the tech sector and claiming the life of Silicon Valley Bank (SVB).

- Financial stress remains high even as markets settle after SVB collapse

- Thinly veiled assets vs. deposits mismatch makes US banks very vulnerable

- Commercial real state may follow the tech sector into the banking crisis

Financial stress still worryingly high after SVB collapse

The markets have seemingly settled into anxious drift after US officials scrambled to stop a banking crisis from engulfing the global financial system. The blow-up began with the hurriedly managed collapse of Silicon Valley Bank (SVB) and shuttering of Signature Bank.

Already-wounded Swiss banking giant Credit Suisse seemed like it would be unable to withstand the rough seas in the wake of the shock and was promptly cajoled into a tie-up with its main rival UBS. Further contagion seems to have been mostly contained, at least for now.

Nevertheless, investors remain cautious.

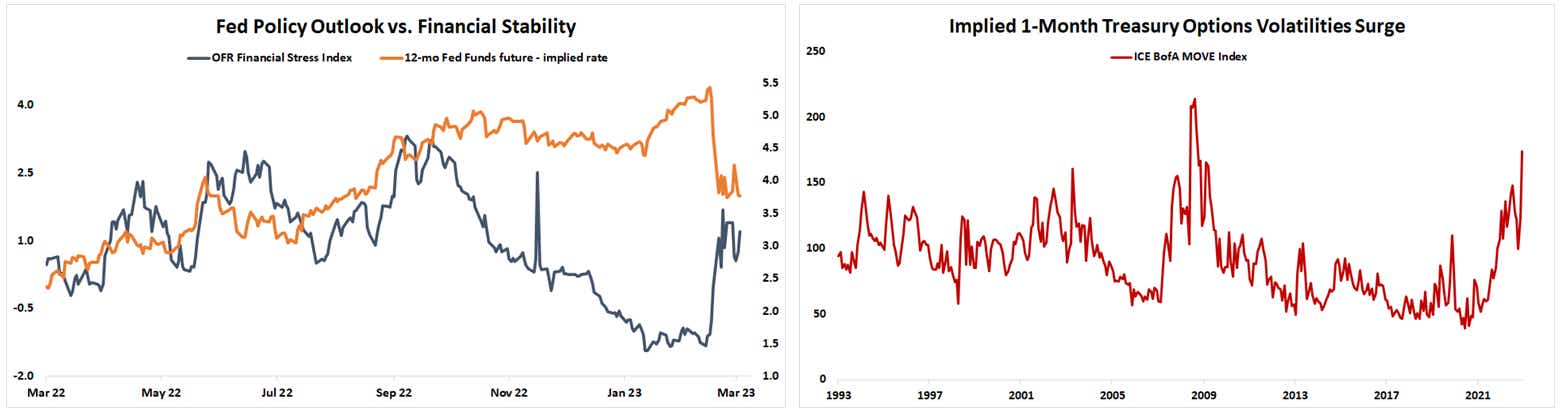

The OFR Financial Stress Index – a catch-all benchmark for market health coming out of the US Treasury department – has stopped rising after a steep jump but remains pinned near recent highs. Fed rate hike odds plunged as the crisis hit. They have been unable to rebuild despite de-escalation. The MOVE index of 1-month implied Treasury options volatilities – the sort of ‘fear’ gauge for the bond market that the VIX is for stocks – jumped to levels unseen since the bedlam of 2009 and looks stuck there.

Data Source: Bloomberg

Banking crisis vulnerability hides in plain sight, FDIC data shows

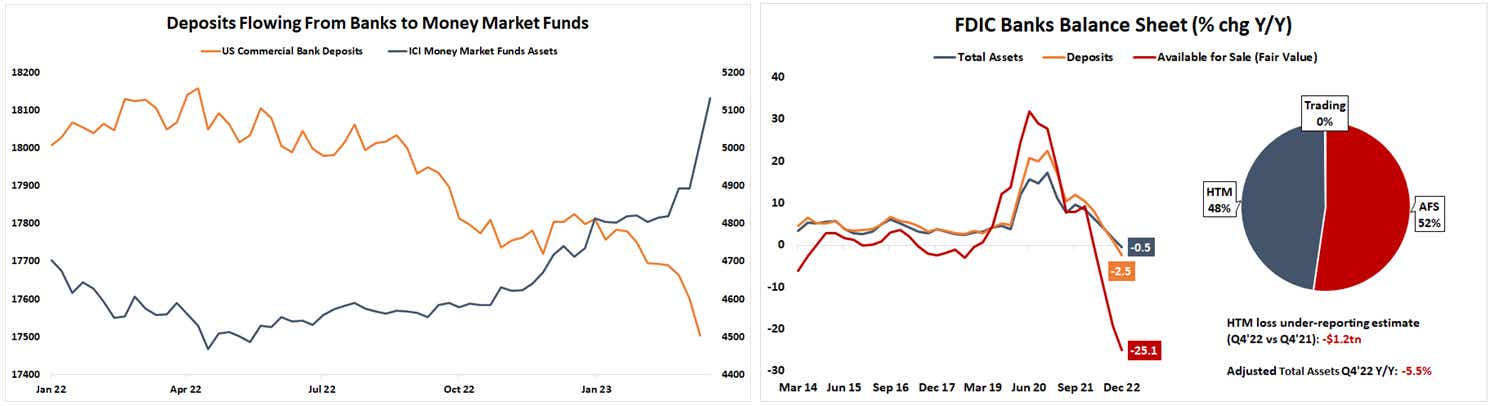

This lingering unease makes sense considering the problems that brought down SVB seem to threaten a broader swathe of the US banking sector. The story begins with dropping deposits: money market funds have been faster to pass on the Fed’s rapid rate hikes to investors, and so capital has increasingly flowed into them and out of the banks. These funds then park the influx with the Fed via its reverse-repo facility, which too offers better yields than the banks.

FDIC data shows that this led to a sharp 2.5 percent year-on-year drop in deposits at US commercial banks as of the fourth quarter 2022. On the surface, it looks like lenders should be able to stomach such a thing. Deposits are liabilities for banks because they must be paid back on request to clients, and so have to be offset with assets to ensure the business is solvent. Total asset holdings fell 0.5 percent year-on-year in Q4, a seemingly plush cushion against the larger deposits drop.

The reality is grimmer, as we the world learned with SVB. Banks keep securities in two buckets on their balance sheet. Those labelled as “Available for Sale” (AFS) are marked to market – meaning their values rise and fall with prevailing trends – while those tagged as “Held to Maturity” (HTM) are not. This obscures losses on such holdings on banks’ balance sheets.

In the case of SVB, insolvency was hidden in plain sight because the bonds incurring the losses that ate up the capital needed to pay up depositors were mainly sitting in the HTM pile from the onset. Other major banks moved hundreds of billions from AFS to HTM over the course of 2022. Analysis by the Wall Street Journal shows Charles Schwab moved close to $190 billion, PNC did nearly $83 billion, and JPMorgan transferred close to $78 billion, just to name a few.

Data Source: Bloomberg

Data Source: BloombergAFS securities recorded a bruising 25.1 percent year-on-year loss in the fourth quarter of 2022. If the same performance were applied to HTM holdings – a crude but telling exercise – the overall decline in total assets looks to be understated by about $1.2 trillion. Adjusted accordingly, this would amount to a 5.5 percent year-on-year decline against a 2.5 percent drop in deposits.

US commercial real estate market: a ticking time bomb?

This seems to put much of the banking system in a dangerously precarious position. The mismatch between assets and deposits is weaponized if customers decide to withdraw at scale. That makes smaller banks catering to a concentrated, niche clientele particularly vulnerable.

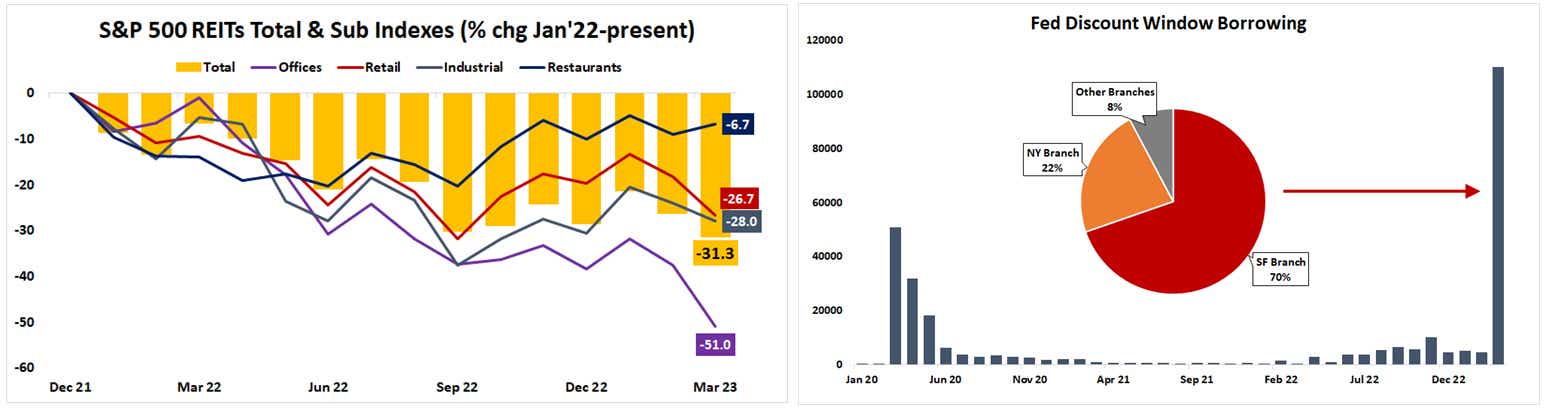

For SVB, financing the tech world of Silicon Valley made for skewed gearing to a capital-hungry industry that suffered outsized pain amid the rapid rise in interest rates. Commercial real estate (CRE) appears to be another such area.

Assets in the space have suffered as borrowing costs swelled, as with the tech sector. The legacy of Covid lockdowns compounds the pain. Publicly traded REITs linked to office space are down 51 percent in just 15 months as hybrid and work-from-home arrangements become more common. Some 80 percent of CRE mortgages are held at banks outside the big, “too-big-to-fail” money centers.

Accelerating withdrawals from such banks could make for another SVB-like episode, and probably more than one. Meanwhile, emergency borrowing from the Fed’s discount window – a lender-of-last-resort liquidity outlet – has mostly flowed through the US central bank’s San Francisco branch. That suggests the scramble for cash has been concentrated in the tech space, while banks geared to CRE have been reluctant to appear weak by beefing up cash access via the central bank. Another last-minute scramble in the event of trouble may well follow.

Data Source: Bloomberg

Ilya Spivak is the Head of Global Macro at tastylive, where he hosts Macro Money every week, Monday-Thursday.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2024 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.