Bed Bath & Beyond (BBBY) Stock: All You Need to Know

.jpg?format=pjpg&quality=50&width=387&disable=upscale&auto=webp)

Bed Bath & Beyond (BBBY) Stock: All You Need to Know

Bed Bath and Beyond catapulted to the top of the meme trade last week on the back of massive trading volume and a flurry of news in the “meme” space including the issuance of APE “dividend” for AMC holders. BBBY transaction volume doubled on Friday 8/5 leading into the frenzy, seeing another double on Monday, with the stock price responding similarly on its way to $20. On 8/16, BBBY reached nearly 400 million shares traded on a float of just about 80 million. The day ended at nearly 5x volume to shares outstanding with the stock toping out just under $30, up nearly 600% over the span of just two weeks.

What is Bed Bad & Beyond’s meme stock history?

While certainly secondary to GME, the original mother-of-all-squeezes, BBBY has one common denominator – Ryan Cohen. Ryan Cohen was the co-founder of Chewy (CHWY) and is currently an activist investor through his fund RC Ventures, with large stakes in AAPL and most notably, GME and BBBY. Ryan led the charge in GME, buying a large stake in GME in late 2020.

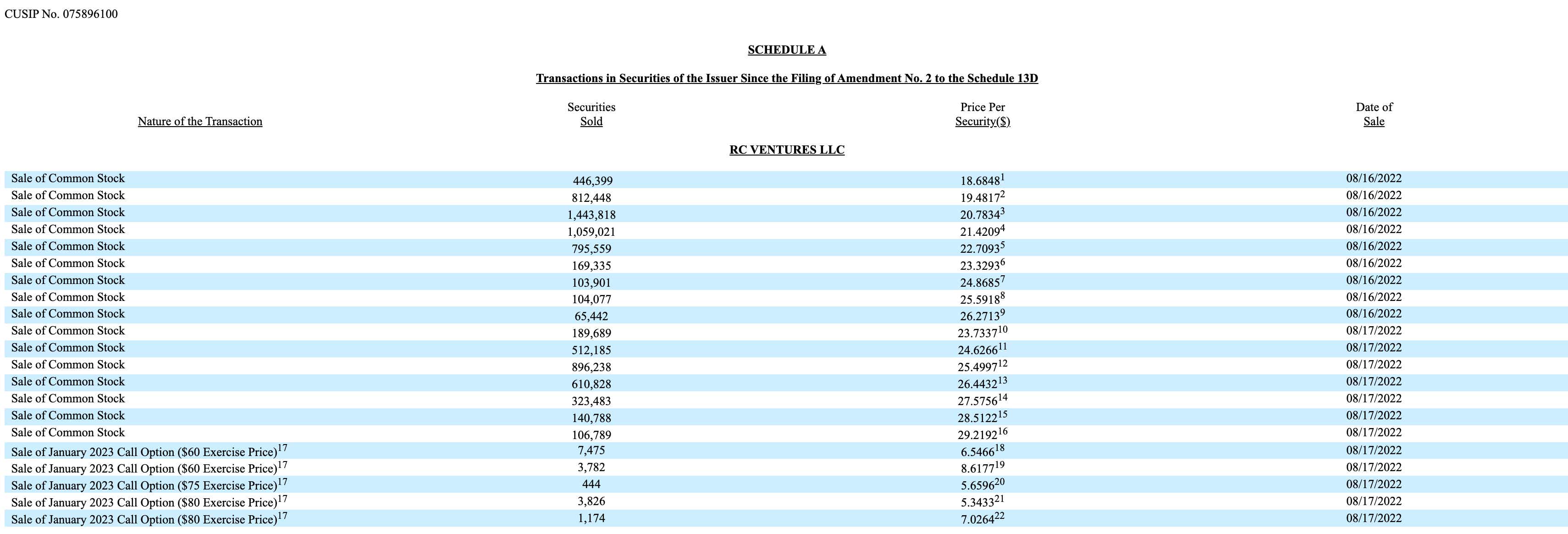

Cohen’s involvement with BBBY is a bit more complex. Through RC Ventures, Cohen purchased stock positions at around $15 per shares totaling around 9.8% of the company stock, along with far out of the money call options. These call options, expiring in January 2023 at the $60, $75, $80 strikes, represented the right to buy shares of BBBY stock at a price many multiples of the stock price even at its $30 price height. These call options helped propel the “gamma” squeeze through massive stock and call volume.

Buy low, sell high! As the stock rallied up to $30 RC Ventures took the opportunity to liquidate the position. RC Ventures liquidated tranches of BBBY stock on its way up, selling out of shares between $18 - $29, and liquidating the far out of the money call options. A massive win for RC Ventures, estimates peg profits on just the stock transactions at around $60 Million with potentially more profit coming from the sale of the out of the money call options.

SEC Filing: https://www.sec.gov/Archives/edgar/data/886158/000092189522002496/sc13da313351002_08182022.htm

Why is the BBBY stock price crashing now? What's next?

Many of the meme stocks have felt the pressure of negative headlines, but most will point to the BBBY fundamentals. Bed Bath & Beyond has seen 25% year over year declines in net sales, and posted a $358 million loss for the second quarter ending in June. Heavily debt laden, BBBY bonds trade north of 30%, the market isn’t pricing in much upside for this stock.

Create a tastytrade account or log in (learn more about opening an account at tastytrade)

tastytrade, Inc. and tastylive, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.