Top 3 Stocks to Watch in April 2023

Top 3 Stocks to Watch in April 2023

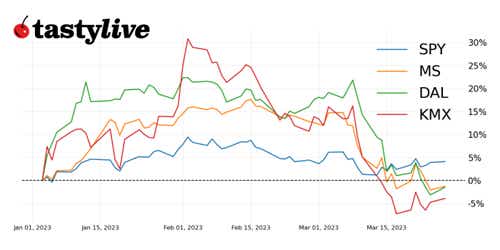

Market Update: S&P500 up 3.22% year to date

So far in 2023, the market has been up, then back down to test the opening price level of 2023, and then back up slightly. The test of the opening price of 2023 occurred about two weeks ago in mid-March. It appears as though the market found buyers at that level, around $3880 in the S&P 500 e-mini futures contract.

Since we found buying support in late December of last year and January of this year, and we have again found buying support around the same level in mid-March of this year, we can begin drawing some conclusions about where the market is currently priced.

It’s possible that we test this same level again and push through lower to find new buying support. However, it seems that we are defining a base that could remain a support level that we continue to bounce off in 2023.

Top Stocks to Watch in April 2023

- KMX 4/11 Before the Open

- DAL 4/12 Before the Open

- MS 4/19 Before the Open

1) Carmax Inc. (KMX)

Earnings Date: April 11th, 2023 (Before the open)

Carmax Inc. is the largest retailer of used vehicles in the U.S. and one of the nation's largest operators of wholesale vehicle auctions. CarMax is engaged in providing related services including financing of vehicle purchases and sale of extended warranties, accessories and vehicle repair services. CarMax operates under two reportable segments: CarMax Sales Operations and CarMax Auto Finance (CAF).

Carmax is currently trading at $58.27, down 5.56% from its opening price of 2023. The last 14 months of trading have been bearish for KMX. However, since October of 2022, price action appears to be defining a larger base with support at its current price level. It is possible that KMX begins its climb higher and starts a bullish trend if support around $58 holds.

Carmax has reported positive net income for the last five quarters and their balance sheet has remained consistent.

If you’d like to make an earnings play in April, you have the opportunity to use either April or May contracts. If you make an earnings trade using April contracts, you may want to define the risk for your trade in case you get a move against you. You also have the opportunity to roll that position out to May if you need to.

The options market in April and May for KMX is liquid and tight. Right now, you can get pretty with your strikes and still collect a good amount of premium compared to the buying power used.

2) Delta Air Lines Inc. (DAL)

Earnings Date: April 12th, 2023 (Before the open)

Delta Air Lines is part of the US aviation market. The bulk of this Atlanta, GA. based carrier's revenues are recognized from its airline segment. Delta Air Lines also has a refinery segment, which operates for the benefit of the airline division by providing it with jet fuel from its own production and agreements with third parties.

Delta is currently trading at $32.13, down 3.37% from its opening price of 2023. DAL has reported positive net income for the last three quarters. Their balance sheet is trending down slightly, possibly indicating cost-saving efforts.

DAL’s options markets in April and May contracts are liquid and very tight. You have the opportunity to use either April or May contracts for an earnings play. With the price of DAL stock in the thirties, the premium to buying power used ratio is quite efficient.

This is an opportunity for smaller accounts to consider undefined risk positions. However, it is important to remember that lower priced stocks can make large moves through earnings reports. For that reason, it may still be prudent to define the risk for your earnings trade.

3) Morgan Stanley (MS)

Earnings Date: April 19th, 2023 (Before the open)

Morgan Stanley serves corporations, governments, financial institutions, and individuals worldwide. It has 3 business units, Institutional Securities, Wealth Management, and Investment Management.

Morgan Stanley is currently trading at $84.64, down 1.16% from its opening price of 2023. Over the last five quarters, MS has reported positive net income. During that same period MS’s balance sheet has been consistent with a slight down trend.

If you’d like to make an earnings play trade for MS, you have the opportunity to use either April or May contracts. If you use April contracts and place your trade the day before earnings is reported, you’ll only be two days out. If you do this, it is recommended that you define your risk for this trade, making it a binary event.

You also have the opportunity to use May contracts, and it could be beneficial to use MS’s earnings report next month as a catalyst for the position. Both May and April contract markets are liquid and tight. This underlying also provides a nice premium to buying power used ratio that is efficient for smaller accounts.

Honorable Stock Mentions for April 2023

- Taiwan Semiconductor ADR (TSM): April 13th, 2023 (Before the Open)

- The Charles Schwab Corp. (SCHW): April 17th, 2023 (Before the Open)

- American Express Company (AXP): April 20th, 2023 (Before the Open)

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.