Bloom Energy Surges on Fuel Cell Momentum in the AI Era

Bloom Energy Surges on Fuel Cell Momentum in the AI Era

Bloom Energy Rides AI Wave - Has the Stock Gotten Ahead of Itself?

Bloom Energy’s fuel cells are emerging as an alternative power solution for AI-driven data centers, offering reliability and scalability beyond what the grid can deliver.

The company’s latest earnings report reflected strengthening financials—record revenue and improving margins—with plans to double capacity by 2026.

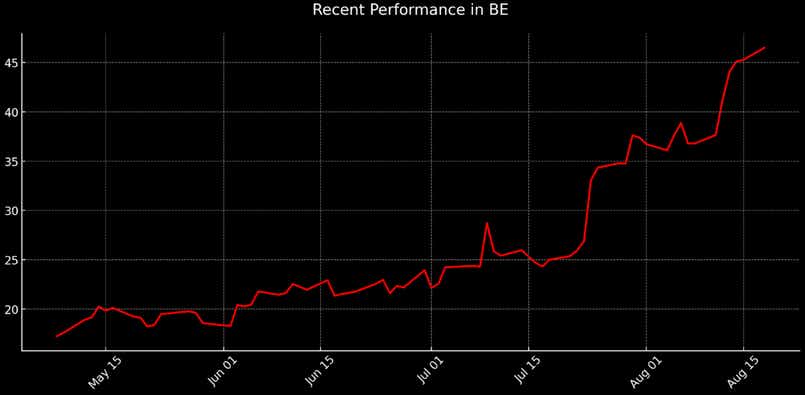

Shares have surged more than 80% this year, but the stock’s stretched valuation raises the risk of a pullback if momentum falters.

Bloom Energy (BE) isn’t waiting for a modernized grid—it’s building onsite power for the data centers fueling the AI boom. While utilities grapple with bottlenecks and reliability concerns, Bloom’s solid-oxide fuel cells deliver a faster, cleaner and more scalable solution—already powering Oracle and other hyperscale operators.

Investors have noticed. Shares have soared 70% in the past 30 days and nearly doubled form the start of the year, as the company’s AI-driven momentum has transformed it from a niche clean-tech player into one of the market’s hottest energy names. Today, we unpack Bloom’s rapid ascent—and whether its breakout marks the start of a new era or simply a rally that’s raced ahead of fundamentals.

Powering the AI Boom with Onsite Fuel Cells

Bloom Energy has long positioned itself as a clean-energy disruptor, designing and deploying solid-oxide fuel cells that generate electricity directly at customer facilities by converting natural gas, biogas, or hydrogen into power—without combustion. The result is a modular, scalable system that delivers lower emissions than fossil-fuel plants and greater reliability than the conventional grid. They’re especially attractive to sectors where uninterrupted power is essential, from data centers to healthcare and advanced manufacturing.

For much of its history, Bloom was viewed as a niche alternative-energy play—volatile, capital-intensive and often overshadowed by wind and solar. But in 2025, the narrative has shifted. With AI data centers emerging as some of the world’s most power-hungry infrastructure, Bloom’s technology is suddenly in high demand. Unlike centralized utilities, Bloom’s fuel cells can be deployed onsite, delivering reliable, low-carbon electricity directly to servers that can’t afford downtime.

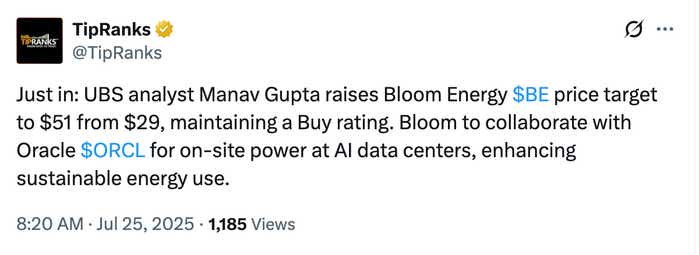

The market has taken notice. Shares have nearly doubled year-to-date—with most of that surge materializing in the last month—after Bloom announced a deal to supply Oracle Cloud Infrastructure data centers in the United States. CEO KR Sridhar has since confirmed that more agreements with major operators are in the works. That momentum pushed Bloom’s stock to record highs above $46, underscoring how quickly investors are recalibrating the story.

Bloom already supplies more than half a gigawatt of electricity to data centers and is targeting 2 GW of capacity by the end of 2026. Partnerships with Oracle, Equinix, American Electric Power and Quanta Computing signal growing recognition that Bloom’s technology isn’t just a green alternative—it’s a potential backbone for next-generation computing.

Beyond data centers, Bloom’s energy servers and electrolyzers are gaining traction in hospitals, biotech, retail, and higher education, as well as in the emerging global hydrogen market. But today, it’s the AI buildout that’s driving both the story and the stock price. Increasingly, investors view Bloom less as a speculative clean-tech play and more as an energy infrastructure provider wired into the most powerful technology cycle of the decade.

Financial Position Improving, but Profitability Remains Elusive

At the end of July, Bloom Energy reported its second quarter results, giving investors a timely look at how the company is executing just as its stock hits all-time highs. The July 31 release reinforced Bloom’s growing traction in the AI data center power market while also highlighting the financial challenges that remain.

Revenue reached $401 million, up nearly 20% year-over-year and marking Bloom’s third straight quarter of sequential growth. Product and services sales climbed an even stronger 26%, fueled by surging demand from data center and industrial customers.

Margins have also improved meaningfully. Gross margin rose to 26.7% in GAAP terms (versus 28.2% non-GAAP), a six-point improvement from last year, reflecting stronger pricing, better operating leverage and a more profitable services business. Bloom has now logged six straight quarters of services profitability, a sign that recurring revenue is starting to offset the lumpiness of large equipment orders.

On the bottom line, Bloom is inching closer to consistent profitability but isn’t there yet. The company posted a GAAP net loss of $42.6 million (-$0.18 per share) last quarter, though its non-GAAP earnings improved to $0.10 per share, versus a loss of $0.06 in the prior year. Non-GAAP operating income also swung positive at $28.6 million, compared with a loss during the same period last year—reflecting strengthening operational execution and improving cost discipline.

The balance sheet remains a focal point. Bloom ended Q1 with roughly $800 million in cash, and while its convertible notes maturing this August are expected to convert into equity rather than pressure liquidity, the company still carries a heavy debt load relative to peers. That overhang, coupled with continuing operating losses on a GAAP basis, suggest the stock could be sensitive to a shift in sentiment.

Looking ahead, management confirmed its 2025 guidance for $1.65–$1.85 billion in revenue, non-GAAP gross margins of about 29% and operating income of $135–$165 million. The company also announced plans to double factory capacity from 1 GW to 2 GW by the end of 2026, signaling confidence that demand—particularly from hyperscale data centers—will continue to accelerate. CEO KR Sridhar was blunt about the strategic opportunity: “As onsite power becomes increasingly self-evident, given rapid AI growth, there has never been better market pull for Bloom products.”

Strong Momentum Meets a Stretched Valuation

After nearly doubling year-to-date—and climbing above $40/share in August—Bloom Energy now trades at a valuation that look more like a hypergrowth tech stock than a clean-energy equipment supplier. On a forward non-GAAP basis, Bloom’s P/E ratio sits near 90, more than four times the sector median of ~20. Its price-to-sales multiple of 6.4—and price-to-book ratio of 17.8—also tower over sector averages of 1.7 and 2.9, respectively. By almost any traditional yardstick, Bloom screens as expensive.

Wall Street sentiment reflects this tension. Of the 25 analysts covering the stock, only 11 rate the stock a “buy” or “overweight,” while 12 maintain a “hold” stance. One analyst rates the shares “underweight” and another recommends “sell.” This distribution underscores a cautious consensus: while Bloom is seen as a legitimate growth story, some analysts remain wary of valuation risk. Moreover, the average analyst price target of $37—well below the current ~$47 trading level—suggests the stock’s rally has already outpaced the fundamentals.

And yet, the valuation isn’t entirely untethered from reality. Bloom sits at the intersection of two powerful investment narratives: the clean energy transition and the AI-driven buildout of data center capacity. In that context, investors may be willing to pay up for a company delivering record growth, expanding margins and securing high-profile partnerships with the likes of Oracle and Equinix. A capacity expansion plan that doubles output to 2 GW by 2026 further reinforces the idea that Bloom is building for long-term demand, not just chasing hype.

The question is whether Bloom can “grow into” its valuation. At present, the stock assumes a rapid expansion path—sustained revenue growth, operating leverage and eventual GAAP profitability. If the company delivers, the multiples could normalize over time as earnings catch up. But if growth slows or margins stall, today’s premium could quickly become a liability.

Bloom Energy Investment Takeaways

Bloom Energy enters the back half of 2025 with clear momentum. Revenue is accelerating, margins are improving and its technology is increasingly positioned as a solution for the power demands of hyperscale AI data centers. The Oracle partnership—and the potential for additional high-profile announcements—has reframed Bloom from a niche clean-tech supplier into an energy infrastructure player tied to one of the most powerful trends of the decade.

But the story isn’t without risk. Bloom remains loss-making on a GAAP basis, carries a heavy debt load and now trades at valuation multiples far above sector norms—nearly 90x forward earnings and over 6x sales. At these levels, the stock already reflects much of the good news. Any stumble in execution, delays in customer adoption or margin compression could quickly spark a correction.

For long-term investors, Bloom offers exposure to both the clean-energy transition and the AI boom, but it is best viewed as a high-beta growth play rather than a stable utility-like holding. For tactical traders, options may provide a way to participate in upside while managing risk—for example, using call spreads to capture momentum if shares push higher on new partnerships, or selling puts as a way to enter closer to the $37 analyst target range if volatility pulls the stock back.

In short, Bloom no longer flies under the radar. It is executing better, expanding capacity and gaining relevance with blue-chip customers. The next positive announcement—especially another marquee data center deal—could be a powerful catalyst for the shares. On the other hand, a broader market downturn could drag on the stock’s lofty valuation.

Andrew Prochnow has traded the global financial markets for more than 15 years, including 10 years as a professional options trader.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices