Bonds Drop Alongside September Rate Cut Odds Ahead of Powell Speech

Bonds Drop Alongside September Rate Cut Odds Ahead of Powell Speech

Bond Market Update: US 10-year Yield up to 4.330%

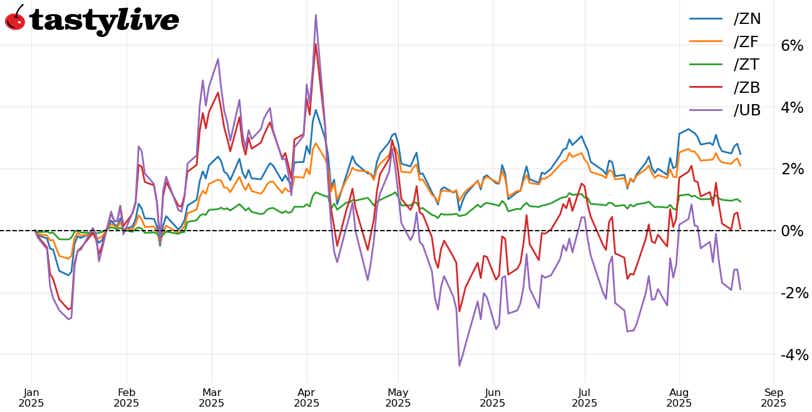

Fig. 1: Week-to-date price percent change chart for /ZT, /ZF, /ZN, /ZB, /UB

Bonds Key Takeaways:

U.S. Treasury notes and bonds are slumping ahead of Fed Chair Jerome Powell’s speech in Jackson Hole.

Rate cut odds for 2025 have receded sharply over the past week, with the odds of a 25-bps rate cut in September down from 100% a week ago to 71% today.

Bond volatility remains near its yearly lows, which were the lowest levels seen since January 2022.

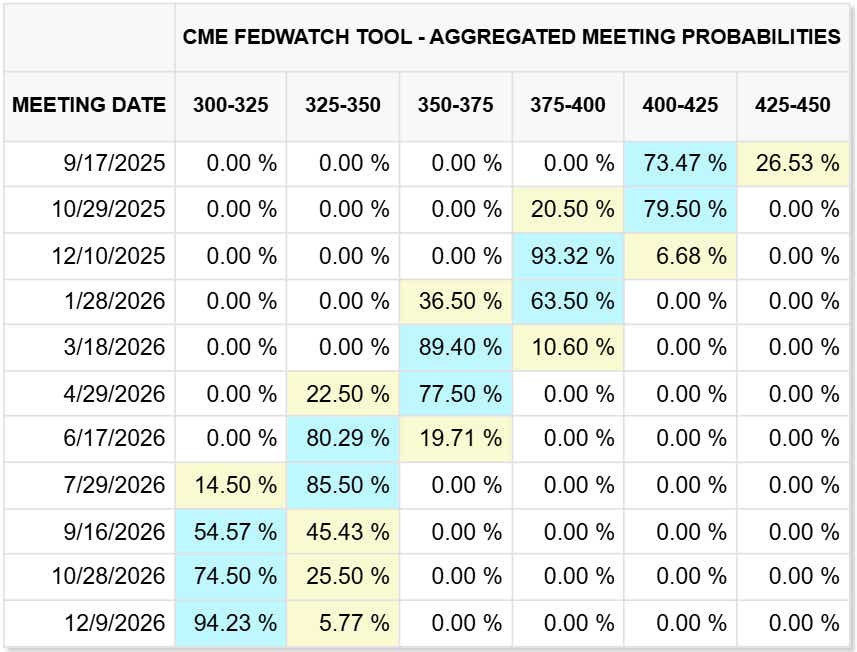

Fed Chair Jerome Powell’s speech at the Jackson Hole Economic Policy Symposium on Friday, August 22 is the most important macro event of the week – and perhaps from now until the next Fed meeting on September 17. In the run-up to the remarks, traders have taken a decidedly more level-headed view: the odds of a 25-bps rate cut in September has plummeted from 100% last Thursday to just 74% today:

Fig. 2: CME FedWatch Tool – Meeting Probabilities Through December 2026

Scant expectations of a 50-bps rate cut in September (5.7% chance at their peak last Thursday) have likewise been eliminated. What hasn’t changed is the fact that markets are still expecting Fed Chair Powell to communicate at least two 25-bps rate cuts in 2025. The degree to which Fed Chair Powell makes a promise for a September rate cut (from ‘not happening’ to ‘data dependent’ to ‘definitely happening’) matters, but not as much as it mattered a week ago.

With another inflation report and another jobs report due prior to the September meeting, it makes little sense that the FOMC would be too committal one way or the other, and it’s fair to surmise that traders are back in that headspace of Powell et al leaning towards a cut rather than guaranteeing one after the shift in rates pricing in recent days.

As for the trade? Nothing changes. Both 10s (/ZNU5) and 30s (/ZBU5) have been choppy in the post-Liberation Day world, largely tethered to the midpoint of the year-long trading ranges. Last year, when the Fed cut rates by 50-bps in September, the long-end of the curve blew out; a non-committal, dovish-leaning Fed is less of a risk.

/ZN US 10-year Note Price Technical Analysis: Daily Chart (2025 YTD)

Since the start of June, 10-year Treasury notes (/ZNU5) have traded within the confines of the 38.2% and 61.8% Fibonacci retracements of their 2025 trading range in all but three sessions. The midpoint of the range sits closer to 111’16, which is effectively where 10s were trading at the time this note was written; the 50-day EMA (exponential moving average) resides there as well. Momentum indicators (MACD, Slow Stochastics) are receding but remain in ‘bullish’ territory north of their median lines. Volatility is low (IVR: 7.2), but traders can still find opportunities around the year-long range.

| Strategy: (64DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

| Short Iron Condor | Long 108 p Short 109 p Short 114 c Long 115 c | 63% | +203.13 | -796.88 |

| Short Strangle | Long 108 p Short 109 p Short 114 c | 68% | +484.38 | x |

| Short Put Vertical | Long 108 p Short 109 p | 90% | +93.75 | -906.25 |

/ZB US 30-year Bond Price Technical Analysis: Daily Chart (2025 YTD)

Similar to /ZNU5, the technical picture for 30-year Treasury bonds (/ZBU5) is choppy at best. The series of higher highs and higher lows since May has continued, but 30s are losing momentum below their EMA cloud (5-day EMA, 21-day EMA, and 50-day EMA). And like in the 10s, the 30s are meandering in the area around the midpoint of the yearly high-low trading range. As it were, directionally neutral strategies have worked best in the past few months, and from this analyst’s perspective, “if it ain’t broke, don’t fix it.”

| Strategy: (64DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

| Iron Condor | Long 108 p Short 109 p Short 119 c Long 120 c | 64% | +250 | -750 |

| Short Strangle | Short 109 p Short 119 c | 70% | +1015.63 | x |

| Short Put Vertical | Long 108 p Short 109 p | 86% | +140.63 | -859.38 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices