Chinese Stocks Struggling to Find a Low

Chinese Stocks Struggling to Find a Low

FXI down -14.05% month-to-date

The data and news flow out of China this week have been marginally less bad–but certainly not good yet.

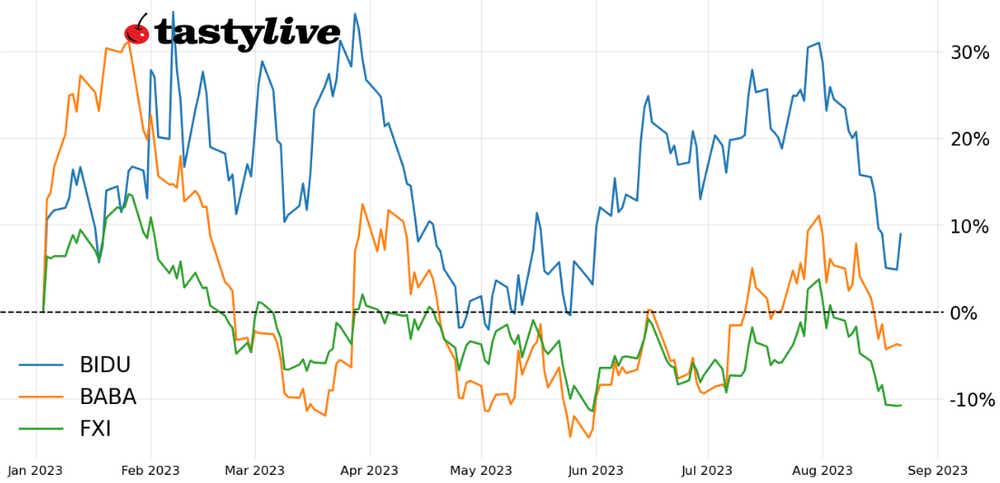

Earnings results aside, shares of major Chinese companies, like BABA and BIDU, have struggled significantly in recent weeks.

The Chinese large-cap ETF, FXI, has underperformed SPY by 10.24% in August.

Fig. 1: Year-to-date price percent change chart for FXI, BABA, BIDU

From bad to worse, the situation in China has deteriorated meaningfully since we first flagged the issue in mid-August, observing that “it may be the case that a scare like the fall of 2021 may be making its way through markets.”

Chinese macroeconomic data has continued to struggle, and a wave of defaults and non-payments on loans have racked major property developers and financiers alike.

And so, the period of Chinese equities struggling, and underperforming their U.S. peers, continued. With Chinese junk bonds trading near fresh 2023 lows, FXI, the China large-cap ETF, now finds itself trailing SPY (S&P 500) by 10.24% month-to-date. Better-than-expected earnings results have proved fleeting at best. Two of the more popular Chinese companies, accounting for nearly 14% of FXI, continued exhibiting signs of meaningful technical breakdowns.

FXI price technical analysis: Daily chart (October 2022 to August 2023)

In mid-August we observed that “the Chinese large-cap ETF is now testing former triangle resistance, from the January and June swing highs, as support … a drop below 27.00 in the coming sessions opens up the possibility of a return to the late-May low near 25.51.” FXI hit a low of 25.85 this week before briefly rebounding.

Is this a double bottom? It’s far too soon to say, given the bearish momentum profile. FXI remains below its daily 5-, 13-, and 21-EMA envelope, which is in bearish sequential order. MACD continues to trend lower below its signal line, while slow stochastics are in oversold territory for the first time since early-July. A drop below late-May low near 25.51 would bring into focus levels below 24.00, unseen since November 2022.

BABA price technical analysis: Daily chart (August 2022 to August 2023)

The decline of Alibaba Group (BABA) in recent weeks has fallen in line with broader Chinese equities, while maintaining the broader consolidation in place late-February. It remains the case that “any pullback may be limited; but the prevailing range between the May lows near 77.77 and multi-month resistance around 101.85/105 appears to be on course to be maintained in the coming weeks.”

That said, a breach of the rising trendline from the September 2022 and May 2023 lows around 85.00 would increase the odds, from a technical perspective, that BABA would retest the May low at 77.77.

BIDU price technical analysis: daily chart (August 2022 to August 2023)

Despite the rebound around earnings, Baidu Inc. (BIDU) retains its alarming technical structure, having already dropped below the rising trendline from the October 2022 and May 2023 swing lows. The rally today has brought BIDU back to its daily 5-EMA (one week moving average), which it has closed below every session since Aug. 2.

Momentum remains bearish, with MACD trending lower while below its signal line and slow stochastics holding in oversold territory. Having previously noted that “failure to hold the aforementioned trendline would open up the path for a drop below 120 in the coming weeks,” our view remains intact.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2024 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.