Copper Shorts Feeling the Pressure

Copper Shorts Feeling the Pressure

Copper market insights from the Commitments of Traders report

- Copper prices end August on a bright note despite losses.

- Short traders might get squeezed out of the trade in September.

- Trading depends on stimulus measures out of Beijing and the Fed's path.

Copper prices (/HGZ3) are poised to register a nearly 5% loss for August, despite showing some resilience in the final weeks of the month. This represents the largest monthly decline for the red metal in percentage terms since May, effectively reversing most of the gains made in the prior two months.

So, what sparked the rise in copper as we transitioned into September, and can we anticipate a similar trend in the coming month? To provide an answer, we must examine the current state of the global economy, specifically focusing on China - the world's largest consumer of copper.

China takes action

The economic challenges facing China have been a significant talking point this summer, with its struggling real estate sector pulling the economy down. This has prompted a series of responses from Beijing, including measures specifically designed to bolster the domestic housing market. Most recently, the People's Bank of China (PBOC) has lowered the down payment required for mortgages.

While these actions alone may not be sufficient to rejuvenate China's once thriving economy, they do indicate a willingness to provide economic support. Coupled with market expectations that the U.S. central bank will soon halt its rate hikes, this paints a more optimistic picture for the global economy, which in turn, is supportive of copper prices.

Copper shorts capitulating

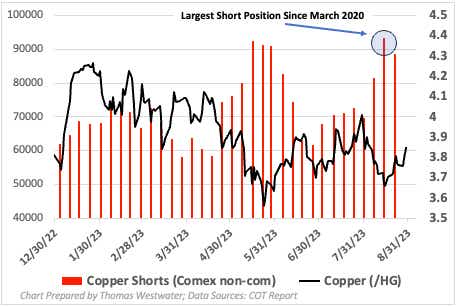

Copper traders seem to be well-informed about the prevailing narrative. A close examination of copper trades via the Commodity Futures Trading Commission’s Commitments of Traders report (COT) reveals a significant shift in sentiment among speculators.

These speculators, identified as non-commercial traders within the COT report, reduced their short contracts by 4,579 for the week ending Aug. 22. This reduction followed the largest short position held by these traders since March 2020. When prices increase it can force traders to close their short positions, which requires them to buy back those contracts. This creates a well-known phenomenon known as a short squeeze.

There are several factors that can influence the pressure shorts will face over the coming weeks, which can dictate how much pressure shorts face. Economic data prints will be the primary driver, with Chinese trade data for August due on September 6.

A purchasing managers’ index (PMI) from Caixin for the same period will precede that on September 4. In the meantime, any additional actions out of Beijing to stimulate economic growth may put more weight on traders to cut their short bets. Copper traders will also have the U.S. jobs report kicking off the month on Sept. 1, a major factor that can swing Fed rate hike bets. Traders may also want to keep an eye on the dollar, which has showed signs of topping.

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices