Corn Price Comeback: Will Elevated Shorts Fuel Further Gains?

Corn Price Comeback: Will Elevated Shorts Fuel Further Gains?

- Corn futures (/ZC) are trading near the highest levels seen since late July.

- Record-breaking production in the U.S. has prompted a big increase in short sellers in the corn market, but is this level sustainable?

- With a still-elevated short position for corn, there may be room for more gains as shorts capitulate.

Corn futures rebound after multi-month selloff driven by supply concerns

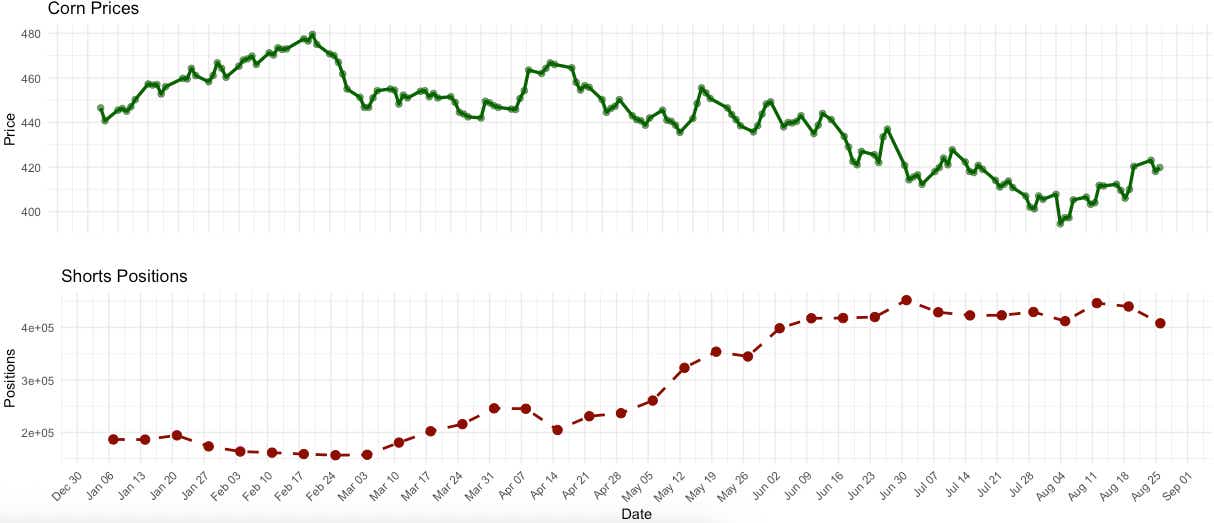

Corn futures (/ZCZ5) are trading near the highest levels traded since early August after rising nearly 14% from their lows in August. Still, prices remain about 8% lower since the start of the year.

The declines have come amid a record-breaking year for corn planting in the United States. According to the August World Agricultural Supply and Demand Estimates (WASDE) report, released on August 12, corn production was forecasted at 16.7 billion bushels, up 1 billion from the month prior.

The record-breaking production wasn’t a huge surprise to markets. The May WASDE report contains the first forecast of the year for the new crop, which is what will be harvested later that year. That report forecasted corn production at 15.82 billion bushels, significantly above the prior year’s forecast for 14.86 billion bushels, or a 6.5% year-over-year increase.

Corn traders reacted to the expected large harvest and started selling corn aggressively in May, with that month recording a 6.6% decline in corn prices followed by a 7.8% and 3.7% drop in the subsequent two months. It wasn’t until August that corn prices started to recover, rising about 6.6% for the month.

Prices have now moderated in the first few trading days of September. The corn market now needs to decide if the recent rebound is justified. The best argument is that corn sellers correctly predicted a surplus in the market amid record production and traded accordingly. That helps explain the recent rebound since profit takers likely collected on their short positions.

Positioning data shows a market still weighted toward the short side. Will that sustain corn’s rally?

Positioning data from the CFTC’s Commitments of Traders (COT) report illustrates this argument when we look at speculative shorts. At the start of May, short speculators, or non-commercial traders to be more specific, totaled 260,718 contracts. By July, total shorts reached 452,005, nearly doubling in just two months. That marked the largest short speculator position since August 2024.

Since July, shorts have backed off. Per the latest COT report, speculator shorts totaled 407,947 contracts, a nearly 50k reduction from July. The next COT report will drop on Friday and it’s likely to show a further reduction in shorts since prices for corn rose over 3% during the reporting period from August 26 to September 2.

Still, even with the recent reductions, short positions remain highly elevated from levels seen earlier this year before short positions started to build aggressively. That said, there is still plenty of dry powder, for lack of a better term, to drive shorts out of the market, especially if prices continue to rise.

This phenomenon is known as short covering and can artificially push prices higher as shorts exit their positions. We can’t say for sure if this will occur, but it does add a potential tailwind for the long view on corn prices.

Corn technical analysis

Since late June, corn prices have largely traded below the 21-day exponential moving average (EMA). August saw prices make a clean break above that EMA before going on to to reclaim position above the 50-day simple moving average (SMA), another moving average that has contained upside action since June.

Prices also broke above a poorly defined trendline that has been in place since June. Taken together, these technical developments have put corn prices in a much stronger position. A break back below the EMA and SMA would shift the momentum back to the bears, but several intraday attempts over the past week have failed to do so. That said, corn looks well positioned for further gains.

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.