Costco Earnings Preview: A Bulk-Sized Barometer for Consumer Sentiment

Costco Earnings Preview: A Bulk-Sized Barometer for Consumer Sentiment

Costco (COST) Earnings Preview

Costco (COST) reports fiscal Q4 2025 results after the close on Thursday, September 25, with analysts expecting around $86 billion in revenue and $5.80–$5.82 in EPS, up roughly 12% year-over-year.

Membership renewal rates, steady traffic growth, and strong cash generation remain Costco’s hallmarks, making it one of the most dependable performers in a choppy retail landscape.

But with shares trading at more than 50x earnings—one of the richest multiples in retail—investors will be looking for evidence that demand and margins are holding firm heading into 2026.

Costco Wholesale (COST) is one of the world’s largest membership-based warehouse retailers, operating more than 850 warehouses worldwide and serving tens of millions of members across North America, Europe, and Asia. Known for its low-price, high-volume business model, Costco has built a reputation for steady growth, disciplined cost control, and industry-leading renewal rates—making it a standout in the retail sector even as headwinds mount in the economy.

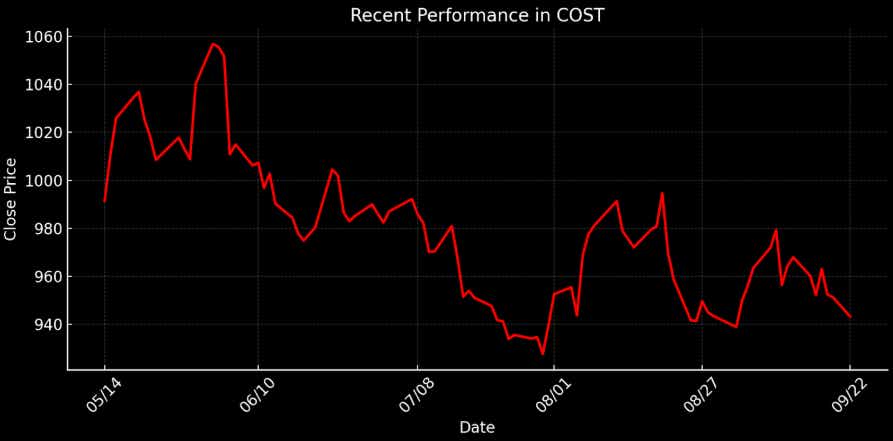

COST shares are up about 5% year-to-date, a sign of modest but steady investor confidence in the company’s ability to grow earnings and navigate a challenging retail backdrop. Strong traffic trends, robust membership fee income, and the resilience of food and essentials categories have kept results solid even as discretionary spending has cooled. With shares still trading at a premium valuation, this quarter’s results will need to show that demand and margins remain intact to justify Costco’s rich multiple heading into 2026.

Costco is scheduled to report earnings results for the fiscal fourth quarter (ended August 2025) after the close on Thursday, September 25. Analysts expect earnings per share to come in around $5.80 to $5.82, up roughly 12% year-over-year, with revenue projected near $86 billion—an 8% gain versus the prior-year quarter.

Near-Term Fortunes Hinge on Growth

Costco’s upcoming report lands at an interesting juncture—part confirmation of its defensive strength, part test of whether its premium valuation is still justified. The company has been a reliable outlier in retail, consistently posting traffic growth, expanding membership income, and delivering steady earnings across diverse consumer environments. But with the stock trading at more than 50 times forward earnings, expectations are running high.

Costco’s growth story remains one of the strongest in retail. Revenue is projected to climb about 8% year-over-year—a pace that outperforms most competitors—while EPS is expected to rise roughly 12%. These gains are driven by industry-leading membership renewal rates, disciplined cost control, and net interest income that’s boosting profits in a high-rate environment. With its global footprint and bulk-buying model, Costco commands pricing power and a fiercely loyal customer base—advantages that could become even more valuable if economic uncertainty persists.

Still, the bar for a “beat-and-raise” quarter is steep. U.S. retail data has been mixed in recent months, with Target reporting negative comps and Walmart posting only mid-single-digit gains. If Costco’s comparable sales slow or margins compress further—already well below industry averages—it could test the market’s appetite for such a rich multiple. And with consumer confidence fragile and discretionary spending under pressure, the risk of a revenue miss can’t be dismissed.

Costco’s Lofty Valuation Multiples Set a High Bar

Costco isn’t just trading at a premium—it’s in a different stratosphere. Trading at roughly $945 per share, the stock carries a trailing GAAP P/E of about 54—more than double the consumer staples sector median near 22x. Its price-to-sales ratio sits at 1.6x versus peers at 1.2x, and its price-to-book multiple of 15.6x towers over the sector median of about 2.6x. Taken together, these metrics suggest investors view Costco less as a traditional retailer and more as a defensive growth compounder—a testament to its consistent execution, sticky membership model, and superior returns on capital.

Whether that premium is justified is the key question heading into earnings. Bulls argue Costco earns its lofty valuation by consistently outpacing peers on growth, generating robust cash flow, and delivering industry-leading renewal rates that provide uncommon long-term visibility. Moreover, its pristine balance sheet, positive net interest income, and global expansion opportunities reinforce the view that it deserves to trade at a “quality” multiple.

Wall Street remains cautiously optimistic on Costco despite its lofty valuation. Of the 38 analysts covering the stock, 21 rate it a “buy” or “overweight,” 16 recommend “hold,” and only one carries a “sell” rating. The average 12-month price target sits near $1,090—about 15% above the current price—signaling that most analysts still expect further upside.

Still, that optimism comes with pressure. This quarter isn’t just another report card—it’s Costco walking a tightrope in full view of the market. A clean landing could keep the premium aloft and send shares climbing higher, but the slightest slip could break the balance, and spark a rare selloff in one of retail’s steadiest acts.

Costco Earnings Preview Takeaways

Costco heads into earnings with its quality credentials fully intact: steady traffic gains, industry-best renewal rates, and a fortress balance sheet that’s generating net interest income even in a high-rate environment. The company continues to outpace peers, and that reliability is precisely why investors have been willing to award it a tech-like multiple despite its retail roots.

That lofty valuation leaves little margin for error. At more than 50x earnings, Costco has to do more than deliver a beat—it has to convince investors that growth will accelerate into fiscal 2026 and beyond. The key variable this quarter is the consumer, whose strength—or weakness—may set the tone for 2026.

U.S. shoppers are grappling with sticky inflation, elevated borrowing costs, and thinning savings—pressures that threaten discretionary spending. If Costco can show that traffic and membership renewals remain resilient despite those headwinds, confidence in its premium multiple should hold. But any sign of consumer fatigue, slowing comps, or margin erosion could quickly challenge the notion that Costco is immune to a tougher macro backdrop.

To learn more about trading earnings events using options, readers can follow this link.

Andrew Prochnow has traded the global financial markets for more than 15 years, including 10 years as a professional options trader.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices