Credit Downgrade Shocker: Fitch Happens!

Credit Downgrade Shocker: Fitch Happens!

Stocks slide as the U.S. credit rating is downgraded from AAA to AA+

- Fitch Ratings surprised markets on Tuesday night with an unexpected downgrade of the U.S. credit rating.

- Citing expected fiscal deterioration and a high and growing general government debt burden, the U.S. credit rating was cut to ‘AA+’.

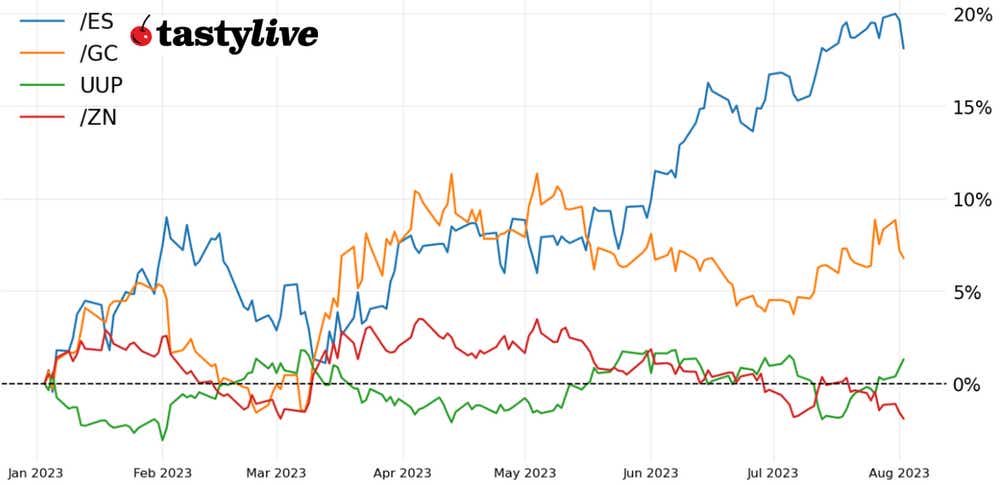

- Initially, U.S. equities declined modestly while U.S. Treasury bonds held steady. Gold rallied, as did the U.S. dollar.

After the U.S. avoided defaulting on its debt in June, no credit rating agencies made any significant announcements - that is until yesterday.

Fitch Ratings announced that it was downgrading the U.S. credit rating from ‘AAA’ to ‘AA+’, citing “the expected fiscal deterioration over the next three years, a high and growing general government debt burden, and the erosion of governance … over the last two decades that has manifested in repeated debt limit standoffs and last-minute resolutions.”

What do the ratings mean?

According to Fitch Ratings, here are the criteria for credit ratings:

- They are forward-looking opinions on the relative ability of an entity or obligation to meet financial commitments.

- Credit ratings are indications of the likelihood of repayment in accordance with the terms of the issuance.

- Fitch’s credit rating scale for issuers and issues is expressed using the categories ‘AAA’ to ‘BBB’ (investment grade) and ‘BB’ to ‘D’ (speculative grade) with an additional +/- for AA through CCC levels indicating relative differences of probability of default or recovery for issues.

- The terms “investment grade” and “speculative grade” are market conventions and do not imply any recommendation or endorsement of a specific security for investment purposes.

- Investment grade categories indicate relatively low to moderate credit risk, while ratings in the speculative categories signal either a higher level of credit risk or that a default has already occurred.

Why should traders care?

U.S. equities initially fell on the news in overnight futures markets, and gold rallied. U.S. Treasury bonds and the U.S. dollar rallied as well. Traders levied their vote and decided that this news was more negative for general risk appetite rather than something that would drag down US-centric and USD-denominated assets.

The initial reactions pale in comparison to the carnage that was unleashed on markets in August 2011, when S&P Global Ratings downgraded the U.S. credit rating from ‘AAA’ to ‘AA+’, which yielded four consecutive days of +/-5% swings in stocks. Since the Fitch Ratings announcement,

U.S. equity futures were down less than -1% today prior to the release of the July U.S. ADP Employment Change report (which provoked a spike in U.S. Treasury yields and a bigger pullback in U.S. equities).

What happens next?

The timing of the U.S. credit rating downgrade comes against a backdrop of complacency in markets. In last week’s and this week’s episode of Let Me Explain, we discussed how the seasonal tendency for volatility to rise in August and September could be a headwind for stocks, which may be due for a period of corrective price action.

Certainly, the price action shaping up today is starting to undercut what has been a reliably bullish trend in stocks for the past three months; further technical damage would warrant an immediate reassessment of the near-term outlook, with more downside becoming increasingly likely in E-mini S&P 500 futures (/ES), E-Mini Nasdaq futures (/NQ), E-mini Russell 2000 futures (/RTY) and E-mini Dow $5 Futures and Options (/YM).

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multi-national firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices