Crude Oil, 10-year T-Note, Gold, S&P 500, and Japanese Yen Futures

Crude Oil, 10-year T-Note, Gold, S&P 500, and Japanese Yen Futures

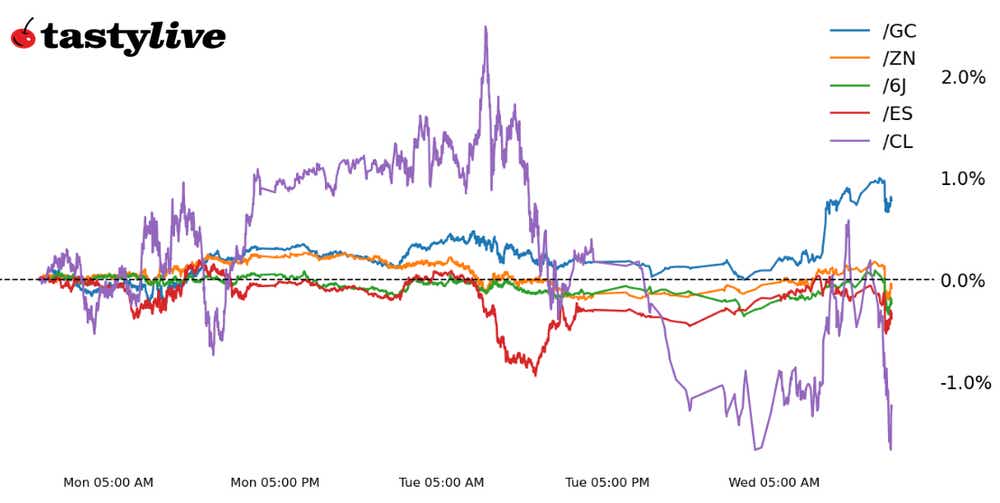

This Morning’s Five Futures in Focus

- S&P 500 E-mini futures (/ES): +0.42%

- 10-Year T-note futures (/ZN): +0.13%

- Gold futures (/GC): +0.27%

- Crude oil futures (/CL): +0.92%

- Japanese yen futures (/6J): -0.49%

Following two of the more difficult days in markets in 2023–the Nasdaq 100 (/NQZ3) fell by -3.3% between Wednesday and Thursday, its worst two-day loss of the year—Friday is providing some relief. The losses haven’t been reversed entirely, but a modest rebound in U.S. equity futures and U.S. Treasury bonds is taking shape ahead of the U.S. cash equity open. Meanwhile, energy prices have resumed their climb, and inaction by the Bank of Japan has the Japanese yen (/6JZ3) on its back foot once more.

Symbol: Equities | Daily Change |

/ESZ3 | +0.42% |

/NQZ3 | +0.72% |

/RTYZ3 | +0.46% |

/YMZ3 | +0.20% |

All four major U.S. equity index futures are trading in positive territory, led higher by the big loser of the week, /NQZ3. But the technical damage may be done: the S&P 500 (/ESZ3) has traded below its August swing low, putting into focus a potential head and shoulders topping pattern; /NQZ3 lost uptrend support from the January and March swing lows; and the Russell 2000 (/RTYZ3) crashed through a critical zone of support/resistance in place since the regional banking crisis began in March. There’s a lot of work to be done if bulls are to reclaim the narrative.

Strategy: (39DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 4350 p Short 4340 p Short 4420 c Long 4430 c | 12% | +437.50 | -62.50 |

Long Strangle | Long 4350 p Long 4430 c | 50% | x | -6225 |

Short Put Vertical | Long 4350 p Short 4340 p | 58% | +175 | -325 |

Symbol: Bonds | Daily Change |

/ZTZ3 | +0.05% |

/ZFZ3 | +0.13% |

/ZNZ3 | +0.13% |

/ZBZ3 | 0.00% |

/UBZ3 | -0.03% |

The elimination of two rate cuts from the Federal Open Market Committee's (FOMC) 2024 projections proved cataclysmic for bond markets on Wednesday and Thursday, and the price action on Friday suggests that a new plateau may have been reached. U.S. Treasury yields are just off cycle highs, and it remains the case that the bond market is the tail that wags the dog of the rest of the market for the near future.

Strategy (35DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 107.5 p Short 108 p Short 111 c Long 111.5 c | 50% | +218.75 | -281.25 |

Long Strangle | Long 107.5 p Long 111.5 c | 30% | x | -640.63 |

Short Put Vertical | Long 107.5 p Short 108 p | 69% | +171.88 | -328.13 |

Symbol: Metals | Daily Change |

/GCZ3 | +0.27% |

/SIZ3 | +0.92% |

/HGZ3 | +0.76% |

Gold prices (/GCZ3) are moving higher today following yesterday’s 1.4% drop, which was the largest daily percentage decline since August 1. Treasury yields are pulling back from highs not seen since the 2000s. That is supporting bullion as well as general concerns over the economy.

Strategy (34DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1930 p Short 1940 p Short 1980 c Long 1990 c | 32% | +660 | -340 |

Long Strangle | Long 1930 p Long 1990 c | 40% | x | -2450 |

Short Put Vertical | Long 1930 p Short 1940 p | 61% | +450 | -550 |

Symbol: Energy | Daily Change |

/CLZ3 | +0.92% |

/NGZ3 | +1.26% |

U.S. crude oil prices (/CLZ3) are moving back toward the $90 per barrel level as energy traders continue to assess how a Russian export ban on diesel and gasoline fuels will impact the global markets. Wholesale diesel prices are already reacting across Europe. The United States doesn’t import any Russian diesel, but supply shortages elsewhere could pull supply away from North America and raise prices in the U.S. as well.

Strategy (26DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 87 p Short 87.5 p Short 90.5 c Long 91 c | 14% | +430 | -80 |

Long Strangle | Long 87.5 p Long 91 c | 47% | x | -6140 |

Short Put Vertical | Long 87.5 p Short 88 p | 57% | +210 | -290 |

Symbol: FX | Daily Change |

/6AZ3 | +0.59% |

/6BZ3 | -0.20% |

/6CZ3 | +0.32% |

/6EZ3 | -0.05% |

/6JZ3 | -0.49% |

The Bank of Japan bucked expectations—expectations that they set through various leaks to the media—that hints of a shift in policy could be coming at its September meeting. Accordingly, /6JZ3 has been under pressure overnight and into the morning, succumbing to the weight of interest rate differentials amid the surge in U.S. Treasury yields. The U.S. dollar remains technically strong, but cracks in the uptrend are beginning to show.

Strategy (42DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.0066 p Short 0.00665 p Short 0.00705 c Long 0.0071 c | 65% | +162.50 | -462.50 |

Long Strangle | Long 0.0066 p Long 0.0071 c | 22% | x | -362.50 |

Short Put Vertical | Long 0.0066 p Short 0.00665 p | 86% | +87.50 | -537.50 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2024 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.