Crude Oil 2023 Forecast: Fundamentals Back Bullish Trading Thesis

Crude Oil 2023 Forecast: Fundamentals Back Bullish Trading Thesis

Despite a late-year drop in crude oil prices, the fundamental backdrop for 2023 may push the commodity back near the $100 per barrel level.

Crude Oil in 2022: An Eventful and Volatile Year

The oil market had an eventful year in 2022. Prices for West Texas Intermediate (WTI) and Brent crude oil—the US and global benchmarks—surged around 60% from January to March before ending the year nearly flat, with prices settling around $80 per barrel as of late December.

A myriad of events drove the volatility. The Western world removed its virus-curbing measures as the Covid pandemic subsided, while China rode out its strict “Zero-Covid” policy for most of the year until it capitulated in the face of protests and a severely damaged economy; economic sanctions on Russia increased, including a $60 price cap on Russian oil as NATO and Western allies stepped up their support for Kyiv; and central banks tightened policy further in the fight against inflation.

Those factors are still in play for oil prices in 2023, which makes forecasting prices somewhat tricky since the variables driving price action largely depend on human decisions. Will central banks end their rate-hiking cycle? Is China going to continue to ease its Covid restrictions? And how will the war in Ukraine end, and would it result in a quick pullback of Western sanctions?

China abandoned its Zero-Covid policy in December. It wasn’t because of the economic damage caused by its lockdowns to curb the virus from spreading but rather public dissident. Regardless of the cause, Chinese policymakers have pivoted to follow a policy more in line with Western nations, describing Omicron as “flu-like.” Still, the virus is spreading rapidly across the country, and citizens are staying inside not because of government orders but fear.

The unrestrained spread is stressing China’s healthcare system and impacting consumer spending. However, health experts see the current virus wave subsiding sometime in the next few months as the virus spreads through the population. After that, a shield of natural immunity amid the milder Omicron strain should see China’s economy pick up steam. That will act as a tailwind to demand-sensitive oil prices, even more so when considering the supply outlook. The International Energy Agency (IEA) predicts that global supply will grow only 770k barrels per day in 2023, down from 4.7 million barrels per day in 2022.

Of course, the possibility still exists for a pivot back to draconian lockdown measures, especially if China’s healthcare system breaks under the stress of what may be the last great wave of infections. That scenario would likely dent the demand outlook. Still, all signs point to letting the virus run its course. That should drive an increase in Chinese oil consumption in the second half of 2023.

Monetary Policy Unlikely to Drag on Oil Prices in 2023

Rational decision-making based on economic conditions drives monetary policy at central banks, or at least that is what they say. One of the most potent for the Federal Reserve—the dominant influencer for the global monetary setting—is inflation, which started subsiding in the backend of 2022, a trend that should continue. If so, that should slow the Fed’s rate hiking cycle considerably. US prices for November rose at the slowest annual pace in 13 months, according to the PCE Price Index. Fed funds futures are pricing a terminal rate of 5 – 5.25% by May 2023 before rates start to ease later in the year.

While the impact of rate hikes will take time to work its way down throughout the economy, the prospect of incoming rate cuts should help buoy economic sentiment. A collapse in demand beyond what has already been seen due to monetary policy isn’t likely if investors remain confident that rate cuts are coming. Even during 2022, amid the fastest rate hiking cycle in decades, oil prices remained firm at around $80 per barrel in late 2022. There is little reason to believe prices will sell off because of rate hikes alone.

Russian Oil Supply to Fall After EU Price Cap, Keeping a Tailwind in Place

The West, responding to Russia’s incursion, aimed at Russia’s coveted energy markets in 2022 to punish Moscow. A price cap on Russian oil intends to limit the Kremlin’s ability to profit from its oil exports while limiting the impact on the vital global supply vein that is Russian oil. A delicate balancing act. Despite efforts by Washington and its allies to balance the pain and gain, their effort is likely damaging to supply. That could be as much as 10%, according to the upper ranges of some estimates. That would be somewhere around 700,000 barrels per day.

Meanwhile, the Organization of the Petroleum Exporting Countries and its allies, which includes Russia, collectively known as OPEC+, see oil demand rising in 2023. The oil cartel’s December forecast sees a 2.3% increase or about 2.2 million barrels per day. That forecast was before China pulled back many of its restrictions, potentially putting it on the conservative side.

Furthermore, OPEC may continue to cut production, and at the current time, it is beneficial for them to do so to maintain the current price. Russia, more so than the others, would like to keep oil prices high, as they are selling large quantities to India and China at a discounted price point; if prices drop too low, Russia would be selling its oil at a loss. Moscow would want to avoid that at all costs when the funding of its war machine depends on those profits.

A divergence between Oil Prices and Oil Stocks: A Signal or Noise?

Oil stocks don’t seem to think so. If you looked at the stock price of Exxon Mobil (XOM) in 2022, you might assume that oil prices continued climbing all year. So why the divergence? One explanation is that oil companies are now favoring the strategy of returning capital to shareholders rather than investing it in capital expenditures to bolster future supply.

That is attractive to investors because oil should remain heavily used for decades. And with companies reducing capital expenditures, prices should remain structurally high even if demand ebbs. Oil producers look poised for healthy profit margins for years to come. That said, forecasting oil prices based on oil stock prices may not be prudent. Although, that divergence may help to inform trading decisions.

How to Trade Oil in 2023:

All in all, the balance of risks for oil prices appears tilted to the upside over the next year. A $100 per barrel price for WTI and Brent crude oil isn’t off the table. The global economy remained surprisingly resilient at a time when interest rates rose and knock-on Covid effects. With supply issues, rising demand, and various wild cards still in play, such as the war in Ukraine, strategies with a neutral to bullish bias, may make sense to trade oil markets in 2023.

One way to get bullish exposure to increasing oil prices is through currencies that benefit from higher oil prices, such as the Canadian Dollar, Mexican Peso or the Norwegian Krone. These oil-linked currencies typically perform well when oil prices rise because their respective issuers generate higher revenues from their energy exports. Moreover, given the expected easing in Fed policy, the US Dollar should come under pressure, potentially making the trade even more attractive. That may also spur a run higher in the equities market, making the previously mentioned oil companies another possible route to trade a long thesis.

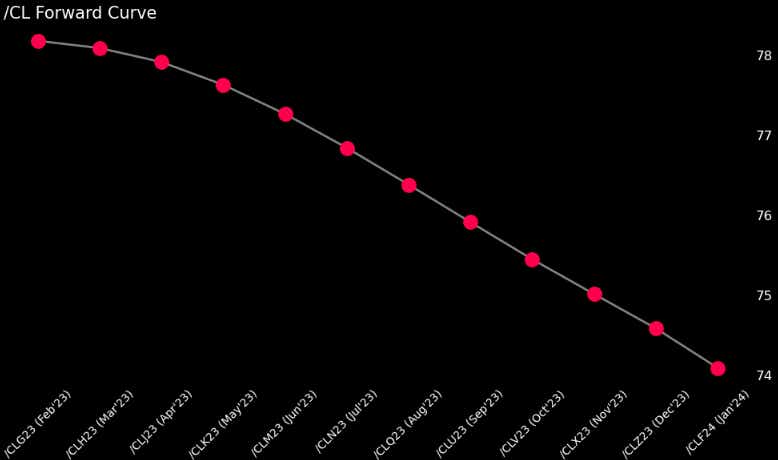

Of course, trading oil futures is another way to trade the commodity. The WTI oil forward curve is currently inverted through 2023, suggesting at face value that spot prices may fall towards the further-dated futures prices. However, over the past month, the December 2023 contract has risen faster than the current spot price, a 2.05% and 3.03% gain, respectively. This backwardated structure is bullish for oil prices, implying that supply may fall or demand may increase.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices