Dell Q2 Earnings Preview: AI Orders Surge, But Profitability is the Test

Dell Q2 Earnings Preview: AI Orders Surge, But Profitability is the Test

Dell Earnings Preview

Dell Technologies (DELL) reports Q2 fiscal 2026 results after the close on Thursday, August 28, with a management call scheduled for 4:30 PM ET.

The company heads into its earnings event with strong momentum: $12 billion in AI server orders last quarter, a $14 billion backlog and signs of stabilization in the PC market.

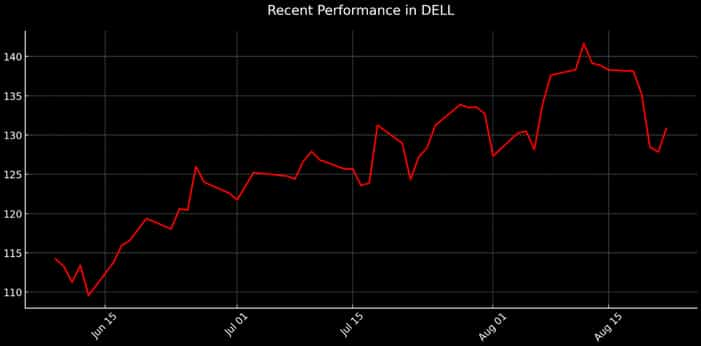

Shares are up about 12% year-to-date, yet still trade at a discount to peers—making this report a potential upside catalyst if Dell can show its AI momentum is translating to the bottom line.

Dell Technologies (DELL) has transformed from a PC-focused brand into a heavyweight in enterprise IT infrastructure. While its Client Solutions Group (CSG) still drives the traditional PC and laptop business, the Infrastructure Solutions Group (ISG)—which houses servers, storage, and networking—has become the true growth engine. That pivot is delivering results: in Q1, Dell reported $23.4 billion in revenue, a 5% year-over-year increase, fueled by $12.1 billion in AI server orders. Remarkably, that single-quarter figure surpassed the company’s total AI server orders for all of last year.

Dell’s strength now rests on its dominance in AI-optimized servers built with Nvidia and AMD chips—positioning the company squarely in the slipstream of one of tech’s most powerful trends. A steadier PC market adds welcome stability, while a 1.6% dividend yield reminds investors that Dell can fuel growth and still reward shareholders along the way.

Dell will report Q2 earnings results after the market closes on Thursday, August 28, with analysts expecting EPS of $2.28 on revenue of about $29.1 billion. Management has guided to $28.5–$29.5 billion and $2.25 EPS, with full-year EPS reaffirmed at $9.40. With shares up 12% year-to-date, the report will be a key test of whether Dell can keep delivering on the AI story while sustaining momentum across its broader business.

Demand for Dell’s AI Servers is Climbing—But Earnings Strength Must Follow

What comes next for Dell isn’t about the personal computers (PCs) that built its name—it’s about whether the company can deliver on its new identity as an AI infrastructure leader. Last quarter, Dell grew revenue 5% to $23.4 billion, but earnings of $1.55 per share came in light. Investors shrugged off the miss because management raised its full-year profit outlook and revealed “unprecedented demand” for AI servers, supported by a $14.4 billion backlog. That backlog is now the heartbeat of the Dell story.

The scale of the shift is hard to ignore. Last quarter, Dell booked $12.1 billion in AI server orders—more than its entire total for all of last year. As one of Nvidia’s top system partners, Dell has become a go-to supplier for enterprises and cloud providers racing to build AI capacity. Analysts see nearly $20 billion in AI server revenue this fiscal year, and Dell’s new partnership with Elastic hints at the next chapter: turning hardware dominance into software-like, higher-margin revenue streams.

The opportunity, though, comes with pressure. AI servers are complex and expensive to deliver, and skeptics question whether Dell’s role as an integrator will bring the kind of profitability the market expects. At the same time, the PC segment is stabilizing, which adds balance but leaves little room for error. Dell has been aggressive about rewarding shareholders—$2.4 billion in buybacks and dividends last quarter—a clear show of confidence, but one that raises the stakes if execution slips.

With the stock already up 12% year-to-date, Wall Street is looking for $29.1 billion in revenue and $2.28 EPS on August 28. The takeaway is simple: if Dell can prove it’s converting backlog into profits and keeping margins healthy, it solidifies its place as a leader in the AI revolution. If not, the story risks losing steam.

A Rare AI Story Still Anchored in Realistic Multiples

Dell heads into its Q2 report with a setup that stands apart from many peers: its valuation looks attractive, not stretched. At roughly $130 per share, Dell trades at a trailing P/E of about 20—well below the sector median near 28. On price-to-sales, the gap is even wider: just 1x trailing sales versus an industry median closer to 3x. That kind of discount is striking given Dell’s rapid growth in AI servers, which investors increasingly see as a durable engine of earnings.

Wall Street sentiment mirrors Dell’s favorable setup. Of the 27 analysts covering the stock, 22 rate it a “buy” or “overweight,” with the rest at “hold.” The consensus price target of $145 suggests solid upside from current levels, while the most bullish forecasts—tied to Dell’s AI-driven growth—reach as high as $180 per share.

The key question for investors is whether Dell should close the gap with higher-multiple peers. The company pairs a steady PC business with a fast-growing AI infrastructure arm, providing both cash flow support and growth potential. The market has already re-rated Dell from deep value to growth-at-a-reasonable-price (GARP), but consensus estimates suggest there’s still room for multiple expansion—if Dell can turn its large AI server backlog into realized revenue and maintain attractive profit margins.

Heading into earnings, that leaves Dell in a constructive spot: valued below the sector, supported by strong buy ratings and trading beneath the average analyst target. If the August 28 report reinforces momentum in AI servers and guides margins higher, Dell could see its valuation begin to converge with peers—turning what has been a relative discount into a potential upside catalyst.

Dell Investment Takeaways

Dell heads into its August 28 earnings report with momentum on several fronts. AI server orders are at record highs, the PC business is showing signs of stabilization, and a $14 billion backlog gives Dell unusual visibility into future revenue. As one of Nvidia’s top partners, the company has become a central supplier in the AI infrastructure buildout. At the same time, strong cash flow is funding sizable share buybacks and steady dividends, reinforcing support for investors.

What sets Dell apart is its valuation. The stock trades at about 20x earnings and just 1x sales—well below sector averages—even as most analysts carry “buy” ratings with price targets above current levels. That leaves a balanced setup: if Dell can convert its backlog into revenue at solid margins, the stock has room for multiple expansion. If execution falls short, sentiment could cool, though the longer-term growth probably remains intact.

In sum, Dell heads into earnings with strong tailwinds, a resilient PC and infrastructure business, and a valuation that offers a clearer risk-reward profile than many other AI-linked stocks. Readers interested in options strategies tailored to earnings events can learn more here.

Andrew Prochnow has traded the global financial markets for more than 15 years, including 10 years as a professional options trader.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices