ECB Leading the Fed into the SVB, Credit Suisse Minefield

ECB Leading the Fed into the SVB, Credit Suisse Minefield

By:Ilya Spivak

The European Central Bank will be the first among its major peers to enter the bank crisis minefield, trying to stay in the fight against inflation after the collapse of SVB and jitters at Credit Suisse.

- ECB leads with rate decision as markets digest SVB collapse, Credit Suisse stress

- Rate hike expectations fizzle as traders price in a quick end of the inflation fight

- The Euro is at risk and may be setting a path to revisit parity with the US Dollar

ECB in the lead as policymakers face credit stress, inflation

The European Central Bank will have the dubious honor of being first among its peers to wade into the minefield following the collapse of SVB and jitters at Credit Suisse. President Christine Lagarde and company are due to issue a monetary policy announcement where – until just days ago – they were all set for another jumbo 50-basis-point interest rate hike. Officials all but pre-announced the move at their last conclave in early February.

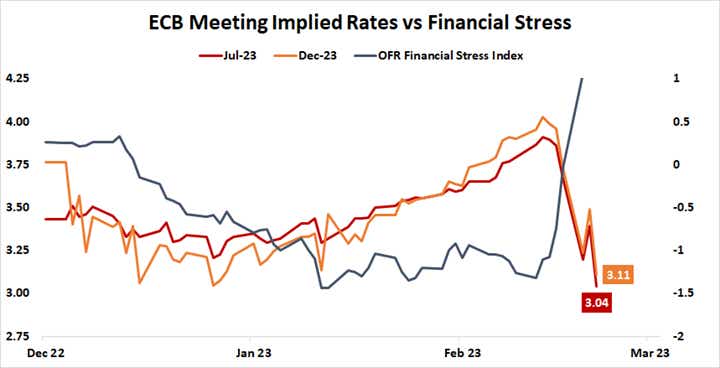

The markets no longer expect follow-through. The priced-in outlook reflects a more modest 25bps increase, with the probability of larger move a meager 14 percent. The tightening cycle is now seen peaking with the benchmark deposit rate at 3.25 percent, a climb-down of 75bps just in the past week. That’s after Silicon Valley Bank (SVB) collapsed in the US and panicky markets fearing contagion found a familiar boogeyman in Credit Suisse.

While the details of these two episodes are very different – so much as to be opposites in some respects – the fundamental issue is the same: liquidity.

SVB sought to boost profits by investing a giant inflow of deposits into longer-dated bonds. When the Fed launched the fight against inflation, rising rates pushed those bonds down in value as depositors came for their cash on mass. There was not enough of it there to give them. By contrast, a litany of scandals at Credit Suisse drained it of deposits, making the whole enterprise more vulnerable as rate hikes made sourcing capital expensive.

Data source: Bloomberg

Central banks between a rock and a hard place

So, it is no wonder that the markets now think that central banks will abandon the inflation fight, lest they capsize the global financial system. Priced-in rate hike projections have broadly withered. That would be a hard pill to swallow for authorities whose mandates demand inflation near 2 percent, but who are still faced with much higher readings – most recently, 8.6 percent in the Eurozone and 6 percent in the US.

The line that Ms Lagarde must walk is ultra-fine. If she appears too dovish, inflation expectations may surge as the Euro drops. Runaway price growth will then threaten to derail growth and bring recession. If she is seen as too hawkish, shell-shocked investors may conclude that more bank crises are in the offing, pulling their money from everywhere but the most giant institutions and feeding a self-fulfilling credit squeeze.

The ECB gets to have a go at managing this delicate balance just as investors anxiously await next week’s Fed rate decision. Whatever European central bankers can muster is likely to be extrapolated into expectations for what Chair Jerome Powell and the FOMC rate-setting committee will attempt in turn. That is likely to amplify the markets’ reaction to what Ms Lagarde’s Governing Council delivers, one way or the other.

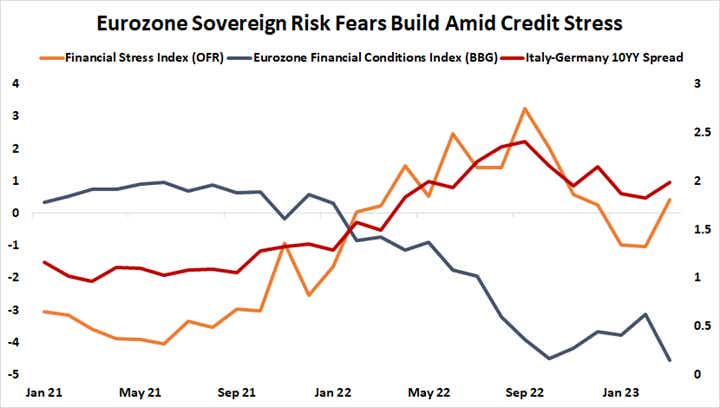

Sovereign risk adds a further dimension. The pick-up in credit stress has brought with it the dreaded widening of the bond yield spread between Germany – considered the Eurozone’s model of fiscal responsibility – and debt-laden Italy. Financial conditions have tightened as markets quake and lenders hoard cash, which has revived insolvency fears in southern Europe. Italy is both the largest and arguably slowest to deal with its debt load among the troubled member states.

Data source: Bloomberg

The Euro in the crosshairs

In all, this seems to bode ill for the Euro. If the markets come away from the ECB meeting thinking that officials have turned soft on inflation, the currency is likely to fall as capital flows out in search of better stores of value. Alternatively, the sense that policymakers are focusing too much on prices and run the risk of ruinous over-tightening may bring broad-based risk aversion. This too may push the Euro lower against the more safety-minded US Dollar.

The 6E future tracking that exchange rate now appears to be carving out a bearish Head and Shoulders (H&S) pattern on the daily chart. A convincing break below the neckline at 1.0529 would confirm the setup, implying a measured move lower toward the parity threshold (where the Euro and the US Dollar trade 1-to-1). Invalidating the pattern seems to demand that the single currency re-establish a foothold above 1.0840.

Ilya Spivak is the Head of Global Macro at tastylive, where he hosts Macro Money every week, Monday-Thursday.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.