EUR/USD: Euro at Risk of Major Breakdown as the ECB Prepares to Cut Rates

EUR/USD: Euro at Risk of Major Breakdown as the ECB Prepares to Cut Rates

By:Ilya Spivak

The ECB is setting the stage for interest rate cuts just as Fed stimulus bets unravel after hot inflation data

- The euro marked its worst day in 11 months as the dollar soars on hot CPI data.

- An ECB policy meeting is now in focus, with a rate cut signal expected.

- A widening yield disadvantage may push the euro below mission-critical support.

The euro plunged against the U.S. dollar as hotter-than-expected inflation data pushed down Federal Reserve interest rate cut expectations (as expected), sending greenback sharply higher against its major counterparts. The single currency shed over 1%, marking the worst one-day performance since May 15, 2023.

The March edition of U.S. consumer price index (CPI) data showed inflation accelerated to 3.5% year-on-year last month, topping forecasts of 3.4%. The core measure excluding volatile food and energy prices—a focal point for the Fed—held steady at 3.8%. It was expected to tick down to 3.7%.

From here, the spotlight turns to a monetary policy announcement from the European Central Bank (ECB). President Christine Lagarde and the Governing Council are expected to keep the target deposit rate unchanged at 4% while preparing to begin cutting borrowing costs in the second half of the year.

Is the ECB finally ready to cut interest rates?

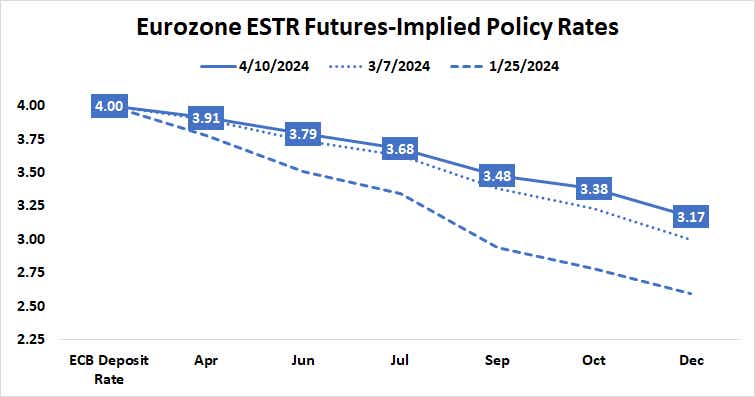

As it stands, benchmark ESTR interest rate futures price in 74 basis points (bps) in ECB rate cuts this year. The probability of a standard-sized 25bps reduction at the central bank’s June meeting is now trading at 84%. Another is on the menu for September and a third by December. The likelihood of a fourth cut is now 32%.

The central bank seems to have the necessary ingredients in place to begin loosening its policy stance. Inflation surprised on the downside in March (as suspected), with headline CPI falling to 2.4% year-on-year. Economists penciled in 2.6% ahead of the release.

Continued progress looks likely. The impact of food prices—the largest upside contributor to overall inflation in 2023—has narrowed to the smallest since November 2021. More of the same looks likely as global food costs continue to decline, showing up in CPI with a lag of about seven months.

The top problem area is now the hospitality sector. This seems likely to unravel as economic weakness takes its toll. The latest purchasing managers index (PMI) data showed Eurozone economic activity contracted for a ninth consecutive month in March as deterioration in the manufacturing sector offset a slight pickup on the services side.

The euro may drop as yield spreads move against it

Financial markets appear to agree. Germany’s two-year breakeven rate—a measure of near-term inflation expectations priced into the bond markets—is hovering just below the ECB target of 2%. This suggests traders find credible the central bank’s ability to deliver on its mandate within its desired timeframe.

If the central bank delivers as expected, the euro willfaced a daunting interest rate disadvantage against the dollar. After the U.S. CPI surprise, Fed is priced in to cut rates by just 35bps. If that pushes prices through support above the 1.07 figure, a slide to test below the 1.05 mark may follow. Range resistance is clustered just below 1.10.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.