An Explosive Euro Rally Looks Likely to Continue: ECB Meeting Preview

An Explosive Euro Rally Looks Likely to Continue: ECB Meeting Preview

By:Ilya Spivak

A sea change is afoot in European markets as the euro soars and bonds collapse

- The euro has surged as German bonds collapse, pushing yields sharply higher.

- Markets are moving to price in a big wave of spending on European defense.

- The ECB is unlikely to disrupt euro momentum with a widely expected rate cut.

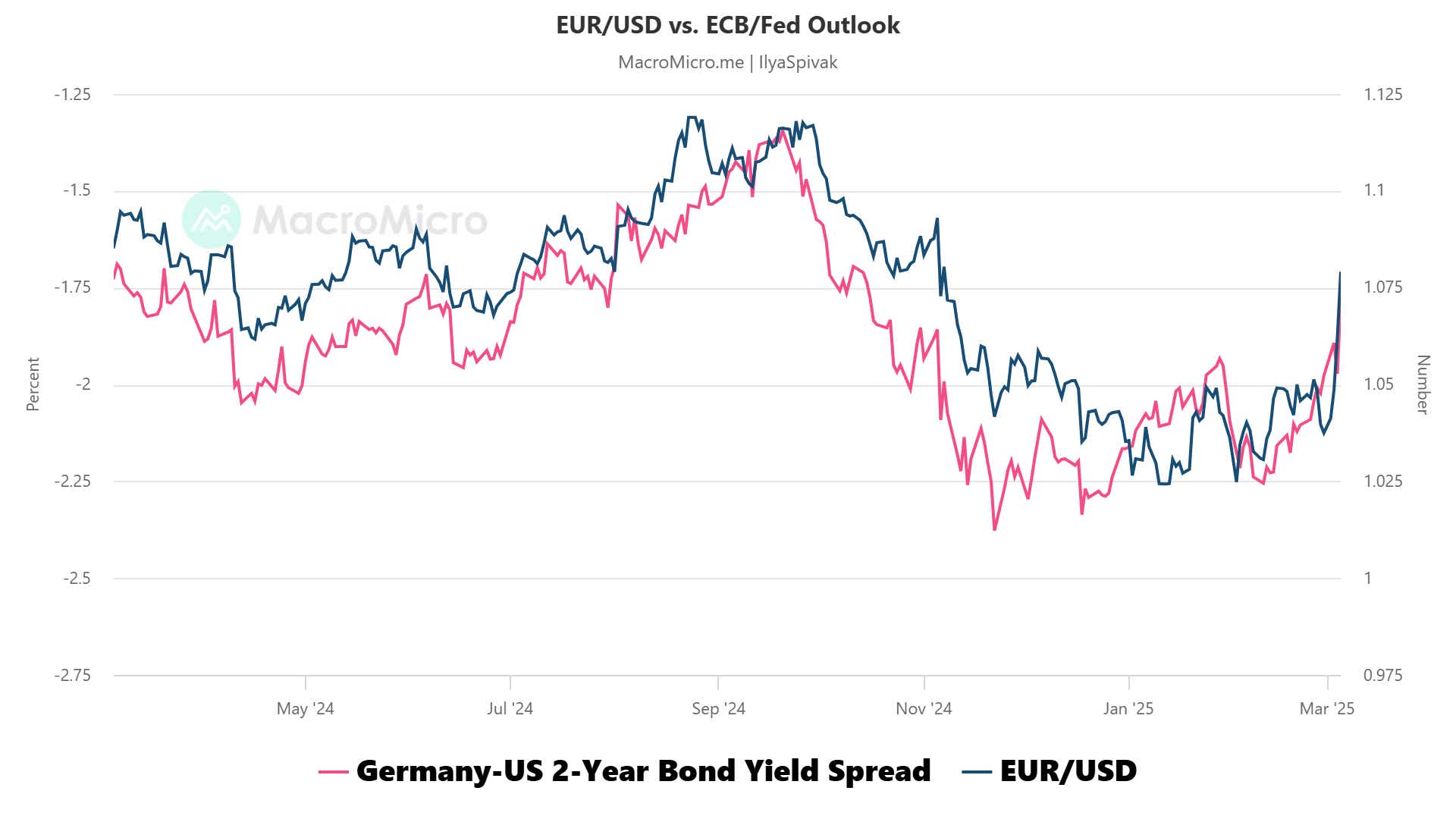

The euro is surging. The currency is on pace for a blistering 3% rise over just two trading days, marking the best performance since November 2022. Prices have traded in lockstep with the spread between German and U.S. two-year bond yields for close to four years, and this move is no different.

Indeed, the U.S. yield advantage at the front end of the yield curve has rapidly narrowed to 173 basis points (bps) – the lowest since mid-October 2024 – from 225bps just one month ago. This reflects a dramatic rally in Eurozone interest rates amid a flurry of activity to boost military spending.

Euro soars as bonds price in European defense buildup

That follows signs of a U.S. pivot away from familiar security guarantees for European allies. The latest and arguably most dramatic signal of the shift came as the White House paused defense assistance for Ukraine in its war with Russia after President Trump and Vice President Vance publicly berated the embattled country’s President Volodymyr Zelensky.

The European Union (EU) leadership jumped into action. European Commission President Ursula von der Leyen announced a proposal to boost defense spending by as much as 800 billion euros, including a 150-billion-euro loan program from the regional bloc to member states.

Meanwhile, the leader of Germany’s CSU/CDU center-right alliance Friedrich Merz – almost certainly the country’s next Chancellor after last month’s elections – has rapidly secured a deal with rival center-left SPD to boost defense spending. Coalition talks are ongoing, but both sides have agreed to suspend Germany’s “debt brake”.

What will the ECB do next after a nearly certain rate cut?

All that has translated into explosive volatility in Europe’s bond markets. The benchmark German 10-year bond lost an eye-watering 2.8% in just two days. That’s the biggest selloff since January 2024. Wednesday’s one-day loss of 2.5% is only the fifth comparable move in the past decade.

.png?format=pjpg&auto=webp&quality=50&width=750&disable=upscale)

This is a dramatic backdrop for the European Central Bank (ECB) as it prepares to issue a monetary policy announcement. The central bank is widely expected to deliver another 25bps rate cut. The move has been fully priced into benchmark ESTR interest rate futures for over five months.

All the same, the carnage in the bond market has marked major changes for the overall trajectory. Nearly 30bps in easing has been erased from expectations on the eve of the ECB conclave. Just three cuts are left on the menu for 2025, and the probability of a rate hike in 2026 has jumped to 56%.

Guidance from ECB President Chrisine Lagarde at the post-meeting press conference is unlikely to surprise on the dovish side as inflation remains stubbornly sticky above 2% despite cooling economic growth. This may give the euro a path to keep marching higher once the dust settles and immediate event risk dissipates.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.