FedEx (FDX) Earnings Preview: Comeback Story Faces Demand Headwinds

FedEx (FDX) Earnings Preview: Comeback Story Faces Demand Headwinds

FedEx (FDX) Earnings Preview

FedEx (FDX) reports Q1 fiscal 2026 results after the close on Thursday, September 18, with analysts expecting EPS of $3.70 on revenue of about $21.6 billion.

FedEx’s DRIVE and Network 2.0 initiatives are on track to unlock $1 billion in savings this year, with the upcoming Freight spin-off positioned to create even more operating leverage.

The company’s valuation is compelling—trading well below peer averages—but a rebound in shipping demand may be required to spark a shift in investor sentiment.

FedEx (FDX) helped write the rules of modern delivery, creating an air-to-ground network that became the backbone of global commerce. Today, that dominance is being tested. Parcel growth has cooled, pricing pressure is rising, and Amazon has morphed from partner to competitor. For investors, this is no longer just a volume story — it’s about whether FedEx can reinvent itself, protect profitability, and prove it can win in a leaner, tougher shipping world.

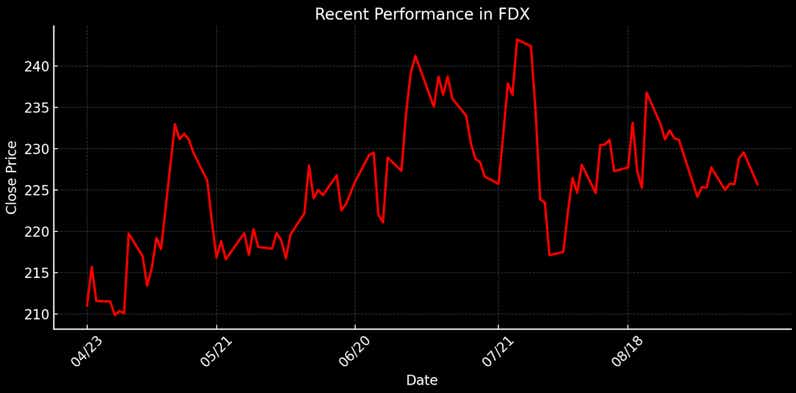

FedEx shares are down about 17% year-to-date and roughly 22% over the past 12 months, leaving the stock among the weaker performers in the transportation sector. The company is under pressure to show that its sweeping cost-cutting program and network redesign can stabilize margins and rebuild investor confidence, even as shipping demand remains muted. That backdrop sets the stage for a closely watched earnings release.

FedEx will report its fiscal Q1 2026 earnings results after the close on Thursday, September 18. Wall Street expects revenue of about $21.6 billion, roughly in line with management’s guidance, and adjusted earnings of $3.70 per share—up 3% from a year ago. Those estimates imply little change in overall sales and modest profit growth, putting the focus on whether management can turn its restructuring efforts into durable margin improvement and strengthen the company’s competitive position against UPS, DHL, and Amazon’s growing logistics arm.

A Leaner FedEx Faces a Growth Test

For FedEx, this earnings report is less about the headline numbers and more about proving that its turnaround is taking hold. After years of margin pressure and choppy demand, management has moved aggressively to reshape the business. At the center of that effort are two key initiatives: DRIVE, a multiyear program aimed at removing billions in structural costs, and Network 2.0, a sweeping overhaul that integrates Express, Ground, and Freight operations into a more unified, efficient delivery network.

On top of those initiatives, FedEx is also preparing to spin off its higher-margin Freight division—a move designed to unlock shareholder value and sharpen the focus on its core parcel and express operations. Taken all together, these efforts reflect management’s push to transform FedEx into a leaner, more efficient, and ultimately more profitable business.

Early signs of progress are emerging. In its fiscal fourth quarter, FedEx managed just 1% year-over-year revenue growth, but operating income rose 8% and margins expanded by 60 basis points. Tighter cost controls pushed capital spending to its lowest level in more than a decade, while free cash flow conversion approached 90%. These trends suggest that cost savings are beginning to take hold—a dynamic that investors will be watching closely to see if it can drive sustained margin improvement.

But headwinds remain. The loss of the U.S. Postal Service contract, a roughly $170 million drag, combined with trade-related pressures on Asia-to-U.S. routes and persistent weakness in higher-margin B2B shipping, weighed on last quarter’s results. Freight volumes improved slightly on a sequential basis, but profitability in that segment is still limited by a soft industrial economy. Meanwhile, intensifying competition from UPS and Amazon Logistics continues to pressure pricing—a challenge FedEx can ill afford as it works to protect margins.

That’s what makes September’s report so important. FedEx is aiming for $1 billion in cost savings from DRIVE and Network 2.0 in fiscal 2026, with additional efficiencies expected in the years ahead. The planned freight spin-off could also help re-rate the stock closer to peers with higher valuations. But for investors, those longer-term catalysts will carry more weight if the near-term story holds up—with clearer signs of margin improvement, disciplined execution, and tangible progress against structural headwinds.

Discounted Valuation Awaits a Bullish Catalyst

From an investor’s perspective, one of the most compelling aspects of the FedEx story is its valuation. By almost any traditional measure, the stock screens as cheap. Shares trade at just 13 times trailing GAAP earnings versus a sector median near 25. The price-to-sales ratio sits at 0.6 compared with 1.7 for peers, and price-to-book is 1.9 versus the group’s 3.1. Taken together, those metrics suggest FedEx is being valued more like a mature cyclical than a global leader in logistics.

That discount may be deserved—at least for now. FedEx is still contending with a sluggish freight market, the revenue hit from its lost U.S. Postal Service contract, and fierce competition from UPS and Amazon Logistics. Until DRIVE and Network 2.0 translate into sustained efficiency gains and margin expansion, investors may be reluctant to value the stock in line with its higher-multiple peers.

Even so, the setup leaves room for upside if the turnaround plan delivers meaningful progress. At roughly $225 per share, FedEx trades well below the average analyst target of $265, with 21 of 32 analysts rating the stock a “buy” or “overweight.” Visible gains from cost-cutting initiatives and greater clarity on the Freight spin-off could help narrow the valuation gap with peers—particularly if earnings growth starts to pull ahead of modest revenue gains.

Fedex Earnings Preview Takeaways

FedEx shares have lost more than 20% over the past year as investors wait for proof that its turnaround is gaining traction. DRIVE and Network 2.0 have already produced early cost savings, cash generation is improving, and management has kept a tight lid on spending. Still, the market remains unconvinced that these gains can fully counterbalance weak shipping volumes and intensifying competition from UPS and Amazon.

Valuation, however, tilts the risk-reward in FedEx’s favor. At just 13 times earnings and trading below peer averages on both sales and book value multiples, the stock already prices in a fair amount of caution. Analysts’ average target of $265 implies meaningful upside, but FedEx still needs to show it can convert incremental efficiencies into durable margin growth. The planned Freight spin-off could provide an additional catalyst to unlock value—but its impact will ultimately hinge on whether the company can deliver consistent execution and restore investor confidence.

Lastly, demand remains one of the most powerful swing factors in the FedEx story. Cost cuts and efficiency gains have made the network leaner, but their real potential is unlocked when more packages flow through the system. A rebound in manufacturing activity, inventory restocking, or global trade could amplify those savings, turning them into stronger margins and faster earnings growth.

Under that favorable scenario, FedEx transitions from a cautious turnaround to a genuine growth story—a setup that could position the stock for a meaningful move higher. To learn more about trading earnings events using options-focused strategies, readers can follow this link.

Andrew Prochnow has traded the global financial markets for more than 15 years, including 10 years as a professional options trader.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices