FOMC Minutes Preview: Does the Fed Know Where It's Leading Markets?

FOMC Minutes Preview: Does the Fed Know Where It's Leading Markets?

By:Ilya Spivak

The markets seem spooked after conflicting messages from Federal Reserve officials.

- Stocks fell as bonds, gold, and the US dollar rose in seemingly “risk off” trade

- Traders may be getting worried about a lack of cohesion at the Federal Reserve

- September FOMC meeting minutes may keep the markets in defense mode

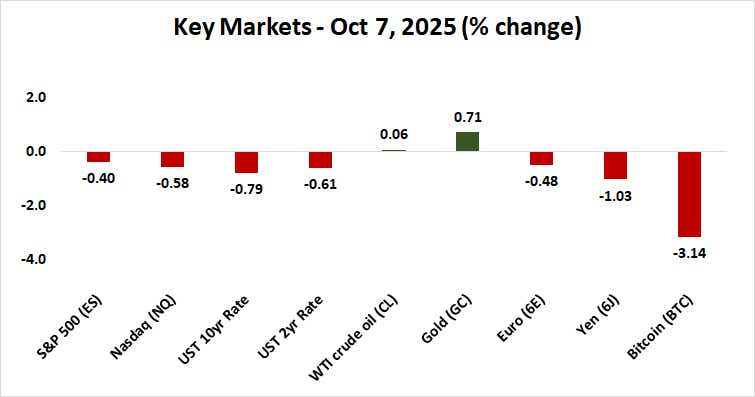

Risk appetite evaporated on Wall Street after a seemingly strong start to the week. The S&P 500 fell 0.4%, erasing the prior day’s rally and putting the bellwether index of US stocks on course for weekly loss. The tech-tilted Nasdaq 100 fell 0.58% while the small-cap Russell 2000 lost a hefty 1.1%.

Curiously, Treasury bonds turned higher, and yields fell. Lower borrowing costs have been supportive for equity markets recently amid Fed interest rate cut speculation, but this had clearly stopped working. Odder still, the US dollar tracked broadly higher despite weaker lending rates, which typically undermine the currency’s yield-seeking appeal.

Stocks fall as bonds, gold, and the US dollar rise amid risk aversion

Gold prices continued to march higher against this backdrop, unbothered by the stronger greenback despite the metal’s typically anti-fiat profile. Silver lost ground however, adding to the sense that something had gone awry on the sentiment front. It tends to show a greater sensitivity to risk trends than its more expensive counterpart.

Perhaps most interesting of all, these moves appeared without a clear-cut catalyst. The US government shutdown has derailed official economic data releases, leaving traders to parse a slew of comments from Fed officials for direction cues. Here too, an obvious lead was pointedly absent.

Minneapolis Fed President Neel Kashkari said that it is too soon to know if inflation from the Trump administration’s tariff policies will be sticky and warned that some data is sending “stagflation” signals. He added that if the US central bank were to lower rates drastically, a burst of high inflation ought to be expected.

Mixed messages from the Fed spook markets as FOMC minutes loom

Newly minted Fed Governor Stephen Miran – on leave from being the Chair of the Council of Economic Advisers at the White House while moonlighting at the Fed through year-end – sent mixed messages. He said that a lot of uncertainty has lifted compared with the first half of the year yet argued that this doesn’t have firm implications for policy.

He went on to say that he is more sanguine than others about inflation and does not see the tariffs as a material driver of price growth, adding that the markets’ reaction to Fed easing supports a push to aggressively cut rates. This seemed to amount to incongruously singing the economy’s praises and calling for powerful stimulus at the same time.

Perhaps the clash in these messages was itself the trigger for the markets’ defensive mood. Kashkari sounded a lot like the Fed’s majority view, as might have been asserted by Chair Jerome Powell himself. Miran clearly disagreed yet also seemed to be at odds with some of his own ideas.

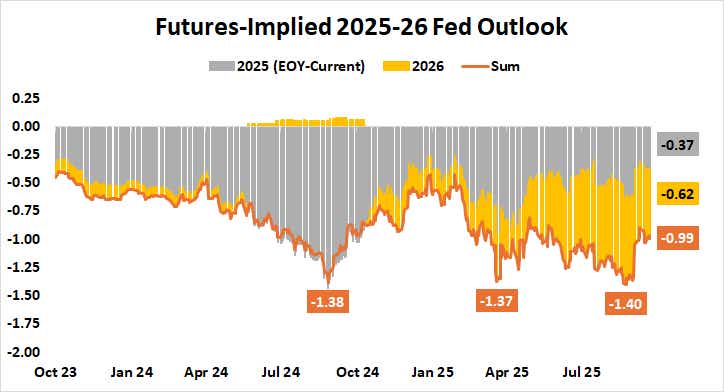

All eyes now turn to September’s Federal Open Market Committee (FOMC) meeting minutes. Wall Street may continued to face selling pressure while haven-seeking capital flows buoy bonds and the US dollar if the document paints policymakers as struggling to cohere around a common vision.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices