Stock, Bonds and the U.S. Dollar in the Balance: FOMC Meeting Preview

Stock, Bonds and the U.S. Dollar in the Balance: FOMC Meeting Preview

By:Ilya Spivak

Fearful financial markets are hoping to feel seen by the Federal Reserve.

- Stocks are falling as data shows policy uncertainty is already hurting growth.

- Traders are hoping that dovish signaling from the FOMC will revive sentiment.

- Bonds may rise while yields and the U.S. dollar fall amid rate cut speculation.

Even before the election in November, financial markets were well aware that Donald Trump and his team favored using tariffs to reshape the country’s economic relationships with friends and foes alike. They knew that these tariffs were almost certainly coming after the votes were counted and took the news in stride.

Traders even dismissed the President’s first flip-flop on tariff policy in February, when the first round of levies on Canada and Mexico were paused within 24 hours of being activated following bilateral talks between Mr. Trump and the two country’s leaders. Markets swooned as the tariffs turned on, then promptly rebounded as they were turned off.

The markets’ assessment has only darkened as it became obvious that economic growth is being hurt by ongoing trade policy reversals and a broader sense of instability in fiscal matters. Scrambling to rehire some haphazardly fired federal workers or issuing a flurry of wavers for cancelled foreign aid recipients make for inconvenient optics.

Stocks scramble as uncertainty starts to hurt the U.S. economy

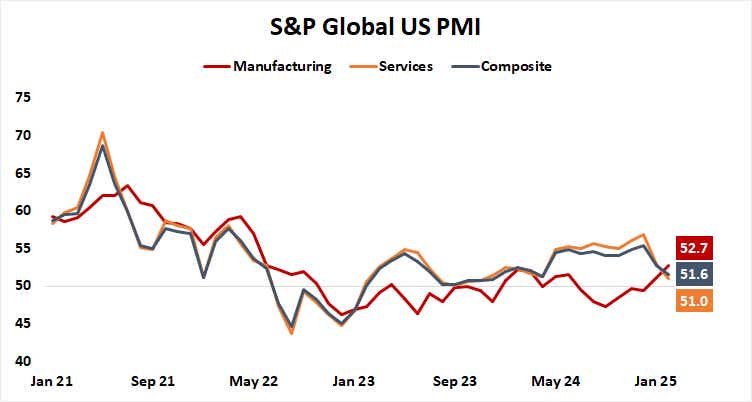

In February, all of this began to appear in stark relief in closely watched business and consumer confidence surveys. S&P Global purchasing managers index (PMI) figures point to a dizzying drop in service sector activity growth so far this year. University of Michigan data puts consumer sentiment at the weakest since July 2022.

Stock markets have tumbled. The bellwether S&P 500 index recorded its first four-week losing streak since August and the steepest such drop since October 2022. For their part, administration officials including Treasury Secretary Scott Bessent dismissed the selloff as a necessary “adjustment” and hailed the economy as “healthy”.

Bond markets have rallied, pushing down Treasury yields. That has eroded the interest rate advantage of the U.S. dollar, sending it sharply lower. Traders have seemingly reasoned that if the White House refuses to hear market signaling and change course, it will fall on the Federal Reserve to come to the rescue with more generous rate cuts.

All eyes on the Fed: when will the cheaper money come?

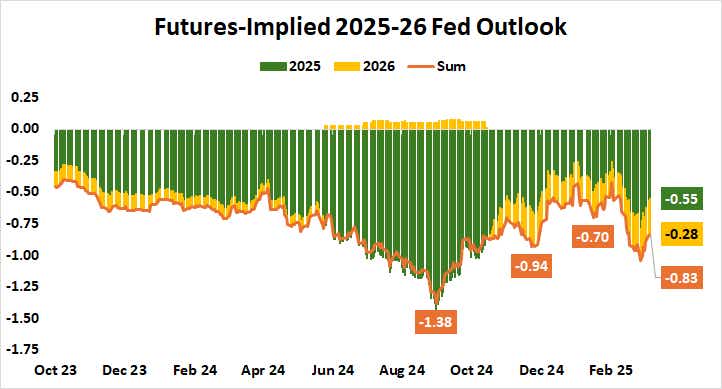

This puts the incoming policy announcement from the U.S. central bank’s rate-setting Federal Open Market Committee (FOMC) firmly into the spotlight. Benchmark Fed Funds interest rate futures have moved from pricing in about 50 basis points (bps) in rate cuts through the end of 2026 a month ago, to nearly double that at 83bps now.

No changes to the target rate range are expected at this meeting, but the quarterly update of the FOMC’s Summary of Economic Projections (SEP) will be closely scrutinized in hopes of a dovish signal. Traders are likely to be disappointed if officials opt for a “wait-and-see” approach instead, as Fed Chair Jerome Powell signaled in a recent speech.

Bonds may continue to march higher as Treasury yields and the U.S. dollar fall if recession fears build against this backdrop. That would reflect traders expecting that a delay now will amount to faster and sharper rate cuts downwind as the Fed catches up to incoming economic weakness. If such hope for cheaper money lifts stocks remains to be seen.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices