Gold and Oil Prices: Ready to Go Up Again?

Gold and Oil Prices: Ready to Go Up Again?

By:Ilya Spivak

Are gold and oil prices ready to go up again after strong waves of selling pressure struck both markets?

- Gold prices sink for a second day. Is the uptrend really over?

- Trump Fed Chair pick spooks metals, but big narrative remains

- Crude oil prices pull back but weakness may be short-lived

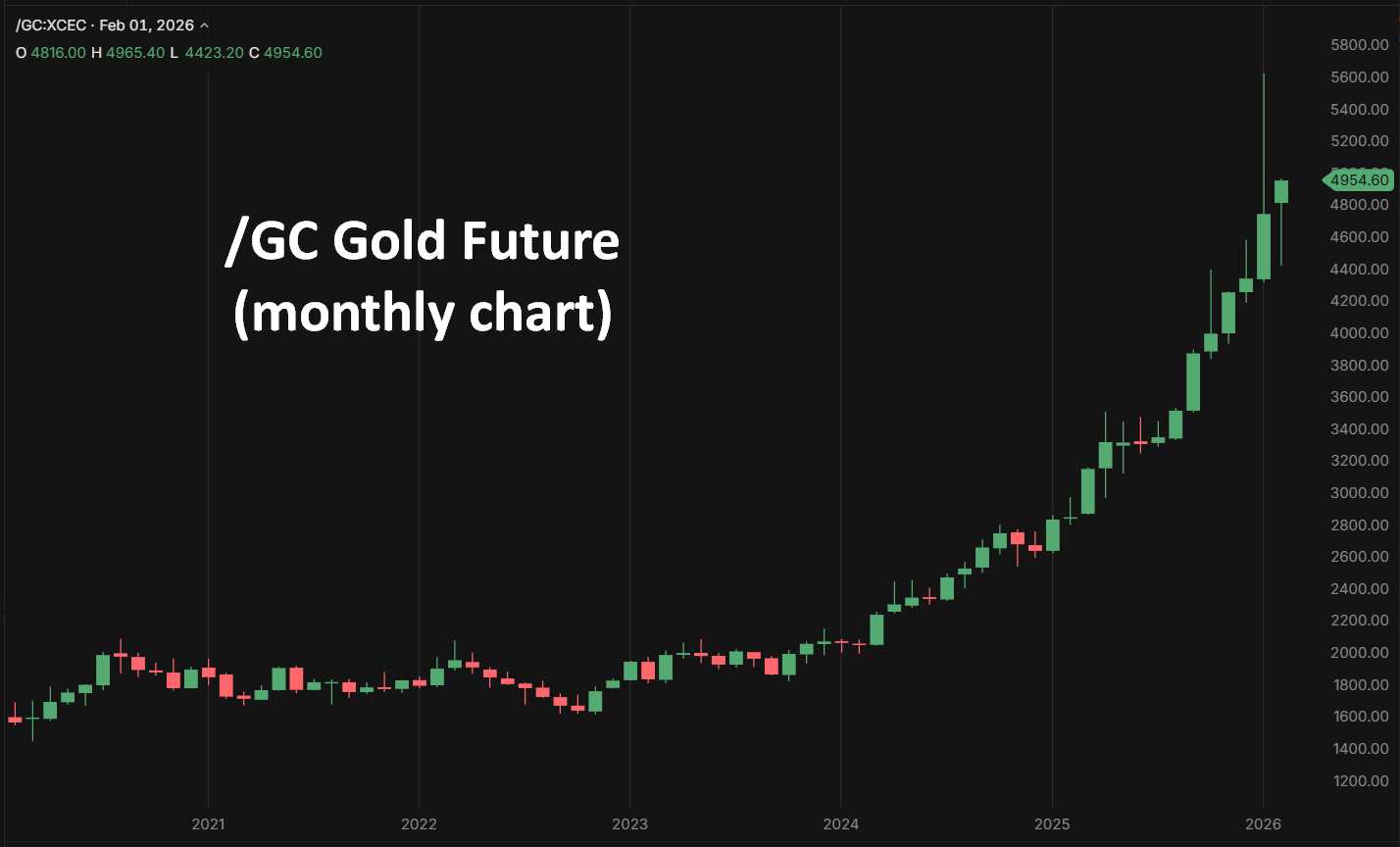

Gold prices continued to slide at the start of the new trading week after a historic plunge on Friday, January 30. That day, a brutal drop of 9% marked the biggest single-session selloff in 46 years. Together with Monday’s further drop of nearly 5%, the yellow metal has erased two weeks of upside progress in two days.

This brutal liquidation of a record-setting rally followed news that US President Donald Trump will nominate former Federal Reserve Governor Kevin Warsh to be the US central bank’s next Chair after Jerome Powell’s tenure expires in May. Warsh loudly favored hawkish policy for decades, until embracing the president’s dovish tilt most recently.

Gold price drop: pull-back or trend change?

Gold was enjoying a historic rally when the selloff struck. Six consecutive months of blistering gains sent prices to a record high and marked the steepest ascent for the yellow metal since early 1980. Then as now, overlapping geopolitical jitters including revolutionary fervor in Iran saw prices build a year-long rally into a violent spike.

Buying hit fever pitch in January 1980, then prices snapped violently backward in February and March before rebuilding back from those losses by September. Now as then, a wave of profit-taking worthy of the breakneck rally preceding it may be followed by a hearty bounce.

That is because the main impetus for gold’s unprecedented rise in 2025 appears to remain firmly in place. Prices rose by nearly $1700 per troy ounce, the biggest increase in dollar terms since relevant records begin in 1972, the first full year after the breakdown of the Gold Standard system.

As the new Trump administration set about escalating the trade war with China while threatening even the closest US allies with punishing tariffs, the markets found increasing appetite for a non-sovereign way to transfer value. Gold emerged as a hedge against the possibility that major countries could weaponize their financial systems.

Crude oil prices: new trend underway?

That logic seems likely to remain unchanged at least this year, regardless of whether a would-be Fed Chair Warsh might try to convince fellow central bankers to cut rates a bit faster. In fact, building inflation risk in the crude oil market might leave the newly dovish Warsh in the minority, outvoted by more hawkish officials.

Oil prices joined gold on the defensive Monday, but here too the losses come in the wake of a heroic rally. The benchmark WTI futures contract is on a six-week winning streak, rising 16.3% and marking the longest run of back-to-back gains since August 2023. However, it gapped lower Monday and slid 5.19%, the biggest one-day drop in three months.

That move was reportedly linked to easing concerns about a possible US strike on Iran after news reports suggested that the two sides were angling for a round of talks. A similar pullback on January 15 gave way uptrend resumption after just one day of losses. This one may be similarly short-lived.

Like gold, crude oil seems focused on a broader narrative. Its rise appears to reflect the realization that a disruption of sanctions-busting oil shipments to China might make a mockery of supply glut expectations. If this turns into a lasting drive higher for energy prices, the Fed will find it devilishly hard to satisfy Mr. Trump’s demand for lower rates.

Ilya Spivak, tastylive head of global macro, has over 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive.com or @tastyliveshow on YouTube

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices