Gold’s Safe Haven Status Under Question: 3-Year Data Breakdown + Trade Ideas

Gold’s Safe Haven Status Under Question: 3-Year Data Breakdown + Trade Ideas

Is Gold the Safe-Haven Asset? Not so much...

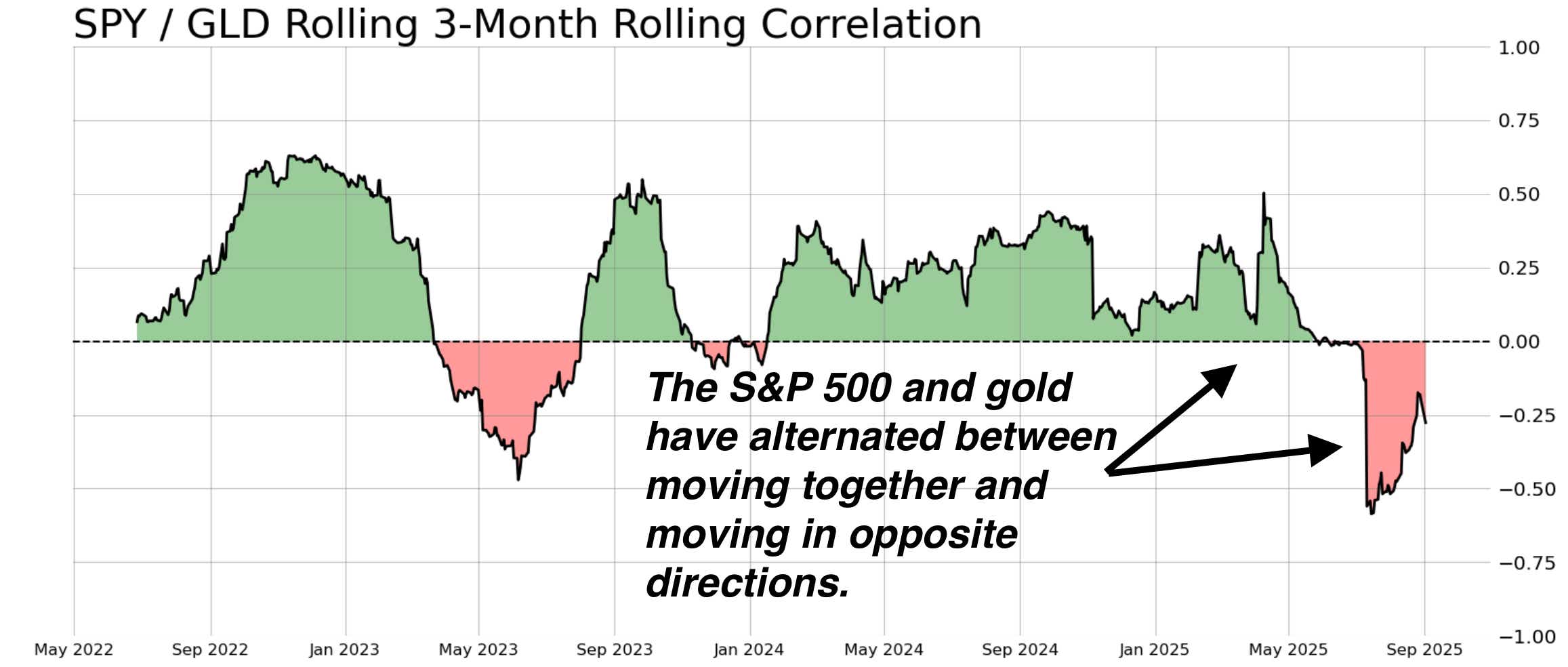

The story goes that when equities fall, investors tend to flock to gold, driving prices up while stocks fall. Over the past three years, the data shows the opposite.

See below:

Over the past three years, gold hasn’t consistently provided the hedge that many investors expect. In fact, many of the biggest down days for equities, gold also weakened.

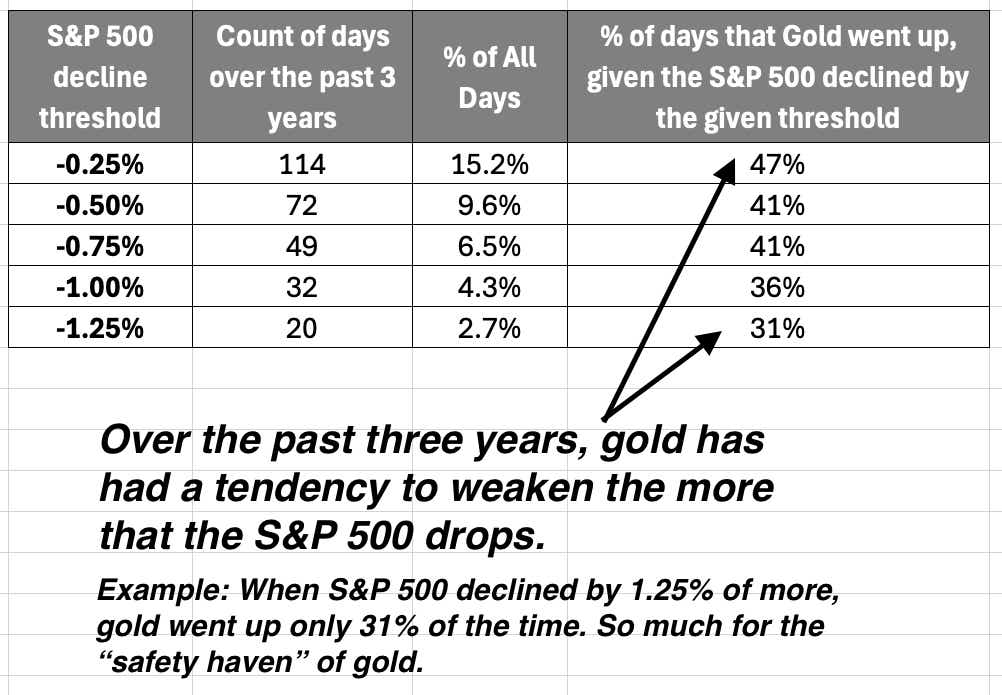

We ran the numbers and show the results below:

The takeaway? As the S&P 500 declines deepen, gold is less likely to rise. In other words, gold’s “safe haven” hasn’t played out over the past few years.

So why has this been true? No one has a definitive answer, but we throw a few reasons below:

- Higher interest rates - with cash and bonds offering yields, the opportunity cost of holding gold has gone up

- Shifts in popularity - Crypto, treasuries, Pokémon cards (?), have drawn some of the “safe haven” flows away from gold

Or simply…uncertainty - Heck, we just aren’t really sure. No one really knows. Gold’s hedge may simply not be as automatic as many assume.

5 ways to go short - tastylive Methodology

Strategy Comparison & Risk Management| STRATEGY | HOW TO PROFIT | TASTYLIVE TRADE MANAGEMENT |

|---|---|---|

| 1. SHORT STOCK | Stock declines Max profit if stock → $0 |

|

| 2. SYNTHETIC SHORT | Dollar-for-dollar as stock declines below strike |

|

| 3. SKEWED IRON CONDOR | Stock stays below short call or moves lower in range |

|

| 4. SHORT CALL SPREAD | Stock stays below short strike at expiration |

|

| 5. LONG PUT SPREAD | Stock moves below long strike toward short strike |

|

Two Trade Ideas

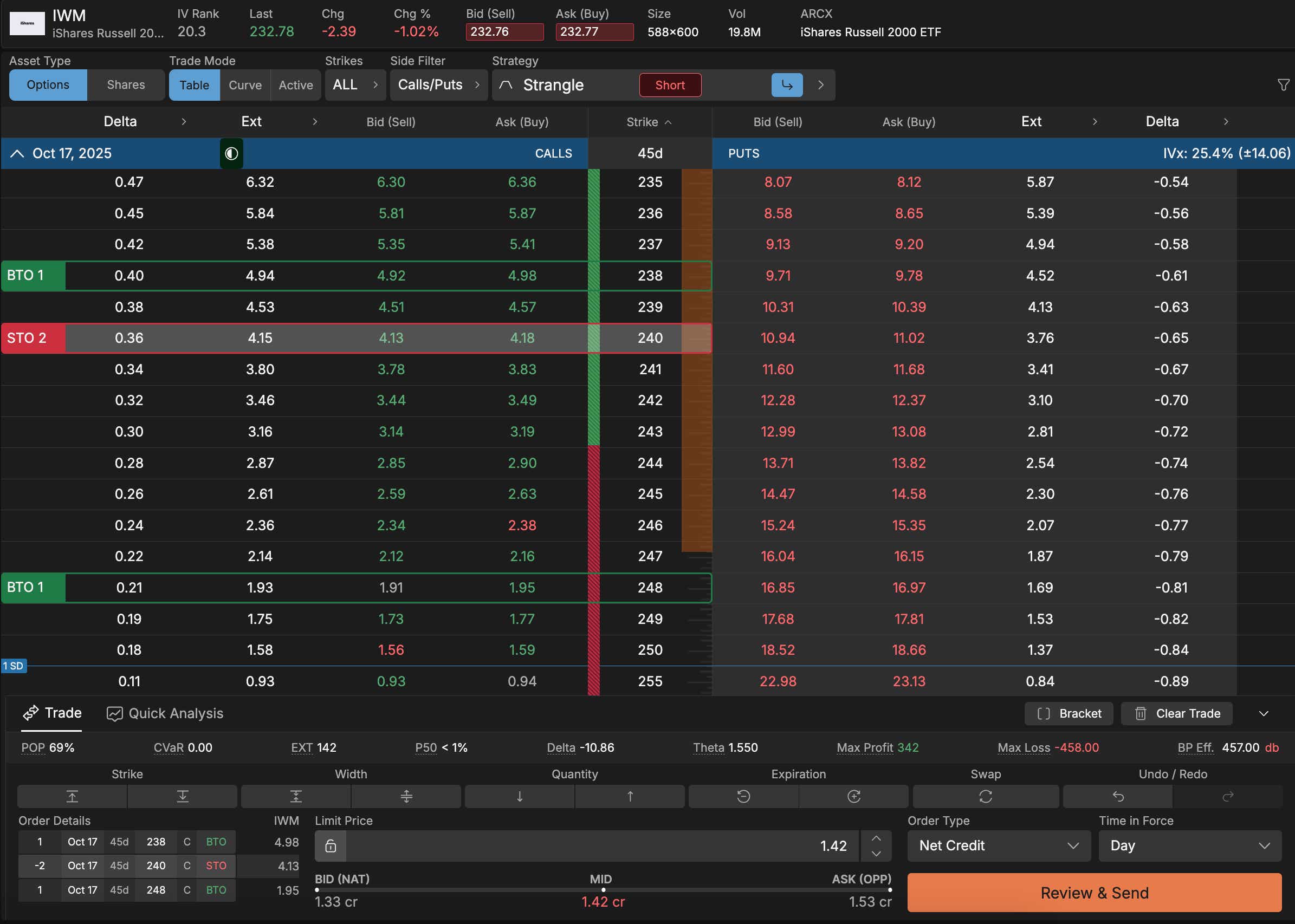

IWM ($232.74) Call Broken Wing Butterfly (OCT) $1.42 Debit

Small caps have shown strength with IWM trading at $232.74 and implied volatility at 21%. With no downside risk and a max profit of $342 possible if IWM pins at $240 at October expiration, this broken wing butterfly offers an asymmetric risk/reward. The trade structure - buying 1 IWM 238 Call, selling 2 IWM 240 Calls, and buying 1 IWM 248 Call (all Oct-17 45 DTE) - creates a neutral to bearish position that profits in the $240 zone while limiting risk to just the $1.42 debit paid.

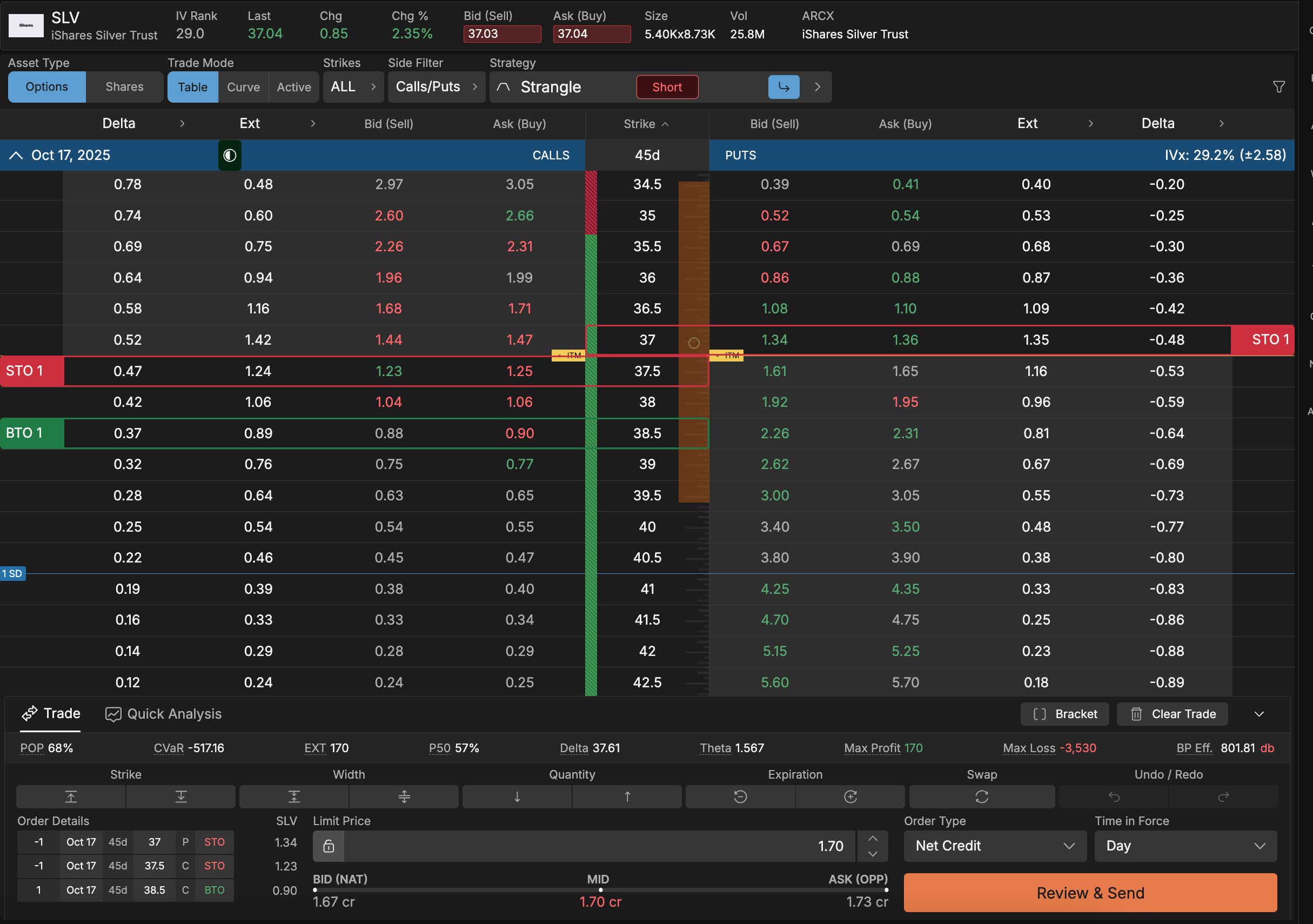

SLV ($37.04) Jade Lizard (OCT) $1.70 CreditWith SLV trading at $37.04 and implied volatility at 29.2%, this jade lizard collects $1.70 in premium by selling the Oct-17 37 Put for $1.33, selling the Oct-17 37.5 Call for $1.23, and buying the Oct-17 38.5 Call for $0.90. This bullish to neutral position has a 68% probability of profit with max profit of $170 if SLV stays between the short strikes at expiration. The trade has no upside risk above $38.50 due to the long call protection, while the max loss of $3,530 would occur on a significant downside move. With theta of 1.557 and 45 days to expiration, time decay works strongly in your favor.

Subscribe

Share our newsletter with your friends and if you don’t have any friends, our condolences. Got feedback or want to say hi?

drdata@tastylive.com or nick@tastylive.com.

Sign up here, and you'll get our newsletter every week.

https://tastylive.com/newsletters

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices