Hang Seng Index Outlook: Evergrande Uncertainty, Beijing Crackdowns Weigh on Sentiment

Hang Seng Index Outlook: Evergrande Uncertainty, Beijing Crackdowns Weigh on Sentiment

HANG SENG, EVERGRANDE, US-CHINA TRADE RELATIONS, USTR, CHINA CRACKDOWN – TALKING POINTS:

- Hang Seng remains under pressure as China data is mixed, Evergrande fears grow

- Evergrande shares halted in Hong Kong over potential acquisition rumors

- Beijing’s crackdown on tech, casino stocks continues to weigh on sentiment

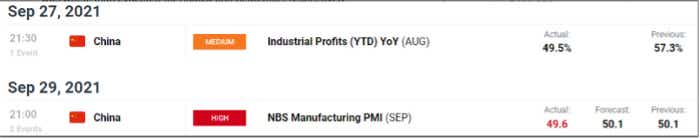

The Hang Seng Index remains firmly in the spotlight as the Evergrande drama continues to unfold. The index fell by more than 2% on Monday as fears continue to grow surrounding Evergrande’s dollar bond payments. Shares of the distressed developer were abruptly halted in Hong Kong along with all related structured products, “pending an announcement related to a merger or takeover.” Initial reports out of Hong Kong state that Hopson Development Holdings is looking to acquire a majority share in Evergrande Property Services Group. Worries over slowing growth in China were amplified last week, as industrial profit and manufacturing PMI data was worse than expected for August and September respectively.

CHINA ECONOMIC CALENDAR

Courtesy of the DailyFX Economic Calendar

The Hang Seng Index’s decline brings key levels into play, the first being major trendline support. Despite being breached on multiple occasions in July and August, the descending trendline has offered a broad level of support. Monday’s decline sees the index testing support, and a break lower could see support in the form of the 0.236 Fibonacci level come into play around 23,500. Given the grim fundamental construct surrounding the index, price may continue to search for a near-term bottom as the Evergrande situation looks for a resolution.

HANG SENG INDEX DAILY CHART

Chart created with TradingView

Away from Evergrande, continued scrutiny from Beijing toward gaming and tech companies continues to weigh on market sentiment. Shares of Tencent and Alibaba Group have declined for consecutive weeks, sending the Hang Seng Tech Index within touching distance of its record low. Market participants remain fearful as Beijing announced last week that it is looking into additional oversight over internet companies.

HANG SENG TECH INDEX DAILY CHART

Chart created with TradingView

US-China trade relations have also returned to the forefront, as Washington actively reevaluates the American supply chain in the wake of recent bottlenecks. In a speech given on Monday, U.S. Trade Representative stated that Washington will be enforcing “phase one” of a trade deal signed in January 2020. Tai also made China aware that tariffs were remaining in place, which may reignite tensions between Beijing and Washington. According to prepared remarks, the Biden Administration has serious concerns over “state-centered and non-market trade practices” emanating out of China.

Written by Brendan Fagan, Intern

@BrendanFaganFX on Twitter

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.