Is Trump's Tweet Anti-(Truth)Social?

Is Trump's Tweet Anti-(Truth)Social?

As of this writing the X post has had more than 140 million views. What does this mean for DWAC?

- Former President Donald Trump tweeted/Xeeted for the first time since January 2021.

- The DWAC-TMTG merger has not yet been completed.

- Traders have reacted as though TruthSocial could be in trouble if Trump is moving back to Twitter/X.

A funny thing happened on his return trip from Georgia last night: Former President Donald Trump posted to X (the platform formerly known as Twitter) for the first time since January 2021. Before you roll your eyes and say “don’t talk about politics,” be aware that this is not political commentary. This is purely about the market implications of Trump’s return to the Twitter/X arena, given his financial stake in Digital World Acquisition Corp. (DWAC), a meme stock maven.

Here's why the tweet/Xeet heard around the world matters.

Digital World Acquisition Corp., is a special purpose acquisition company (SPAC). Like other SPACs, it was a blank check company founded with the intent to acquire a private company to bring to public markets. In October 2021, DWAC announced it intended to go public in a $300 million merger with Trump Media & Technology Group. TMTG is the parent company of TruthSocial, a competitor to the former Twitter/current X.

Under the deal, Trump himself would own about 90% of DWAC. But one of the conditions of the DWAC-TMTG merger was that Trump was only allowed to use other social media sites in a limited fashion: Other than political activities, anything he posted had to go onto TruthSocial first, and then could appear on competitors’ social media sites six hours later.

In their filing for the merger with the SEC, DWAC noted:

"President Trump has a significant influence on TMTG’s business plan. TMTG believes President Trump’s reputation and relationships are a critical element to the success of TMTG’s business. TMTG’s future success will depend, to a significant extent, upon the continued presence and popularity of President Trump."

The DWAC-TMTG merger is still not official, mind you. In a regulatory filing with the Securities and Exchange Commission in July, DWAC agreed to pay an $18 million civil penalty to expedite the merger. A deadline for the merger was set for Sept. 8, 2023. Should the merger fail, DWAC would then dissolve and return the $300 million to the SPAC’s investors.

DWAC Ticker Price Technical Analysis: 5-minute Chart (August 22 to 25, 2023)

So the question is whether Trump’s return to Twitter/X means he will be spending less time, or even abandon, TruthSocial? Traders have reacted as though this is a meaningful possibility. DWAC gapped open lower on Friday, starting the day 5.89% below Thursday’s close. Granted, traders have lapped up the meme stock since the open, as it was only trading lower by -0.92% when this note was written.

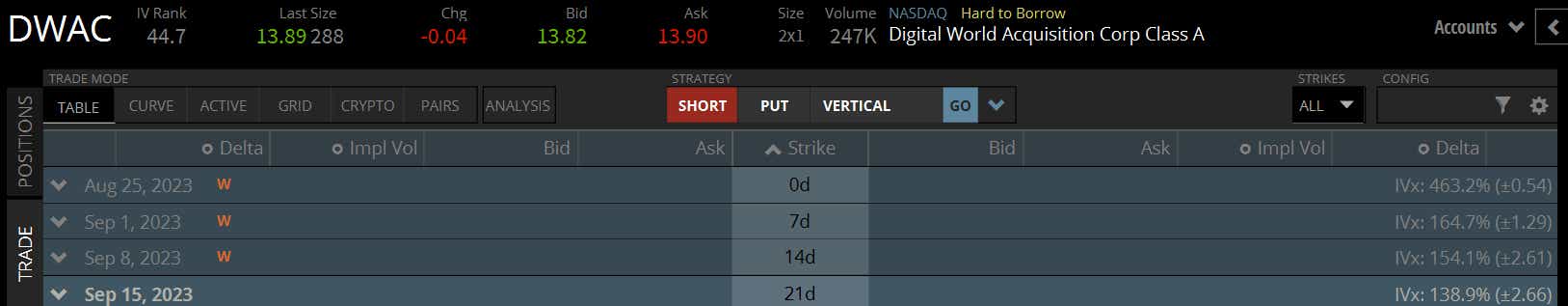

DWAC, a meme stock darling in late 2021 and early 2022, is now squarely back in the cross-hairs of traders. And with the Sept. 8, 2023 merger deadline approaching quickly, DWAC will likely see significantly higher volatility over the coming weeks.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.