Labor Market Data, FOMC Meeting Minutes and PMI Surveys

Labor Market Data, FOMC Meeting Minutes and PMI Surveys

By:Ilya Spivak

Macro events that may move the markets this week

- Hawkish central banks push bond markets to lift rates, signal recession risk.

- Stock markets hold strong, but gains may be owed to the unwinding of hedges.

- U.S. jobs data, FOMC minutes and RBA rate decision in the spotlight ahead.

Except for Friday’s breakneck rally on Wall Street, last week played out as expected.

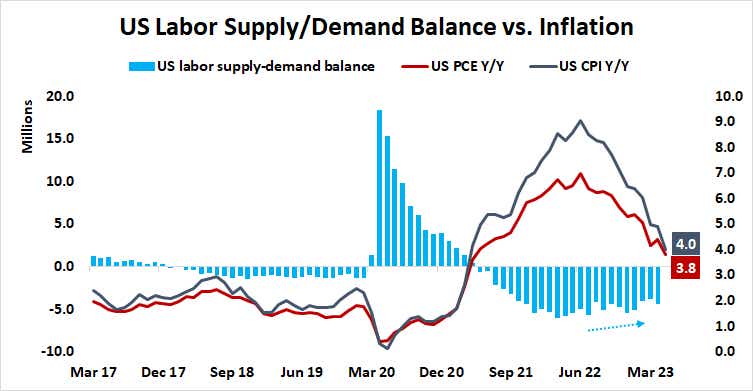

Leading monetary policymakers turned up the heat at the ECB Forum on Central Banking. Fed chair Jerome Powell, ECB president Christine Lagarde, and Bank of England governor Andrew Bailey seemed of one mind on the primacy of beating inflation back to target levels. Forecasts of slower growth and rising unemployment duly followed.

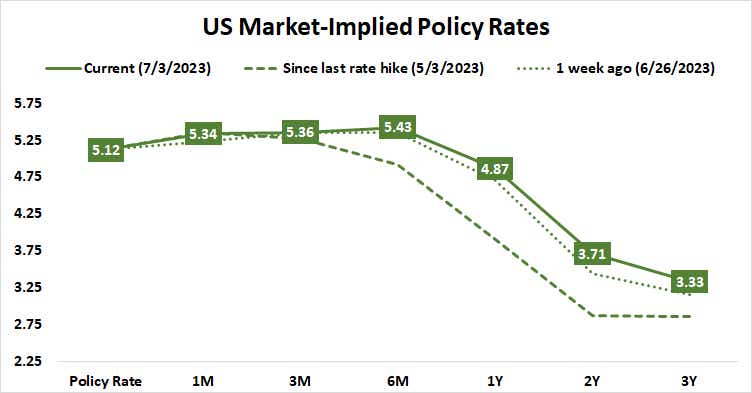

Bond markets responded accordingly. The yield on the two-year Treasury note jumped to within a hair of 5%, returning to levels unseen since the peaks set in March on the eve of the SVB-led banking crisis. Rates rose across the yield curve, but longer-dated maturities lagged. The 10- to 2-year spread inverted to -1.09%, the most since 1981.

The message seems unmistakable: a “higher for longer” interest rate environment in the near term, and a view to its consequences. Pricing in a steepening decline in borrowing costs for the longer term speaks to an eventually sharp policy U-turn, with a brisk round of rate cuts, ostensibly in response to an economic downturn.

Stock markets shrug as central banks goad interest rates

The U.S. dollar duly traded higher and gold prices inched lower, befitting the hawkish adjustment. Stocks seemed curiously disinterested for most of the week, with the benchmark S&P 500 idling above the 4400 level for most of the week. Then, in the opening hours of Friday’s Wall Street trade, they took off sharply higher. By the end of the day, the index secured its highest weekly close since April 2022.

One way to interpret this price action is to conclude that stock markets are content in the belief that they’d pre-emptively discounted in full the latest upshift in interest rates and its sting. That seems far-fetched. Another explanation points to the unwinding of speculative hedges as the reason for stocks’ curious performance.

Positioning data published by the CFTC shows that—among large speculators like hedge funds—shorts in S&P 500 futures outnumbered longs by the largest margin on record at the end of May. The pendulum then swung the other way, with net short exposure reduced by over 50% into the end of June. A final push to reposition on the last day of the month seems plausible.

Does this leave stocks vulnerable to catch-up selling in the coming week? Here are the key macro events ahead.

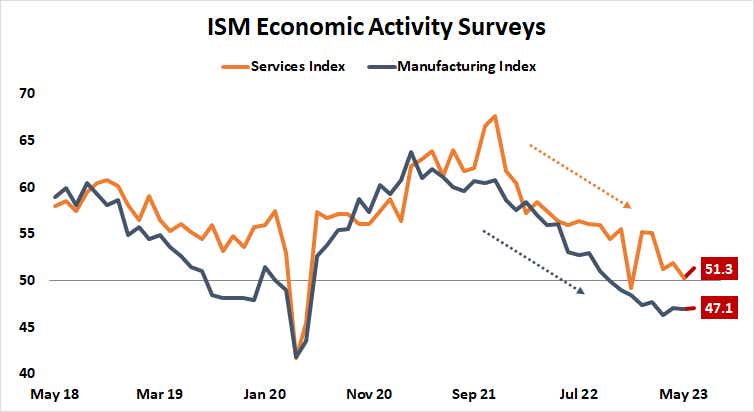

ISM PMI Surveys

June’s ISM manufacturing- and service-sector survey of purchasing managers are closely watched barometers of the U.S. business cycle that traders look to as a timely approximation of the trend in GDP growth. They are expected to show slight improvement from May’s results, though manufacturing is still seen contracting (albeit at a slower pace).

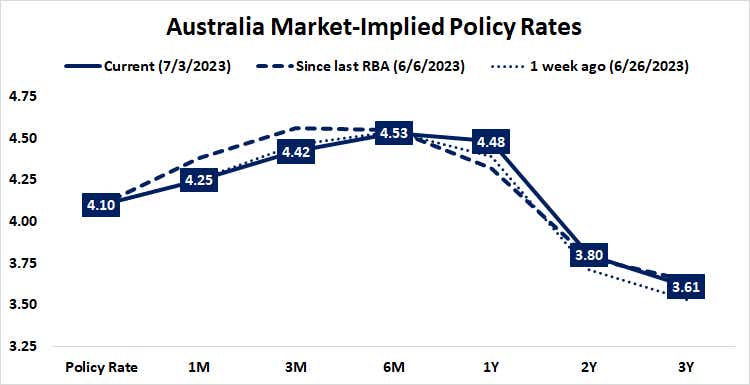

Reserve Bank of Australia (RBA) interest rate decision

Australia’s central bank is expected to keep its target interest rate unchanged at 4.1%, with the next 25 basis points (bps) hike seen as early as August and no later than September. Hawkish rhetoric tilting the balance toward a sooner move and setting the stage for a higher-rate world thereafter may be seen as bolstering the global tightening trend.

June FOMC Meeting Minutes

Chair Powell and company opted to hold fire at June’s policy meeting, ending a streak of ten consecutive rate hikes. Combative rhetoric thereafter suggests the move marked a pause before rate hikes resume later this year. With that in mind, markets will want to glean how officials weighed the balance of risks to arrive at their decision.

U.S. labor market data

May’s JOLTs data on job openings will start things off on Thursday, with the number of vacancies expected to drop to 9.9 million from 10.1 million in the prior month. The main event comes on Friday with June’s official labor market statistics. The economy is expected to have added 225k jobs while the unemployment rate fell from 3.7% to 3.6%. That would leave the labor supply-demand mismatch stoking the Fed’s sticky inflation fears in place.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices