Lululemon (LULU) Earnings Preview: Tariffs Weigh on Softening Retail Sector

Lululemon (LULU) Earnings Preview: Tariffs Weigh on Softening Retail Sector

Lululemon Earnings Preview

Lululemon Athletica (LULU) reports Q2 fiscal 2026 results after the close on Thursday, September 4, with a management call scheduled for 4:30 PM ET.

The company enters earnings under pressure: U.S. comps remain weak, tariffs are weighing on margins, and shares are down more than 40% year-to-date.

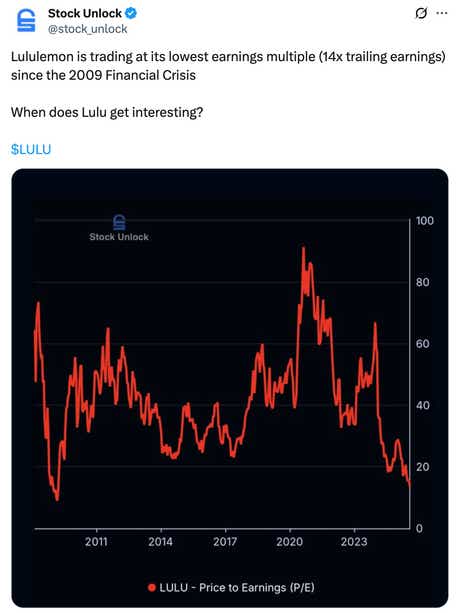

Trading at just 14x earnings and sitting well below consensus price targets, LULU offers a valuation that could draw fresh interest—provided the upcoming report demonstrates tangible progress on both growth and profitability.

Lululemon Athletica (LULU) has evolved from a niche yoga apparel maker into one of the most recognizable names in premium athletic wear. Once defined by leggings and yoga pants, the company now positions itself as a global lifestyle brand spanning men’s and women’s apparel. North America remains its largest revenue engine, but international expansion—especially in China—has become central to the long-term growth story. As Lululemon pushes deeper into the global stage, it finds itself competing not only with giants like Nike and Adidas but also with fast-rising challengers such as Uniqlo.

So far, 2025 has been a difficult year for Lululemon. Shares are down more than 40% year-to-date, driven by worries over slowing North American sales, tariff-related margin pressure, and intensifying competition from both mid-tier rivals and “dupe culture”—knockoffs that erode the brand’s pricing power. Once a market darling that commanded luxury-style multiples, the stock has been pushed into value territory as investors question the durability of its competitive moat.

Lululemon reports Q2 fiscal 2026 earnings results after the close on Thursday, September 4, with a management call at 4:30 PM ET. Wall Street expects earnings of $2.86 per share on revenue of $2.55 billion, versus $2.60 and $2.37 billion in the same quarter last year. Management has reaffirmed full-year EPS guidance of $14.58–$14.78, but with shares hovering near multi-year lows, the report looms as a pivotal test of whether Lululemon can steady demand, protect margins, and rebuild investor confidence.

Cooling Demand & Tariff Headwinds Squeeze Margins

Lululemon’s next act is less about product innovation and more about execution—balancing softer U.S. demand against the weight of tariff pressures. Last quarter, the company cleared the headline hurdle with a revenue and EPS beat, but trimmed full-year profit guidance as Americas comps fell (–2%) and management flagged a more selective consumer. International comps rose 6%, yet the strength abroad wasn’t enough to offset weakness at home, and shares sold off after earnings.

The scale of the tariff headwind is meaningful. Management’s outlook bakes in incremental duties of ~30% on China and ~10% across other sourcing countries—touching a supply chain that still relies heavily on Vietnam and broader Asia. To offset this, Lululemon is rolling out modest price increases in the second half of 2025, and focusing heavily on vendor negotiations and sourcing diversification—moves meant to defend profit margins without breaking the brand’s value equation. Execution is therefore the heartbeat of the story heading into the September 4 earnings event.

Despite the headwinds, the narrative isn't all negative. The company still generates strong cash flows and international growth—particularly in China. If management proves it can stabilize its position in North America, the narrative could shift in its favor. But until that happens, the company's ability to meet its forward guidance will carry outsized weight.

If the company hits its numbers and speaks confidently about its second half outlook, that could provide the basis for optimism in the shares. Under that scenario, the current pullback could look like an attractive buying opportunity. On the other hand, a miss on earnings—or a downward revision of the forward guidance—could generate additional negativity.

Valuations Fall Back to Earth as Brand Strength Gets Tested

Lululemon heads into its Q2 report trading at levels that look far removed from its premium past.

Trading at roughly $200 per share, LULU carries a trailing P/E of just 14—well below the sector median of about 21. On the surface, that discount is striking given the brand’s strong margins and global growth profile. But the picture is mixed: on price-to-sales, the stock still trades above the sector (2.3x vs. 1.0x), and its 5.7x price-to-book multiple remains rich compared to peers at ~2.3x. That mix puts the company in a curious spot—undervalued on earnings, stretched on book, and trading just above average on sales.

Sentiment on Wall Street echoes the valuation profile—conflicted. Of the 34 analysts covering LULU, 16 rate the stock a “buy” or “overweight,” while 15 sit at “hold.” The consensus price target of $270/share still suggests meaningful upside from current levels, but momentum has softened—Barclays and Citi have trimmed estimates closer to the $210–$220 range. With shares down more than 40% year-to-date, caution dominates the narrative. Still, few are ready to abandon the longer-term case that Lululemon’s brand strength and international expansion could justify richer multiples if execution improves.

The central question is whether LULU still merits a premium to traditional retailers. For years, its brand moat, pricing power, and international runway justified multiples well above peers. Today, that advantage looks less secure: tariffs, cautious U.S. consumers, and the rise of “dupe culture” are weighing on comps and margins. If management can blunt tariff impacts, stabilize North America, and maintain international momentum, the current earnings discount may look attractive in hindsight. If not, LULU risks slipping into a lower-tier multiple for the remainder of 2025—and perhaps longer.

Lululemon Earnings Preview Takeaways

Lululemon enters its September 4 earnings event at a crossroads. The brand remains globally resonant, with international sales outpacing the Americas, but U.S. softness, tariff-driven margin pressure, and intensifying competition are forcing investors to reconsider the growth story. The outcome is a valuation paradox: shares trade cheaply on earnings relative to history, yet still command premiums on book and sales compared with peers.

That leaves the setup fairly straightforward heading into the September 4 report. If Lululemon can deliver even modest earnings upside and demonstrate real progress in offsetting tariff pressures, the depressed multiple offers room for expansion. If execution falters or guidance disappoints, however, the discounted P/E may signal less a buying opportunity and more a reset—marking the new normal for a maturing brand.

In sum, this earnings report could prove a catalyst in either direction. Stabilization in the Americas and credible tariff offsets may help restore investor confidence, but renewed weakness in comps or profitability could intensify the bear case. Readers looking to explore options strategies designed for earnings events can follow this link.

Andrew Prochnow has traded the global financial markets for more than 15 years, including 10 years as a professional options trader.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices