Markets Brace for Key Decisions from Central Banks in the U.S., Eurozone and Japan

Markets Brace for Key Decisions from Central Banks in the U.S., Eurozone and Japan

By:Ilya Spivak

Macro events that may move the markets this week

- “Higher for longer” Fed rates view may spook stocks, boost yields and U.S. dollar.

- Euro at risk if the European Central Bank steps back from ultra-hawkish rhetoric.

- Yen may fall as the Bank of Japan signals no hurry to make major policy change.

Much of the price action across global financial markets over the past two weeks seems to have been defined by June’s softer-than-expected U.S. consumer price index (CPI) statistics.

Stocks and gold prices rose in tandem while yields and the U.S. dollar declined. Traders seemed to conclude the data might set the stage for the Fed to bookend its tightening cycle, a likely rate hike at the July Federal Open Market Committee (FOMC) meeting notwithstanding.

The story hit a wall in the middle of last week as pre-positioning for the U.S. central bank’s July 26 policy decision got underway in earnest. Yields rebounded, the bellwether S&P 500 stock index back-pedaled a 15-month high, gold backed away from the 2000/oz figure, and the dollar perked up against its major counterparts.

The reversal may speak to investors’ tactical desire to rebalance exposure to a more neutral setting ahead of big-splash event risk. However, it may also reflect a more substantive realization: After June, base effects will slow disinflation.

June’s year-on-year comparison was with the cyclical inflation peak, registered at over 9% in June 2022. Going forward, comparisons will be with already disinflating numbers, so large drops in headline CPI readings will be harder to come by. That might tie the Fed’s hands and keep a hawkish stance in place longer.

The onset of a deepening global economic downturn complicates matters.

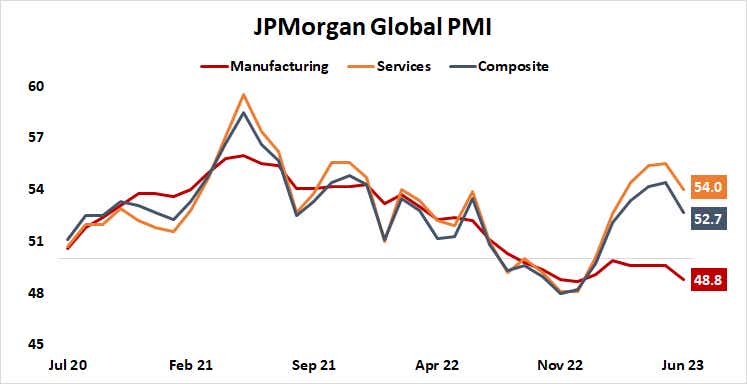

The first round of July’s preliminary purchasing manager index (PMI) reports—from Japan, the Eurozone and the United Kingdom—painted a downbeat picture. Europe looked especially problematic: Economic activity unexpectedly slowed to a near-standstill in the U.K., while on the Continent it shrank outright at the fastest pace in eight months.

More of the same might be ahead. Figures from Citigroup tracking the performance of economic data outcomes relative to baseline forecasts suggest that—in the global aggregate—realized results have increasingly tended to fall short. This implies market-watching analysts’ models envision a rosier setting for the business cycle than reality has confirmed. That sets the stage for disappointments to continue.

How three key central banks will reconcile this backdrop is likely to be pivotal this week.

U.S. Federal Reserve

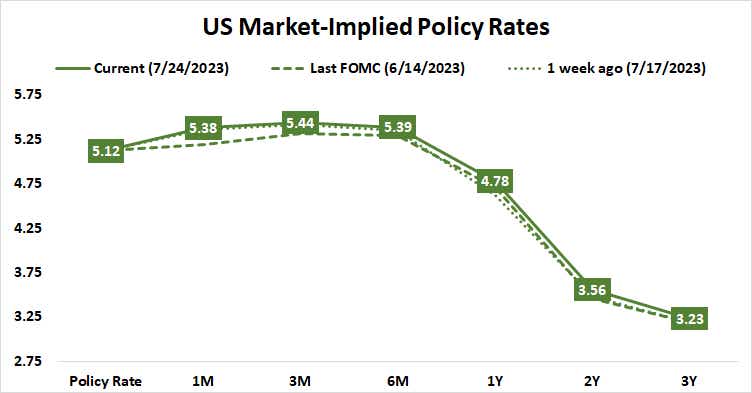

The FOMC will almost certainly raise the target Federal Funds rate by another 25 basis points (bps) when Chair Jerome Powell and company deliver the results of their two-day policy meeting mid-week. Interest rate futures price in the outcome with a commanding probability of 96%. This is unlikely to stir strong feelings from investors, one way or another.

Where policy goes thereafter is the more important question. Markets are leaning toward the belief this is the final rise in the blistering post-COVID rate hike cycle. The priced-in rates curve shows the chance of another 25bps increase peaks at a less-than-even 33% in November, then recedes. Rate cuts are seen commencing in March 2024, with a brisk climbdown bringing the Fed’s target back to 4% by year-end.

If policymakers credibly push back with “higher-for-longer” messaging, stocks may retreat alongside gold as yields and the dollar march upward.

European Central Bank

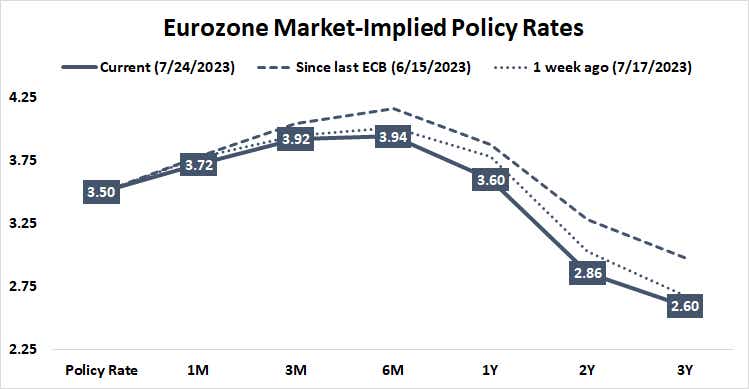

Here, too, the markets are all-but certain a rate hike is due. The probability of a 25-bps increase is priced in at 95%. Unlike the Fed however, another rise before year-end is reckoned likelier than not, at nearly 80%.

European Central Bank (ECB) President Christine Lagarde had taken to all but preannouncing future rate hikes at the central bank’s recent meetings to advertise officials’ inflation-fighting mettle. If the recent spate of soggy economic data releases—including the latest PMIs—translates into a less-combative stance, the euro may suffer. This might take the form of a language update shifting the focus to “data dependence” rather a single-minded, hard-charging push to dis-inflate.

For global markets at large, an ECB that appears to be losing some of its hawkish appetite might read as a worrying sign for economic growth. That may carry negative implications for risk-sensitive assets, including stocks, cyclical commodities like crude oil and copper, and similarly minded currencies like the Australian dollar.

Bank of Japan

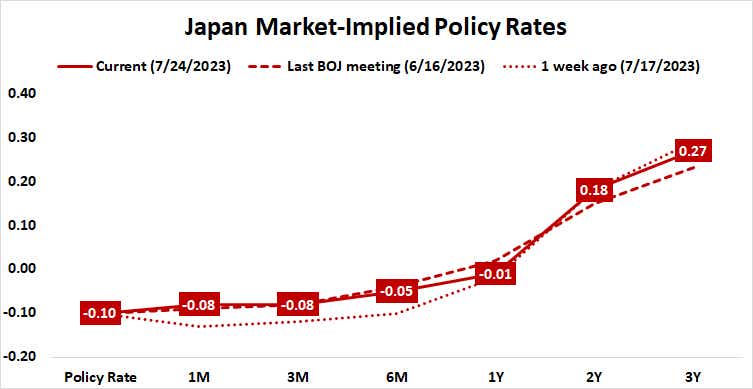

A spate of stubbornly high inflation readings north of 3%—along with the arrival of new Bank of Japan (BOJ) Governor Kazuo Ueda—have put markets tenterhooks. Ueda is an academic without the typical government work pedigree common for BOJ heads but comes from the stable of transformative policymakers groomed by the visionary Stanley Fischer. Other notable Fischer disciples include former Fed and ECB leaders Ben Bernanke and Mario Draghi, respectively.

Taken together, this seems to have inspired investors to consider that Japan’s central bank may finally have the economic backing for reversing decades of ultra-dovish policy, as well as willing leadership to undertake bold change. In the most widely retold version of this narrative, the first act centers around ending so-called “yield curve control” (YCC), the policy of capping the 10-year Japanese government bond (JGB) yield at 0%.

The BOJ may pour cold water on such thinking. The pressure to act seems minimal with the spread between the 10-year JGB yield and the equivalent rate absent central bank meddling implied in the swaps market dropping back from a policy-busting 50bps in January to just 14bps now. Meanwhile, most of Japan's inflation seems to be imported and thereby unlikely to demand a local monetary response.

The Japanese yen is likely to fall in this scenario, while local stocks edge up. That risk-on lead might have some capacity for positive uplift across global equities more broadly. A status-quo BOJ would amount to the continuing availability of cheap, abundant JPY-denominated funding. That might be seen as helping to digest ongoing tightening elsewhere.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.