Markets Give Back Gains as Growth in Employment Slows, the US Dollar Gains and Inflation Pressure Returns

Markets Give Back Gains as Growth in Employment Slows, the US Dollar Gains and Inflation Pressure Returns

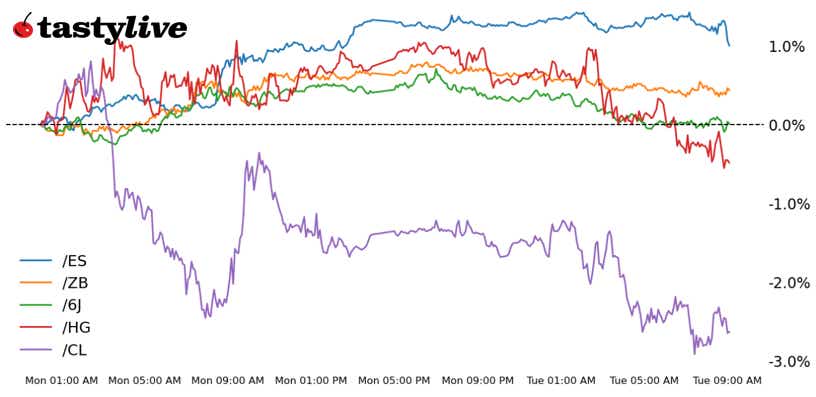

Also 30-year T-bond, copper, crude oil, and Japanese yen futures

- S&P 500 E-mini futures (/ES): -0.33%

- 30-year T-bond futures (/ZB): +0.03%

- Copper futures (/HG): -0.92%

- Crude oil futures (/CL): -1.64%

- Japanese yen futures (/6J): -0.37%

Gains in US equity markets were short-circuited today following the release of the July US Institute for Supply Management (ISM) services purchasing managers’ index (PMI). Topline growth is slowing, employment is fading quickly, and inflation pressures are at their highest level since October 2022 — if the report is to be believed. So much for rate cuts for good reasons when the Federal Reserve meets in September. Treasuries are twisting, precious metals are rising and the US dollar is clawing back recent losses at the halfway mark of the trading day.

| Symbol: Equities | Daily Change |

| /ESU5 | -0.33% |

| /NQU5 | -0.47% |

| /RTYU5 | +0.09% |

| /YMU5 | -0.17% |

The S&P 500 futures ticked higher this morning to extend yesterday’s rally as investors focus on positive corporate earnings. Palantir (PLTR) rose nearly 9% in early trading after the company posted positive earnings results. Caterpillar (CAT) warned investors of a tariff charge of $1.5 billion, but the stock rose about 1.15% in early trading. Pfizer (PFE) rose over 4% after the drug maker raised its full-year guidance. Yum Brands (YUM), the parent company of KFC, Pizza Hut and Taco Bell, slipped nearly 3% after missing revenue estimates. Advanced Micro Devices (AMD) will report earnings after the bell today.

| Strategy: (44DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

| Iron Condor | Long 6225 p Short 6250 p Short 6400 c Long 6425 c | 18% | +937.50 | -312.50 |

| Short Strangle | Short 6250 p Short 6400 c | 48% | +9275 | x |

| Short Put Vertical | Long 6225 p Short 6250 p | 60% | +345 | -905 |

| Symbol: Bonds | Daily Change |

| /ZTU5 | -0.08% |

| /ZFU5 | -0.11% |

| /ZNU5 | -0.11% |

| /ZBU5 | +0.03% |

| /UBU5 | +0.21% |

Treasuries moved lower as the rally over the past few days following Friday’s jobs report cools. Investors are confident that the Fed will cut rates next month, with the CME Group’s Fed Watch Tool showing a 90% chance for a 25-basis-point rate cut. San Francisco Fed President Mary Daly recently said the time for rate cuts is soon, citing a labor market that is showing weakness and little evidence that tariffs have pushed prices higher. 30-year T-bond futures (/ZBU5) fell 0.24% in early trading.

| Strategy (53DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

| Iron Condor | Long 113 p Short 114 p Short 117 c Long 118 c | 30% | +640.63 | -359.38 |

| Short Strangle | Short 114 p Short 117 c | 54% | +2625 | x |

| Short Put Vertical | Long 113 p Short 114 p | 68% | +312.50 | -687.50 |

| Symbol: Metals | Daily Change |

| /GCZ5 | +0.44% |

| /SIU5 | +1.29% |

| /HGU5 | -0.92% |

Copper prices moved lower this morning as weakness from last week’s White House exemption announcement works its way through the market. The remaining tariffs affect only copper pipes and conductors for electronic equipment, which accounted for about a quarter of US imports. American copper producers like Freeport McMoran (FCX) were slightly lower this morning as well. Meanwhile, the arbitrage that existed before the exemption announcement has vanished from the market, which could cause products to flow back to Asia.

| Strategy (51DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

| Iron Condor | Long 4.36 p Short 4.37 p Short 4.56 c Long 4.57 c | 19% | +200 | -50 |

| Short Strangle | Short 4.37 p Short 4.56 c | 53% | +5275 | x |

| Short Put Vertical | Long 4.36 p Short 4.37 p | 59% | +125 | -125 |

| Symbol: Energy | Daily Change |

| /CLU5 | -1.64% |

| /HOU5 | -2.33% |

| /NGU5 | +2.56% |

| /RBU5 | +0.09% |

Crude oil prices (/CLU5) dropped to a one-week low this morning as concern over the global economy weighed on sentiment for the commodity. OPEC+ recently announced it will increase production by 547,000 barrels per day in September. Meanwhile, traders remain unconvinced President Trump will take decisive action against Russia’s crude oil complex because risking higher fuel prices could hurt his domestic agenda. Trump did threaten India with higher tariffs over its purchases of Russian crude. Traders are watching today’s inventory report from the American Petroleum Institute (API).

| Strategy (43DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

| Iron Condor | Long 62.5 p Short 63 p Short 67 c Long 67.5 c | 20% | +380 | -120 |

| Short Strangle | Short 63 p Short 67 c | 52% | +4460 | x |

| Short Put Vertical | Long 62.5 p Short 63 p | 57% | +210 | -290 |

| Symbol: FX | Daily Change |

| /6AU5 | +0.19% |

| /6BU5 | +0.26% |

| /6CU5 | +0.06% |

| /6EU5 | +0.17% |

| /6JU5 | -0.37% |

Japanese yen futures (/6JU5) remained lower after US services PMI data crossed the wires. That came in at 50.1, just above the expansion/contraction point and below estimates. The weaker-than-expected print may keep gains in the greenback capped for now. The Bank of Japan’s June meeting minutes showed it’s open to more rate hikes once trade tensions subside. That said, the wild card remains the US-imposed trade war, which is complicating the view for global central banks.

| Strategy (59DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

| Iron Condor | Long 0.00675 p Short 0.0068 p Short 0.00695 c Long 0.007 c | 28% | +437.50 | -187.50 |

| Short Strangle | Short 0.0068 p Short 0.00695 c | 55% | +1950 | x |

| Short Put Vertical | Long 0.00675 p Short 0.0068 p | 68% | +237.50 | -387.50 |

Our newsletter even counts as "research" when your boss walks by.Forward this email to your friends so they can subscribe to our newsletters, too! Get weekly data-driventrade ideas with Cherry Picks and daily pre-market insights and trade ideas with Cherry Bomb.

Michael Rechenthin,Ph.D., (aka “Dr. Data”), managing director of research and development, has 25 years of trading and markets experience. He’s known best for his weekly Cherry Picks newsletter. On Thursdays, he appears on Trades from the Research Team LIVE.

Nick Battista, tastylivedirector of market intelligence, has a decade of trading experience. He appears Monday-Friday onOptions Trading Concepts Live. On Wednesdays, he co-hosts Johnny Trades. @tradernickybat

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex and macro.

Trade with a better broker. Open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices