Meme Stock Traders are Here To Stay… but They’ll Need to Adapt

Meme Stock Traders are Here To Stay… but They’ll Need to Adapt

By:Eric Villa

In the DailyFX office, conversations around the Gamestock and AMC rallies last year are referred to as “the meme-stock fad”. Seasoned analysts and traders can’t help but think that the impact of retail traders chasing stocks were creating anything other than choppy waves in the vast ocean of the markets; opposed to the signal of potentially shifting fundamental tides.

But, to me, this is nothing short of denial. New-to-markets retail traders will only continue to bring even less predictability to traditional traders’ expectations as we continue to expand the democratization of global financial markets.

For traders of all sizes and experience levels, understanding how retail traders react to markets in the year ahead will be a valuable indicator.

2022: New Traders Will Pay Tuition

A look at markets in 2015 will reveal potentially comparable trends to what we see today. In 2015, the Fed hiked interest rates for the first time since the financial collapse: Market performance was underwhelming, and bonds rose while high-growth tech equities lagged.

Rising energy prices and declining tech performance is a often a strong indicator of being in a late-stage cycle. We are seeing many of these same trends take place now.

The biggest distinction between 2022 and 2015 is the seemingly constant hunger for speculative assets. For retail traders who got started with markets in the 2020 and 2021 pandemic, growth was associated with buying shares of Cathie Wood’s ARKK fund, or TSLA at an already-elevated valuation or even fringe cryptocurrencies.

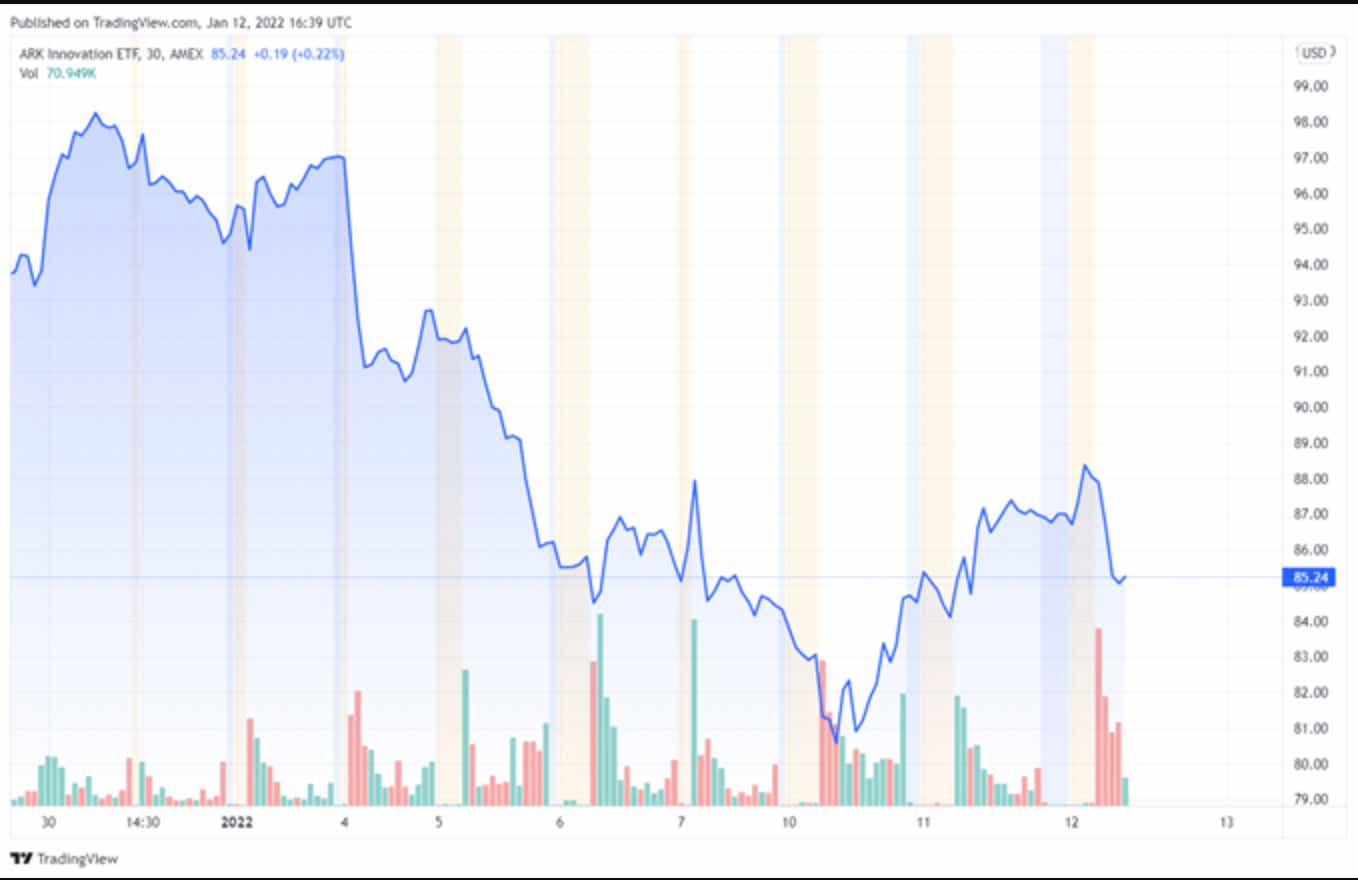

In the past month, we’ve seen what happens when the market starts to price in a rising rate regime. The ARKK innovation fund saw a steep drop from $96 per share to $85 per share within the past month. Cryptocurrencies such as Shiba Inu have seen 10% of their market cap dissipate in just a few weeks.

Arkk Innovation ETF January 2022

Chart created by Eric Villa in Trading View

Just as recently as last week, Peloton, a pandemic darling stock, saw a 10% drop within an hour of announcing the firm would stop manufacturing bikes, as demand for the exercise equipment has fallen dramatically.

Peloton Stock January 20th, 2022

Chart created by Eric Villa in Trading View

As the trades often associated with meme mania like Tesla, Shib, Arkk, and other high-growth tech assets begin to lose value in the face of diminished growth forecasts, traders will need to find new ways to capitalize on lower levels of volatility around typically high-growth in markets through 2022.

A Graduation to Options

Options contracts, at their core, give the trader additional tools to utilize, particularly in the face of shifting market conditions. In the past two years, a meme-stock retail trader’s go-to trade was to wait for monumental rallies in accessible equities, like Gamestop or AMC.

This strategy, while fun and attractive in an era of stimulus, also has a low probability of ever becoming a sustainable trading approach and requires a great deal of volatility in markets as a whole.

Options give traders the ability to not only capitalize on volatility, but even the lack of volatility. This flexibility comes with the cost of giving up unlimited profitability to increase the probability of a successful trade.

For details on how the benefits of options could translate into good starter-trades for options traders, visit DailyFX’s sister company tastylive and watch their Beginner Options Trading course.

tastylive’s Mike Butler recommended retail traders learn about moving defined risk call spreads into a call skew:

- “Call skew” – equidistant OTM calls are trading for more than OTM puts – in HTZ @ $20.00, 15 strike put trading for $0.20, 25 strike call trading for $0.50

- Call debit spreads into call skew create a greater profit potential v risk/ 15:25 call spread Hertz. Risk is defined, max profit > max loss

Rush Week is Over

As a member of the meme-stock generation, I am looking forward to seeing how my peers adapt to the next generation of retail traders in bull markets over the next ten years. As we grind through our first significant downturn, we’ll be able to reflect on our hubris in the era of stimulus, and better anticipate seemingly random trends driven by new traders.

Traders who enjoyed the thrill of making short-term gains by staying alert to news about Hertz or Tesla will need to adapt as we enter this new phase in the cycle. A trader who does not learn how to master more nuanced financial products may put themselves in a position to exacerbate losses, see lackluster growth, or give up on trading entirely.

That would be a travesty.

The democratization of investment from meme-stocks and high-growth tech were a great onboarding ramp for an entire generation of future traders, but 2022 will be the year traders face the ultimate test. 2022 is the year retail traders give up, or go deep.

Thanks to DailyFX’s Chris Veccio and James Stanley and tastylive’s Katie McGarrigle and Mike Butler for insights on retail trader’s macro outlook and the flexibility of options.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.