Why We Sell Small Delta Options

Why We Sell Small Delta Options

By:Kai Zeng

When trading options, it's important to minimize risk and improve odds. A method to achieve this is by focusing on selling options with smaller deltas.

Minimizing risk becomes especially important when the threat of a correction looms.

Selling options with a 10 or 5 delta, can be conservative.

Two-standard-deviation strangles can have a success rate as high as 95%.

With the looming threat of a market correction, the importance of minimizing risk and improving odds becomes even more pronounced. A popular method to achieve this is by focusing on options trading, specifically by selling options with smaller deltas.

Deltas can be used as a proxy for the probability of profit. Selling options with a 10 or 5 delta, which represents a 10% or 5% chance of the option ending in the money, can be a conservative approach compared to selling 20 or 30 delta options. That’s because smaller delta options are farther out of the money, thus less likely to be exercised.

Strategies like selling two standard deviation (SD) strangles, which typically have a delta of around 2.5, can have a success rate as high as 95%. This is particularly appealing to traders who prioritize a high success rate in their trading endeavors.

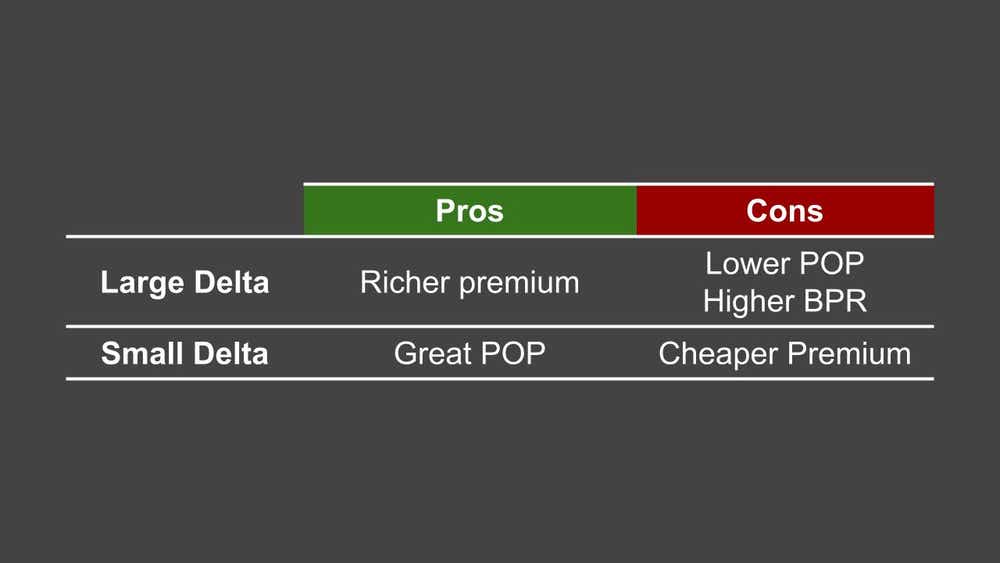

However, it's crucial to weigh the pros and cons of each strategy. While smaller delta options boast a higher success rate, they often come with a lower return on capital (ROC) because of the reduced credit received upon selling such options.

This is a trade-off between risk and potential reward that traders must consider based on their individual risk tolerance and trading goals.

So, which strategy has performed better historically—large or small delta? To understand, we conducted a test on SPY 1SD strangles (16 deltas, representing a relatively larger delta) and 2SD strangles (2.5 deltas, representing a relatively smaller delta), both with 45 days to expiration.

.jpg?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

The results show both strategies have achieved remarkable success rates. In particular, the 2SD strangles nearly reached a perfect success rate, though they resulted in a lower average profit and loss (P/L) and return on capital (ROC) per position.

.jpg?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

From a broader perspective, when evaluating long-term portfolio performance by simulating these strategies in an account of equal size and allocating 25% of the asset value to each strategy, 2SD strangles have been found to underperform 1SD strangles by 27%. However, they offer superior volatility control, an aspect that can be crucial during turbulent market phases.

.jpg?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

In conclusion, for traders who prioritize a higher success rate and wish to maintain tight control over volatility, smaller delta options like 2SD strangles present a compelling choice. These strategies may yield lower P/L and ROC, but their ability to provide a cushion against market fluctuations can be invaluable, especially in uncertain times.

Traders must carefully consider their risk appetite and trading objectives when choosing the right strategy, as each comes with its own set of trade-offs.

Kai Zeng, director of the research team and head of Chinese content at tastylive, has 20 years of experience in markets and derivatives trading. He cohosts several live shows, including From Theory to Practice and Building Blocks. @kai_zeng1

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices