Monthly Futures Seasonality, September 2024: Typically Terrible

Monthly Futures Seasonality, September 2024: Typically Terrible

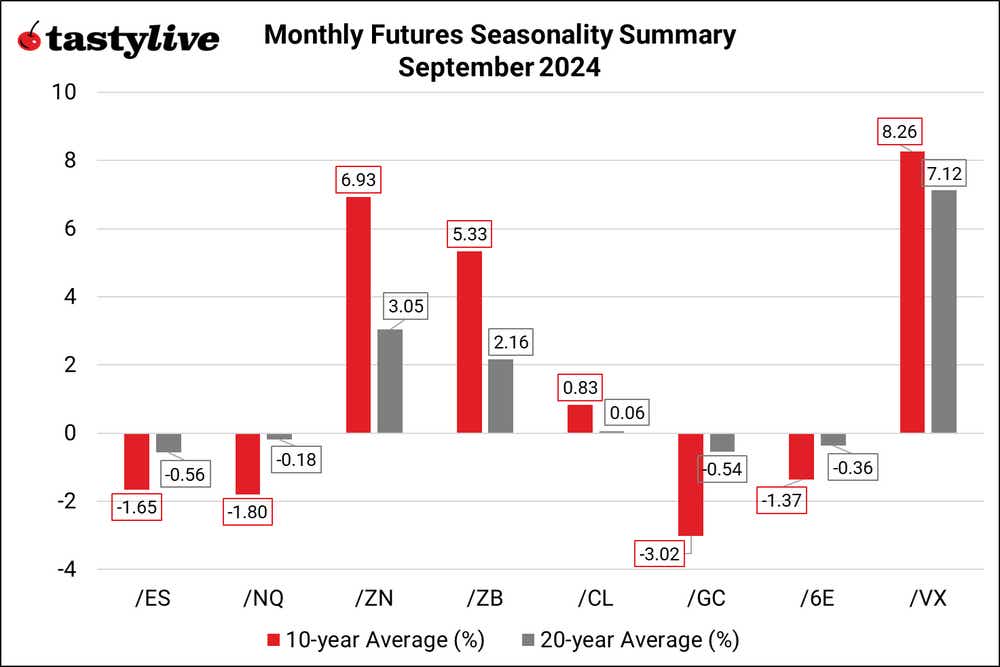

Cross-asset performance seems crisis-like—everything but dollars and Treasuries goes down.

August saw a sharp rise in volatility, at least temporarily, and a modest rise in U.S. equity markets when all was said and done. Despite the rebound in share prices and drop in volatility, anxiety remains and technical structures remain shaky at best.

Historically, September is not the month to provide relief for nervous hands. The worst month of the year for both the S&P 500 and Nasdaq 100 is likewise the worst month of the year for gold. If history is any guide, bonds and the U.S. dollar may find new reasons to rally. Cumulatively, the seasonal cross-asset performance speaks to crisis-like flows, whereby everything not dollars or Treasuries goes down.

Monthly futures seasonality summary–September 2024

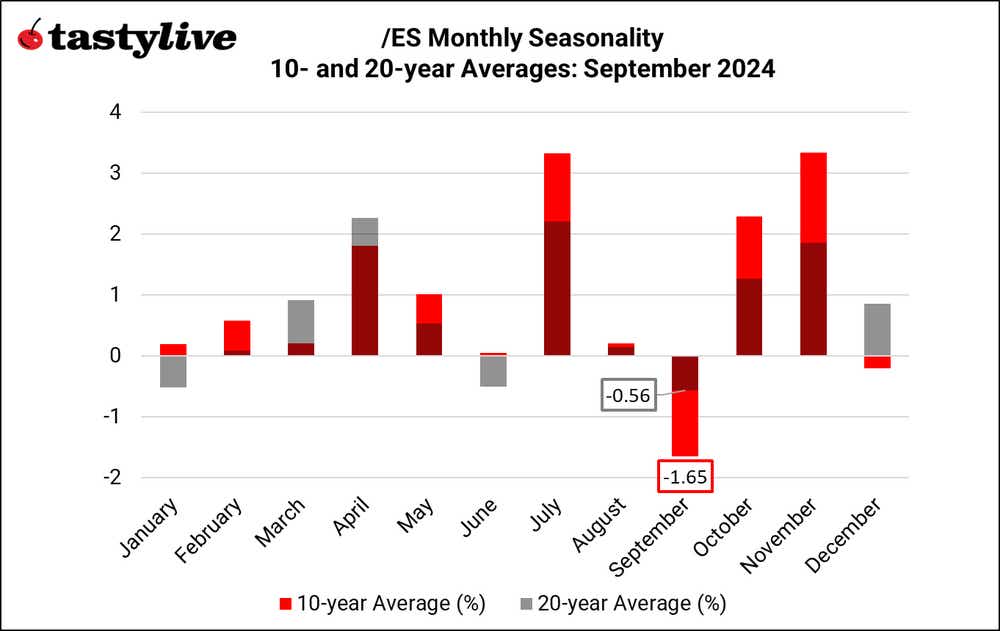

Monthly seasonality in S&P 500 (/ES)

September is a very bearish month for /ES, on a seasonal basis. Over the past 10 years, it has been the worst month of the year for the index, averaging a loss of 1.65%. Over the past 20 years, it has been the worst month of the year, averaging a loss of 0.56%.

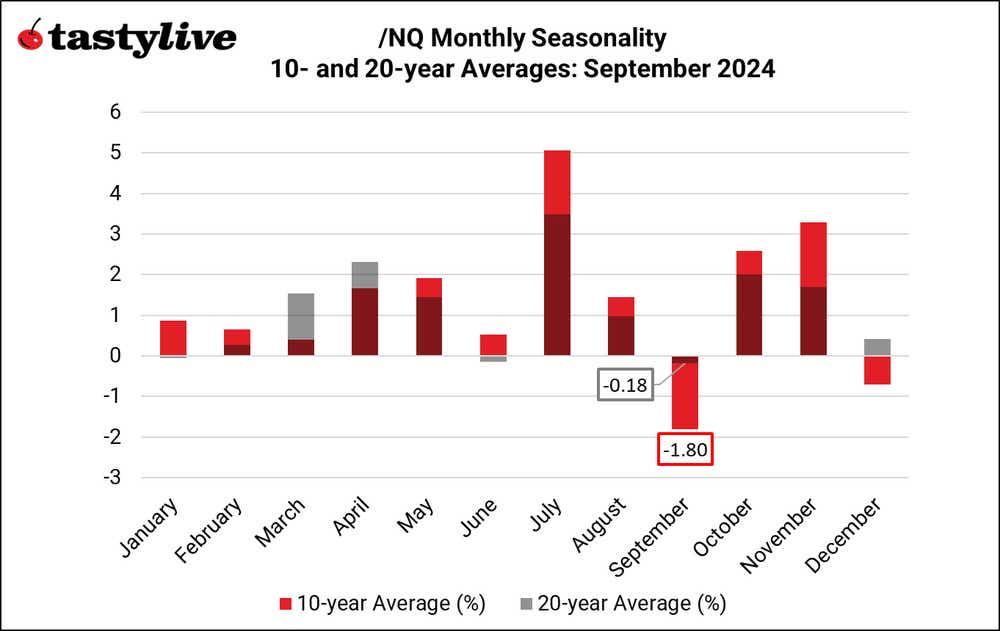

Monthly Seasonality in Nasdaq 100 (/NQ)

September is a bearish month for /NQ, on a seasonal basis. Over the past 10 years, it has been the worst month of the year for the index, averaging a loss of 1.8%. Over the past 20 years, it has been the worst month of the year, averaging a loss of 0.18%.

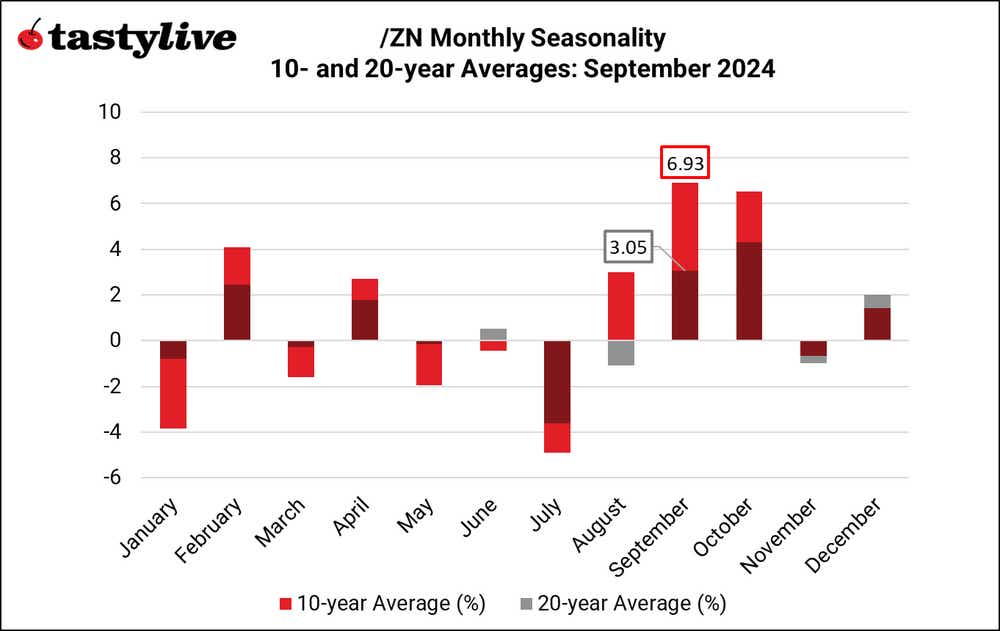

Monthly seasonality in Treasury notes (/ZN)

September is a bullish month for /ZN, on a seasonal basis. Over the past 10 years, it has been the best month of the year for the 10-year notes, averaging a gain of 6.93%. Over the past 20y ears, it has been the second-best month of the year, averaging a gain of 3.05%.

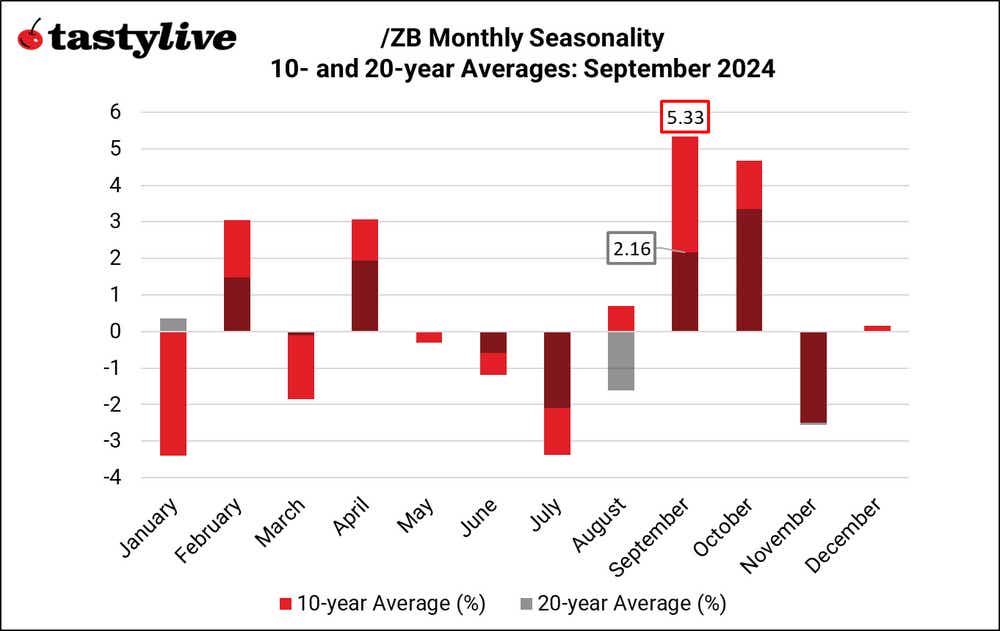

Monthly seasonality in Treasury bonds (/ZB)

September is a bullish month for /ZB, on a seasonal basis. Over the past 10 years, it has been the best month of the year for the 30-year bonds, averaging a gain of 5.33%. Over the past 20 years, it has been the second-best month of the year, averaging a gain of 2.16%.

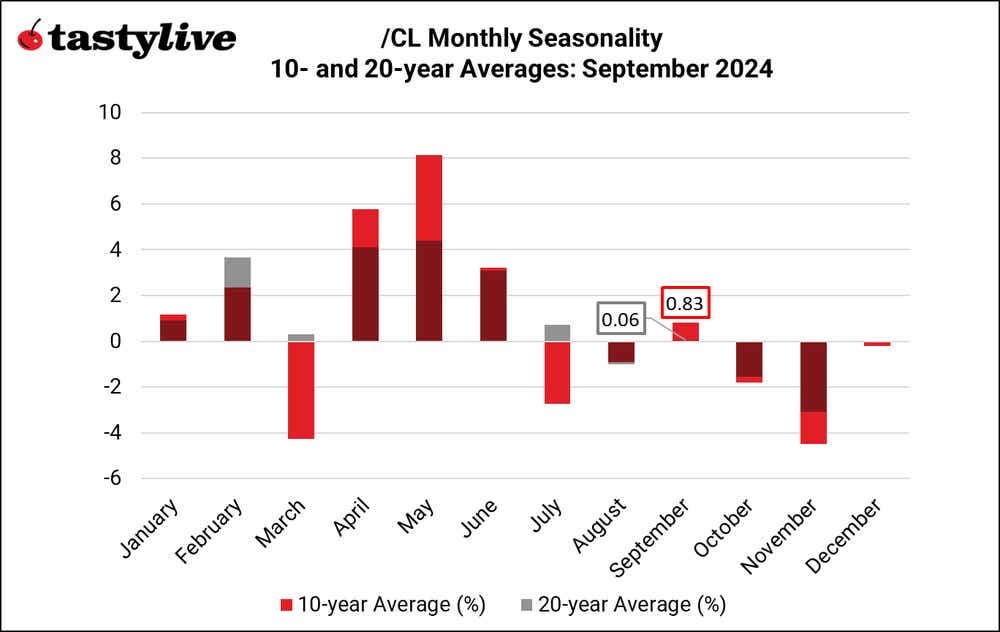

Monthly seasonality in crude oil (/CL)

September is a slightly bullish month for /CL, on a seasonal basis. Over the past 10 years, it has been the sixth best month of the year for the energy product, averaging a gain of 0.83%. Over the past 20 years, it has been the fifth-worst month of the year, averaging a gain of 0.06%.

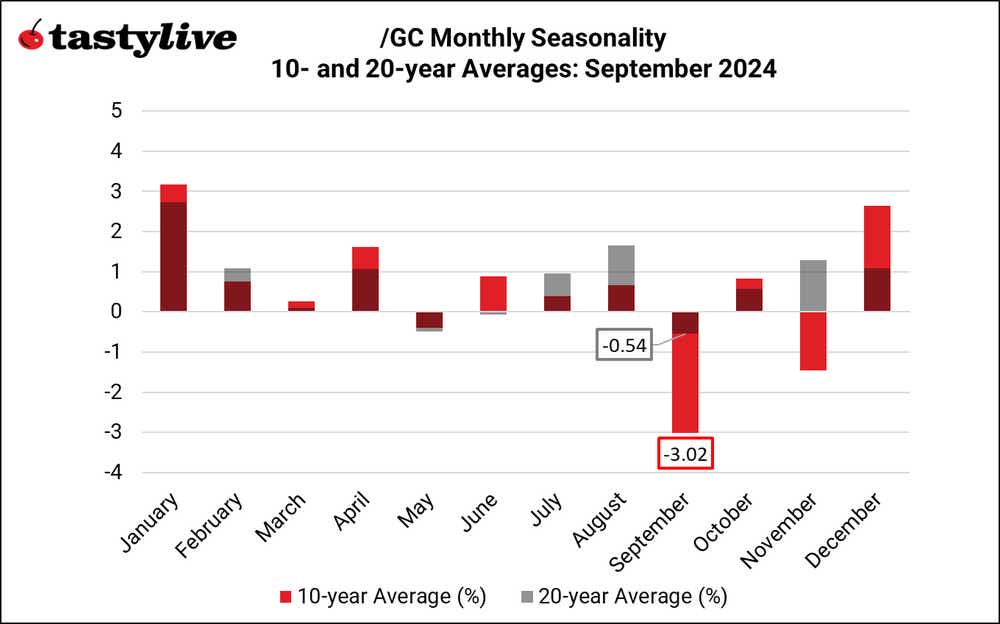

Monthly seasonality in gold (/GC)

September is a bearish month for /GC, on a seasonal basis. Over the past 10 years, it has been the worst month of the year for the precious metal, averaging a loss of 3.02%. Over the past 20 years, it has been the worst month of the year, averaging a loss of 0.54%.

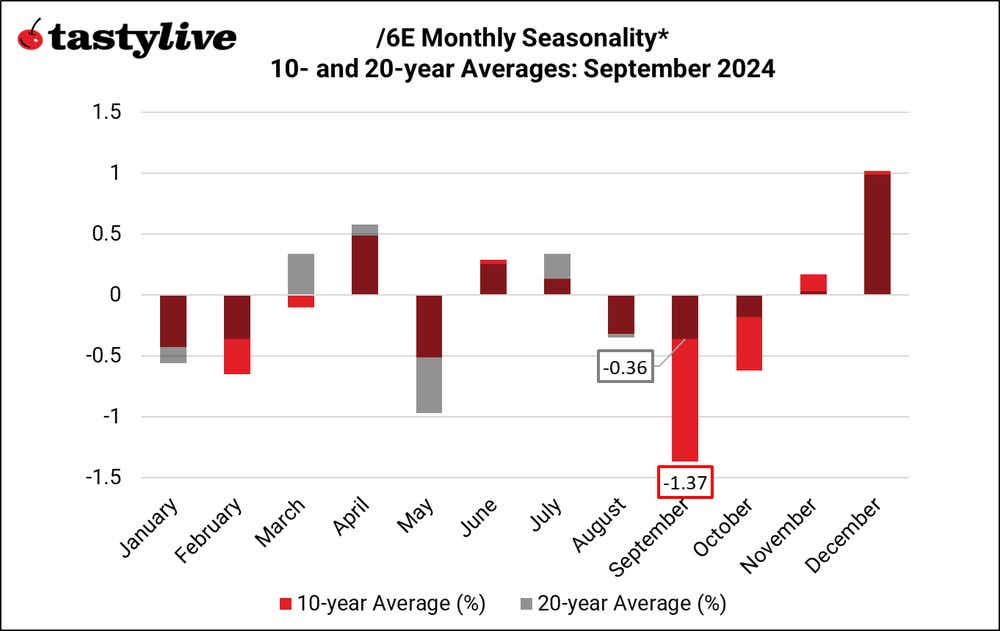

Monthly seasonality in euro (/6E)

September is a bearish month for /6E, on a seasonal basis. Over the past 10 years, it has been the worst month of the year for the pair, averaging a loss of 1.37%. Over the past 20-years, it has been the fourth worst month of the year, averaging a loss of -0.36%. Note: the time series for Euro futures (/6E) does not extend beyond 2018; the data series has been backfilled using EUR/USD spot rates as a proxy.

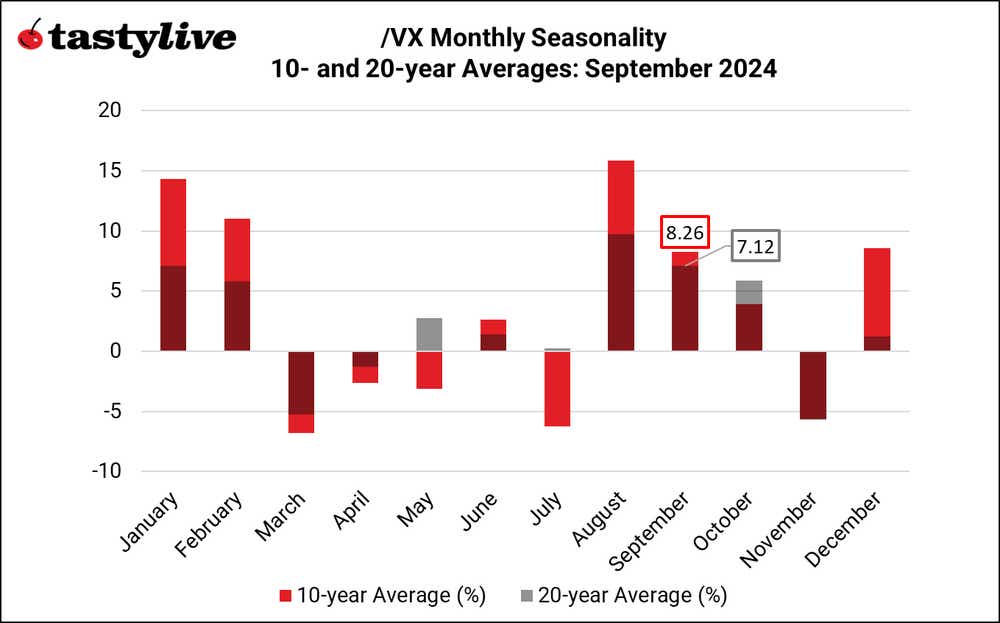

Monthly seasonality in VIX (/VX)

September is a bullish month for /VX, on a seasonal basis. Over the past 10 years, it has been the fifth-best month of the year for volatility, averaging a gain of 8.26%. Over the past 20 years, it has been the third best month of the year, averaging a gain of 7.12%.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices