Nasdaq 100 Stalls as Traders Brush Off Latest Trump Tariff Tactics

Nasdaq 100 Stalls as Traders Brush Off Latest Trump Tariff Tactics

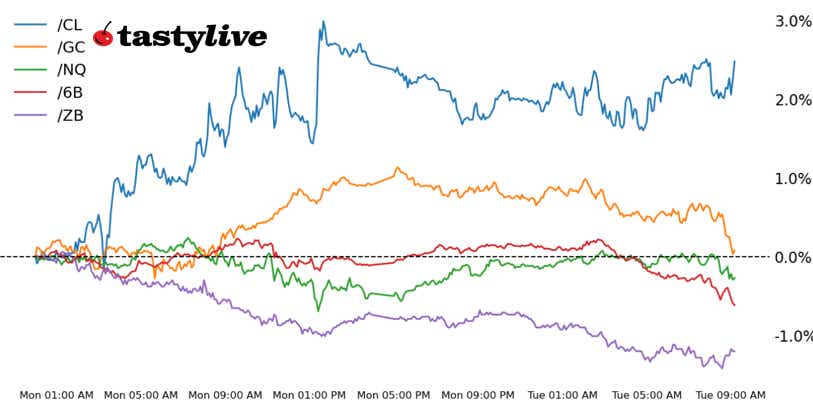

Also, 30-year T-bond, gold, crude oil and British pound futures

- Nasdaq 100 E-mini futures (/NQ): -0.02%

- 30-year T-bond futures (/ZB): -0.3%

- Gold futures (/GC): -0.95%

- Crude oil futures (/CL): +0.13%

- British pound futures (/6B): -0.44%

Tariffs on Japan, South Korea and others spooked markets modestly yesterday, but a turnaround may be in the works today — at least for equity markets. U.S. stocks have stabilized, with volatility dropping back to levels seen last week. Bonds are a different story, where the combination of bigger debts and deficits against the backdrop of a trade war makes for an uneasy situation for longs. Higher yields are helping the US dollar, which in turn is making for a difficult morning for precious metals.

| Symbol: Equities | Daily Change |

| /ESU5 | -0.07% |

| /NQU5 | -0.02% |

| /RTYU5 | +0.55% |

| /YMU5 | -0.21% |

Nasdaq futures (/NQU5) were slightly higher this morning as traders shrugged off concerns about tariffs. President Trump said he tariff deadline of Aug. 1 is “not 100% firm.” Solar stocks fell this morning after Trump issued an executive order to remove subsidies for renewable energy. Sunrun (RUN) fell over 8% and First Solar (FSLR) dropped 3.6% in early trading. Amazon (AMZN) was nearly unchanged as its Prime Day event kicked off.

| Strategy: (52DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

| Iron Condor | Long 22500 p Short 22600 p Short 23300 c Long 23400 c | 18% | +1530 | -470 |

| Short Strangle | Short 22600 p Short 23300 c | 51% | +18675 | x |

| Short Put Vertical | Long 22500 p Short 22600 p | 58% | +675 | -1315 |

| Symbol: Bonds | Daily Change |

| /ZTU5 | -0.02% |

| /ZFU5 | -0.08% |

| /ZNU5 | -0.14% |

| /ZBU5 | -0.3% |

| /UBU5 | -0.4% |

Bond traders continued to sell Treasuries today, with 30-year T-bond futures (/ZBU5) dropping by 0.47% in early trading. Prices are now challenging levels from mid-June as confidence in the US debt market wanes. Concerns about sticky inflation have pushed back bets for rate cuts, with Fed Funds futures now showing only a 4.7% chance for a rate cut in June compared to 20.7% a week ago. The Treasury will auction three-year notes today.

| Strategy (45DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

| Iron Condor | Long 111 p Short 112 p Short 114 c Long 115 c | 27% | +703.13 | -296.88 |

| Short Strangle | Short 112 p Short 114 c | 54% | +2593.75 | x |

| Short Put Vertical | Long 111 p Short 112 p | 64% | +359.38 | -640.63 |

| Symbol: Metals | Daily Change |

| /GCQ5 | -0.95% |

| /SIU5 | -0.76% |

| /HGU5 | -0.68% |

Gold prices (/GCQ5) were slightly lower this morning, but prices are holding above last week’s lows. A stronger dollar and higher yields are working against gold prices despite some uncertainty about tariffs. The lower odds that the Fed will cut soon are also working against bullion, but prices remain rather resilient given the factors working against it. Meanwhile, silver prices (/SIU5) were down 0.5%, as the metal’s recent outperformance against gold fades.

| Strategy (49DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

| Iron Condor | Long 3300 p Short 3305 p Short 3395 c Long 3400 c | 20% | +400 | -100 |

| Short Strangle | Short 3305 p Short 3395 c | 55% | +10480 | x |

| Short Put Vertical | Long 3300 p Short 3305 p | 61% | +220 | -280 |

| Symbol: Energy | Daily Change |

| /CLQ5 | +0.13% |

| /HOQ5 | +0.39% |

| /NGQ5 | -0.94% |

| /RBQ5 | +1.27% |

The threat of tariffs is eating into the demand outlook for crude oil prices (/CLQ5), which were down 0.43% this morning following a gain of over 1% yesterday. Prices remain supported compared to where we were at the end of June, with tensions in the Middle East helping to support sentiment. Meanwhile, OPEC is set to deliver more oil to the market in August to extend its rollback of voluntary production cuts. The American Petroleum Institute will report inventory data today.

| Strategy (38DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

| Iron Condor | Long 64.5 p Short 65 p Short 68.5 c Long 69 c | 19% | +370 | -130 |

| Short Strangle | Short 65 p Short 68.5 c | 50% | +4110 | x |

| Short Put Vertical | Long 64.5 p Short 65 p | 57% | +210 | -290 |

| Symbol: FX | Daily Change |

| /6AU5 | +0.18% |

| /6BU5 | -0.44% |

| /6CU5 | -0.16% |

| /6EU5 | -0.25% |

| /6JU5 | -0.49% |

British Pound futures (/6BU5) continued to slide on Tuesday as concerns over the fiscal situation in the United Kingdom pushes investors out of UK government bonds (gilts). The pound has now retraced about half of its gains from its June swing low to recent highs, and prices are below the 21-day exponential moving average. The welfare bill is expected to increase UK debt by almost 5 billion pounds by 2030.

| Strategy (59DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

| Iron Condor | Long 1.34 p Short 1.345 p Short 1.365 c Long 1.37 c | 23% | +231.25 | -81.25 |

| Short Strangle | Short 1.345 p Short 1.365 c | 54% | +1518.75 | x |

| Short Put Vertical | Long 1.34 p Short 1.345 p | 67% | +112.50 | -193.75 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.