Nasdaq 100 Shrugs Off Weak ADP Jobs Report and the Dollar Drops Alongside Yields

Nasdaq 100 Shrugs Off Weak ADP Jobs Report and the Dollar Drops Alongside Yields

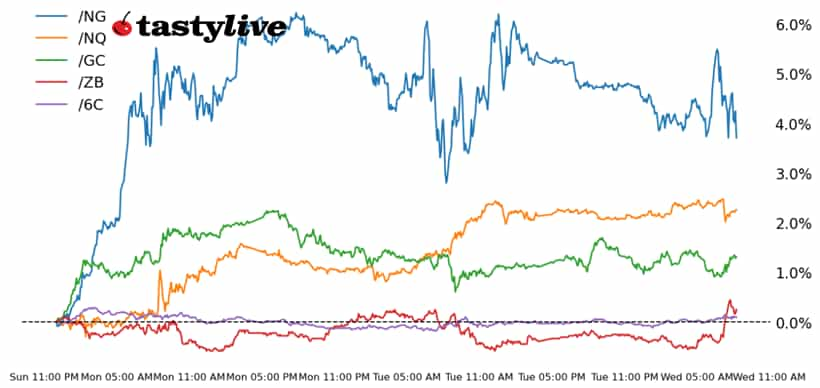

Also, 30-year T-bond, gold, natural gas and Canadian dollar futures

- Nasdaq 100 E-mini futures (/NQ): +0.31%

- 30-year T-bond futures (/ZB): +0.61%

- Gold futures (/GC): +0.03%

- Natural gas futures (/NG): -0.32%

- Canadian dollar futures (/6C): +0.08%

In the lead-in to the official May US jobs figures this Friday, traders were afforded an appetizer this morning with the ADP employment change report — and it wasn’t a good one. Jobs growth decelerated sharply last month, with just 37,000 jobs added. The May US Institute for Supply Management (ISM) services reading likewise came in weaker than anticipated, slipping into contraction territory at 49.9. While US equities are being jostled by the data, the figures have been decidedly good news for both bonds and metals. Elsewhere, the Bank of Canada kept rates on hold today.

| Symbol: Equities | Daily Change |

| /ESM5 | +0.26% |

| /NQM5 | +0.31% |

| /RTYM5 | +0.33% |

| /YMM5 | +0.17% |

Traders sold Nasdaq 100 futures early today following the ADP job numbers, but buyers stepped in quickly and prices trimmed losses to trade positive at the opening bell. Dollar Tree (DLTR) fell over 9% after the retailer projected weak earnings because of tariffs in the current quarter. Wells Fargo (WFC) rose nearly 3% after having its asset cap removed by the Federal Reserve. CrowdStrike (CRWD) plunged 8% after Bank of America (BAC) downgraded the stock. Apple (AAPL) received a downgrade from Needham, but the stock shrugged it off and rose over 0.5% in early trading.

| Strategy: (44DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

| Iron Condor | Long 19750 p Short 20000 p Short 23250 c Long 23500 c | 68% | +1095 | -3905 |

| Short Strangle | Short 20000 p Short 23250 c | 73% | +4760 | x |

| Short Put Vertical | Long 19750 p Short 20000 p | 87% | +425 | -4575 |

| Symbol: Bonds | Daily Change |

| /ZTM5 | +0.07% |

| /ZFM5 | +0.18% |

| /ZNM5 | +0.27% |

| /ZBM5 | +0.61% |

| /UBM5 | +0.81% |

Treasuries rose after this morning’s jobs data crossed the wires. 30-year T-bond futures (/ZBU5) were up 0.61% shortly after the New York open. Meanwhile, bond traders continue to monitor trade developments. One headline was that President Trump said Chinese President Xi is hard to make a deal with. The focus for bond traders now shifts to Friday morning when the non-farm payrolls report is due.

| Strategy (51DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

| Iron Condor | Long 105 p Short 107 p Short 117 c Long 119 c | 62% | +500 | -1500 |

| Short Strangle | Short 107 p Short 117 c | 68% | +1203.13 | x |

| Short Put Vertical | Long 105 p Short 107 p | 87% | +203.13 | -1796.88 |

| Symbol: Metals | Daily Change |

| /GCQ5 | +0.03% |

| /SIN5 | -0.1% |

| /HGN5 | +0.79% |

Gold futures (/GCQ5) traded flat through early trading today. The metal remains nearly 2% higher since the start of the month following Monday’s big up move. Prices rose slightly after this morning’s jobs report, but the focus remains on Friday’s numbers from the Labor Department. A weaker-than-expected report would likely offer a tailwind for gold prices.

| Strategy (54DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

| Iron Condor | Long 3325 p Short 3330 p Short 3445 c Long 3450 c | 19% | +380 | -120 |

| Short Strangle | Short 3330 p Short 3445 c | 55% | +13330 | x |

| Short Put Vertical | Long 3325 p Short 3330 p | 60% | +220 | -280 |

| Symbol: Energy | Daily Change |

| /CLN5 | +0.55% |

| /HON5 | +0.48% |

| /NGN5 | -0.32% |

| /RBN5 | -0.53% |

Natural gas prices (NGN5) were slightly lower this morning. Prices rose sharply at the start of the week, but bulls are having trouble near the 3.8 level, which has capped upside since mid-May. Gas production in the United States has dropped to below 104 billion cubic feet per day, according to Bloomberg data. The impacts from maintenance season are likely reflected in the production drop off as producers repair and upgrade facilities. The temperature outlook sees chances for above-average temperatures across much of the United States next week, which could offer some support to the commodity over the short term.

| Strategy (54DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

| Iron Condor | Long 3.6 p Short 3.65 p Short 4.1 c Long 4.15 c | 22% | +390 | -110 |

| Short Strangle | Short 3.65 p Short 4.1 c | 57% | +5060 | x |

| Short Put Vertical | Long 3.6 p Short 3.65 p | 53% | +250 | -250 |

| Symbol: FX | Daily Change |

| /6AM5 | +0.35% |

| /6BM5 | +0.08% |

| /6CM5 | +0.08% |

| /6EM5 | +0.18% |

| /6JM5 | +0.08% |

The Bank of Canada (BoC) held rates steady today, citing the impact of tariffs and the need to wait to see how they develop throughout the economy. The move aligned with what rate traders called for. However, the messaging was on the dovish side, with the bank leaving the door open to possible rate cuts in the future. Canadian dollar futures (/6CM5) were 0.08% higher following the announcement.

| Strategy (65DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

| Iron Condor | Long 0.725 p Short 0.73 p Short 0.74 c Long 0.745 c | 37% | +320 | -180 |

| Short Strangle | Short 0.73 p Short 0.74 c | 53% | +1030 | x |

| Short Put Vertical | Long 0.725 p Short 0.73 p | 71% | +180 | -320 |

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.