Nasdaq 100 Stretches to New Highs as Bessent Downplays Aug. 1 Tariff Deadline

Nasdaq 100 Stretches to New Highs as Bessent Downplays Aug. 1 Tariff Deadline

Also, 30-year T-bond, gold, natural gas and Japanese yen futures

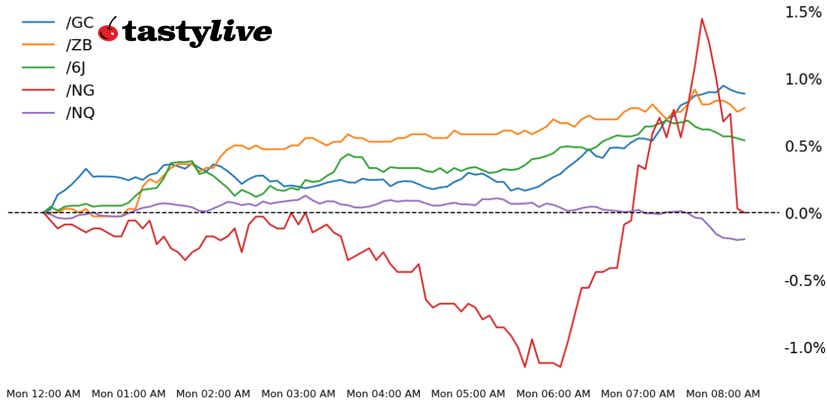

- Nasdaq 100 E-mini futures (/NQ): +0.31%

- 30-year T-bond futures (/ZB): +0.83%

- Gold futures (/GC): +1.12%

- Natural gas futures (/NG): -5.5%

- Japanese yen futures (/6J): +0.73%

US Treasury Secretary Scott Bessent kickstarted the trading week by telling traders the Aug. 1 tariff deadline didn’t really matter, noting that “we’re not going to rush for the sake of doing deals.” Markets are responding accordingly, with stocks higher and long-end US Treasury yields lower. Weaker US yields are undercutting the US dollar, which in turn may be fueling the surge in precious metals today.

| Symbol: Equities | Daily Change |

| /ESU5 | +0.12% |

| /NQU5 | +0.31% |

| /RTYU5 | +0.53% |

| /YMU5 | +0.19% |

US stocks moved higher to start the week, with Nasdaq 100 futures (/NQU5) adding about 0.42% in early trading. Earnings season has gotten off to a strong start, and we’re heading into a busy week of results. Stellantis NV (STLA) fell over 1% after the automaker said it expects a $2.7 billion hit from tariffs and restructuring costs. Dollar Tree (DLTR) rose after an upgrade from Barclays. Verizon (VZ) rose 2.3% after reporting a beat on earnings. Block (XYZ) rose over 7% ahead of its debut in the S&P 500 later this week.

| Strategy: (39DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

| Iron Condor | Long 21750 p Short 22000 p Short 24750 c Long 25000 c | 64% | +1090 | -3910 |

| Short Strangle | Short 22000 p Short 24750 c | 69% | +4720 | x |

| Short Put Vertical | Long 21750 p Short 22000 p | 84% | +605 | -4395 |

| Symbol: Bonds | Daily Change |

| /ZTU5 | +0.05% |

| /ZFU5 | +0.19% |

| /ZNU5 | +0.35% |

| /ZBU5 | +0.83% |

| /UBU5 | +1.09% |

Bonds advanced today to continue last week’s trend higher, as traders see the Aug. 1 tariff deadline moving closer. Rate cut bets for next week’s Federal Reserve meeting are essentially at zero, but markets see a successor to Fed Chair Jerome Powell as being more dovish. This week’s corporate earnings schedule and a 20-year bond auction later this week will be in the spotlight for traders. 30-year T-bond futures (/ZBU5) were 0.83% higher early today.

| Strategy (67DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

| Iron Condor | Long 106 p Short 108 p Short 120 c Long 122 c | 66% | +453.13 | -1546.88 |

| Short Strangle | Short 108 p Short 120 c | 72% | +1187.50 | x |

| Short Put Vertical | Long 106 p Short 108 p | 85% | +281.25 | -1718.75 |

| Symbol: Metals | Daily Change |

| /GCQ5 | +1.12% |

| /SIU5 | +1.34% |

| /HGU5 | +0.31% |

Lower yields and a softer dollar helped to lift gold prices (/GCQ5), adding 1.12% this morning. Today’s move puts the metal at its highest level since June 23 and above 3,400. The move higher comes despite more risk taking in the equity market. Traders may be moving some money into safe-haven assets given the recent gains in equities that have put prices near all-time highs.

| Strategy (36DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

| Iron Condor | Long 3200 p Short 3225 p Short 3575 c Long 3600 c | 68% | +650 | -1850 |

| Short Strangle | Short 3225 p Short 3575 c | 75% | +3260 | x |

| Short Put Vertical | Long 3200 p Short 3225 p | 86% | +230 | -2270 |

| Symbol: Energy | Daily Change |

| /CLQ5 | -0.48% |

| /HOQ5 | +0.53% |

| /NGQ5 | -5.5% |

| /RBQ5 | -1.01% |

Natural gas futures (/NGQ5) fell nearly 6% this morning as weather models looking into August cooled off a bit from last week. Meanwhile, production in the United States reached a record high, according to Bloomberg data. A lack of heat across the Northeast is also keeping bulls at bay, with the demand-concentrated area doing little to cut down on supply.

| Strategy (36DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

| Iron Condor | Long 2.7 p Short 2.8 p Short 3.9 c Long 4 c | 66% | +290 | -710 |

| Short Strangle | Short 2.8 p Short 3.9 c | 73% | +1220 | x |

| Short Put Vertical | Long 2.7 p Short 2.8 p | 83% | +130 | -870 |

| Symbol: FX | Daily Change |

| /6AU5 | +0.15% |

| /6BU5 | +0.39% |

| /6CU5 | +0.14% |

| /6EU5 | +0.34% |

| /6JU5 | +0.73% |

The ruling Japanese coalition, LDP and Komeito, appear to have lost their grip on the upper house of parliament in their worst electoral showing since 2013. And yet the Japanese yen (/6JU5) is rallying today, thanks in part because the election results were not as bad for continuity in governance as many observers feared. Sprinkle in lower US Treasury yields, and it’s an ideal mix for a snapback rally by the yen to start the week.

| Strategy (46DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

| Iron Condor | Long 0.00655 p Short 0.0066 p Short 0.00705 c Long 0.0071 c | 63% | +175 | -450 |

| Short Strangle | Short 0.0066 p Short 0.00705 c | 70% | +650 | x |

| Short Put Vertical | Long 0.00655 p Short 0.0066 p | 85% | +87.50 | -537.50 |

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices