Natural Gas Bulls Relent Following U.S. Inventory Data

Natural Gas Bulls Relent Following U.S. Inventory Data

But macro factors support higher prices

- Hot weather is increasing demand for the natural gas that generates electricity.

- Today’s move takes natural gas prices close to last week’s July swing low at 2.536. A break below that level could spur some additional downside.

- Bulls may decide to regroup for the next push higher in natural gas prices.

Natural gas prices erase weekly gain

U.S. natural gas futures (/NG) have risen steadily this summer, but prices remain well below levels from last year. Since April, futures prices have risen more than 20%, from $1.946 per million British thermal units (mmBtu) to as high as $2.878 by late June.

As of Thursday, prices are trading about 2% lower on the day to around the $2.579 level, which extinguishes the weekly gain that was intact before today’s inventory report. This follows last week’s 7.72% decline, which broke a four-week win streak. Will prices decline further?

Macro factors suggest pullback is temporary

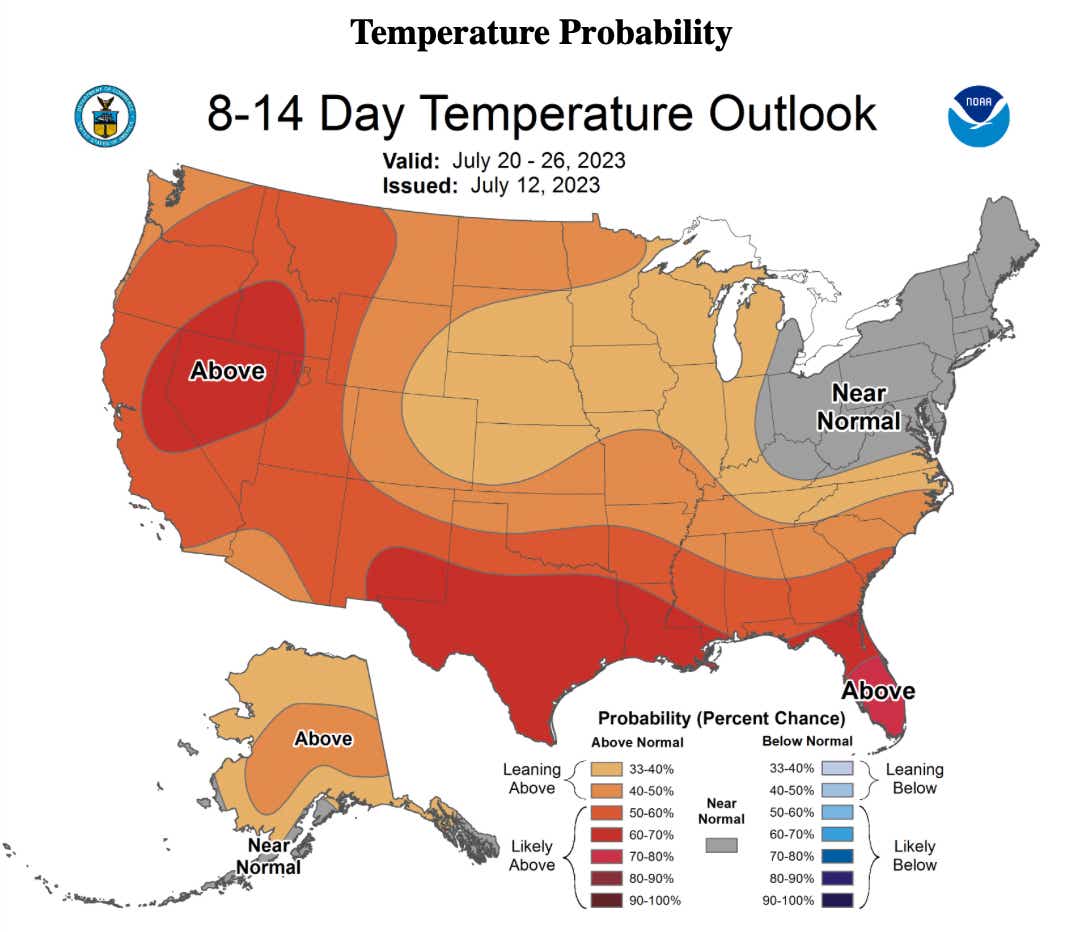

It has been a very hot summer in the United States and that heat is expected to continue, according to short-term forecasting models. Hotter-than-average temperatures increase cooling demand, and with natural gas accounting for nearly 40% of U.S. energy generation, the commodity is in high demand.

In the image below, we see the National Oceanic and Atmospheric Administration’s eight-to-14-Day Temperature Outlook forecasts an above-normal probability for above-average temperature across much of the United States. If this forecast proves right, that will mean higher energy demand from cooling for the forecasted period. This should soften the chances of bearish moves occurring over the short term.

EIA inventory report shows smaller-than-expected build

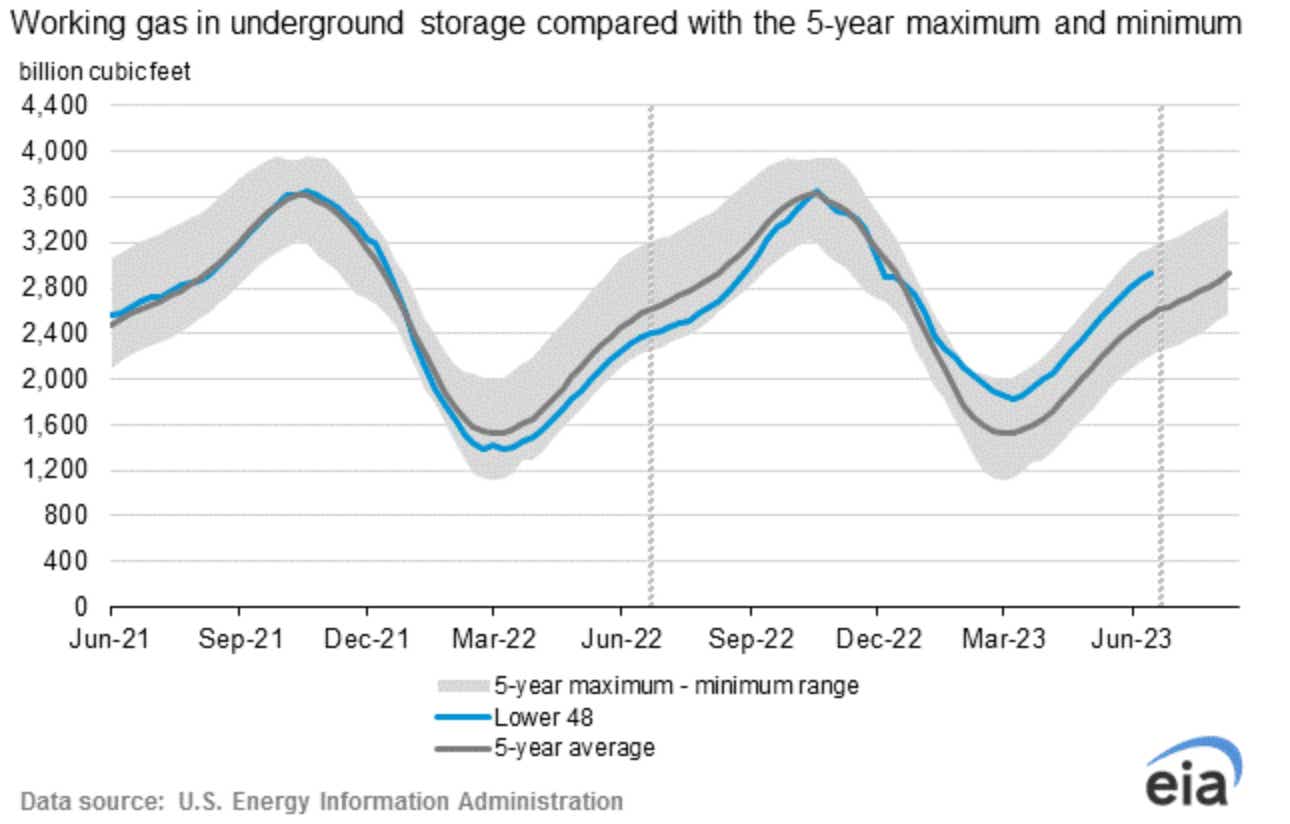

This morning’s inventory report from the U.S. Energy Information Administration (EIA) reflected the effects of higher mercury readings. For the week ending July 7, natural gas injections were at 49 billion cubic feet (Bcf), missing the +51Bcf consensus forecast. A lower injection number typically occurs when energy demand is high.

Despite the smaller-than-expected build, traders started selling after the EIA numbers crossed the wires. Perhaps bulls expected a smaller number? A revision in the data for June 30 changed working gas in storage from 2,877 Bcf to 2,881 Bcf, pushing the total build from that period to +76 Bcf from +72 Bcf.

For July 7, total storage stands at 2,930 Bcf, which puts stocks 569 Bcf higher than this period last year and 364 Bcf higher than the five-year average, according to the EIA.

Natural gas technical chart

Today’s move takes prices close to last week’s July swing low at 2.536. A break below that level could spur some additional downside. Alternatively, bulls may decide to regroup at the level for the next push higher. The 50-day Simple Moving Average (SMA) adds some confluence to the possible support level. A bounce higher would look at the falling 100-day SMA and the 38.2% Fibonacci retracement from the March/May move.

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices