Natural Gas: Seasonality and Tech Support Offer Bulls a Bet for August

Natural Gas: Seasonality and Tech Support Offer Bulls a Bet for August

Prices have rebounded after hitting fresh summer lows but will depend upon the weather

- Natural gas prices have recovered after falling below the 3 handle.

- Prices for July were on track to drop over 10% in the last trading day of the month.

- August seasonality may offer bulls a chance to play the long side at technical support.

Natural gas prices (/NGU5) bounced back after trading below the 3 handle this morning following an extended downtrend that has dropped prices by over 15% since July 18.

Traders haven’t seen prices trade at these levels since November 2024, when natural gas saw an intraday drop below the 3 handle. The selling over the past week has frustrated bulls, but there is lasting enthusiasm with the commodity remaining above the psychological level.

Cooler-than-average temperatures in the back half of July have reduced power demand and allowed inventory levels to rise faster than their seasonal averages. That came alongside near-record high production, which added pressure to the commodity.

Traders appeared keen to take on longs during the brief dip below $3 MMBtu today, evidenced by enthusiastic discourse on X, or Twitter. Whether today’s move results in more gains or a failed breakout is yet to be seen, however.

Will bulls regain control in August?

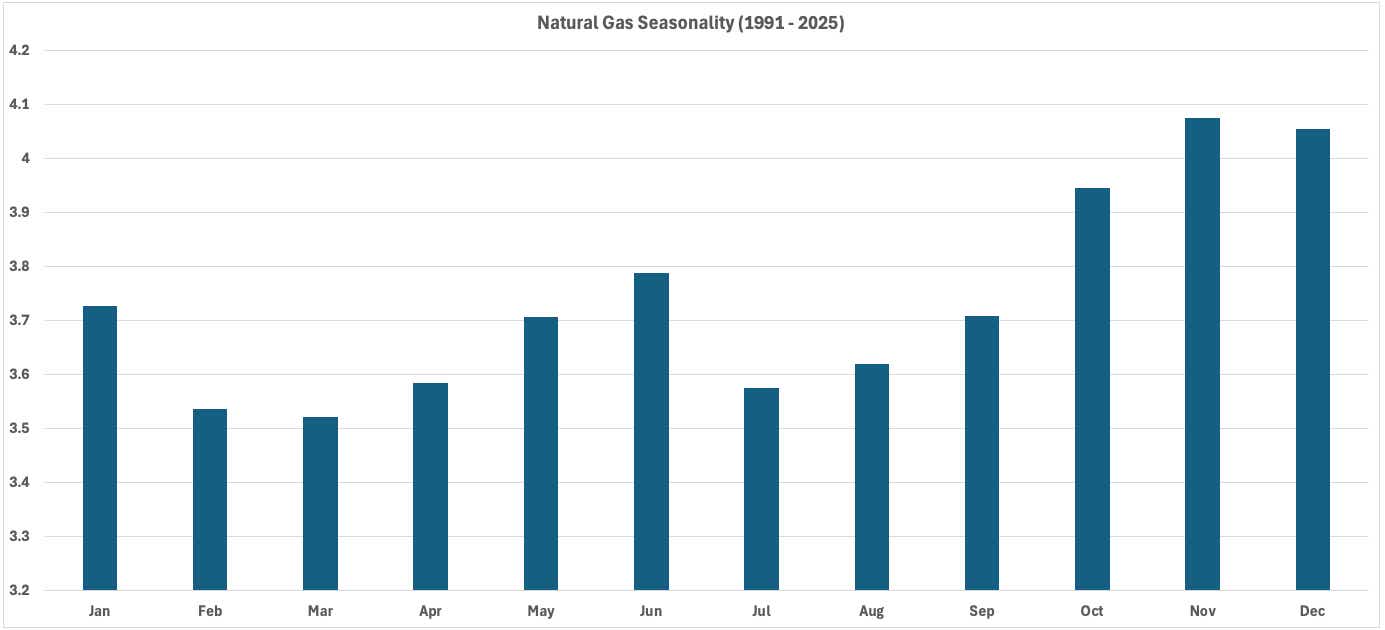

One notable factor for bulls to consider as we move into August is seasonality. Since 1991, the average price of natural gas in July was 3.58 and the average price of natural gas in August was 3.62. That said, since 1991, the average gain from July to August was 1.12%, and seasonality continues to strengthen from August to November. The chart below illustrates the seasonality dynamic.

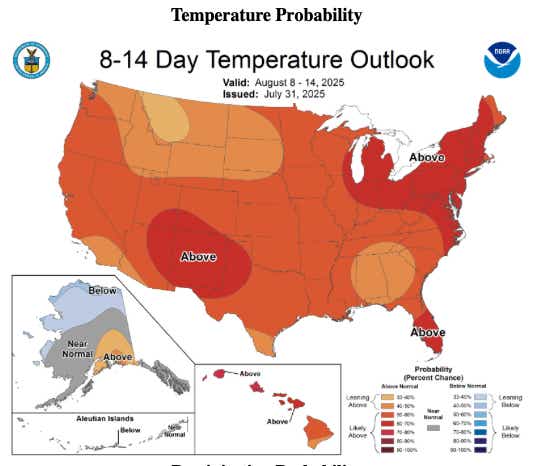

While seasonality supports short-term strength, the commodity will require some weather support to help induce demand. One thing lacking in July was heat in the Eastern United States, particularly in the Northeast where a lot of energy demand is concentrated. So far, weather models show a good chance for above-average temperatures through the first half of August, not only in the Northeast but across much of the continental United States.

Trading natural gas

Natural gas is trading at its lowest level since April on a continuous contract basis. July prices were on track to record a loss of over 10% in the last day of trading for the month. The sell-off has injected some volatility into the product.

That said, traders looking to position long for August can take a risk-defined strategy of selling a put spread at or outside of the money, which would work out if prices stay above the 3 handle.

Another strategy would be to take a long position, which perhaps could be better achieved for retail traders by trading the micro-sized futures contract (/MNG), which is a tenth of the size of the standard contract at 1,000 MMBtu.

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.